Surprise hung parliament result sends Sterling sharply lower

- Go back to blog home

- Latest

The worst case scenario is that the parties fail to form a Government at all, or at best manage a short lived one and a new election has to be called. All the while, the Article 50 two-year clock is ticking away with the UK unable to carry out any substantial negotiations.

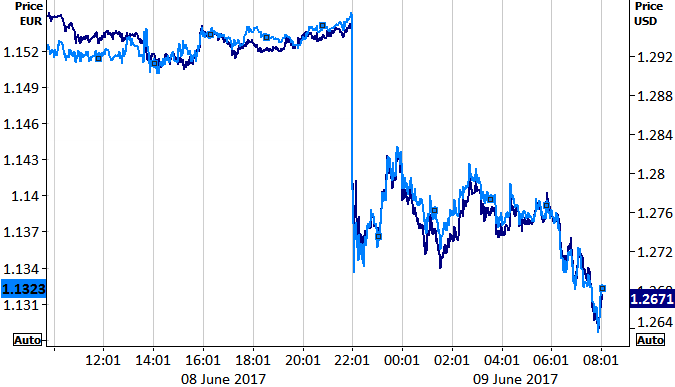

Either way, markets are likely to attach a significant risk premium to Sterling. We think that the path of least resistance for the time being is down, further than the 2% that is has dropped so far (Figure 1). We will soon revise our forecasts accordingly. At any rate, we are probably facing a period of market volatility comparable to that of the immediate aftermath of the Brexit referendum.

Figure 1: GBP/USD & GBP/EUR (09/06/2017)

Dovish Draghi in no rush to begin tightening policy

Prior to the election results in the UK, the ECB kept its monetary policy unchanged on Thursday as expected while dropping the reference in its statement to the possibility of further cuts from its forward guidance.

Comments from ECB President Mario Draghi were relatively mixed. The ECB acknowledged momentum in the Euro-area economy had picked up pace since the last meeting and that growth would be stronger-than-expected. Draghi did, however, reiterate the message that while serious downside risks to the economy had receded, continued QE would be necessary for inflation to reach its target. The ECB actually issued a rather sharp downgrade to its inflation projections and now predicts prices to grow by 1.5% this year (down from 1.7%) and a meagre 1.3% in 2018 (down from 1.6%).

The ECB made it clear it is no hurry to beginning tightening monetary policy and we expect easy monetary policy to remain with us for considerably longer that the markets seems to be pricing in. Markets seem to agree with this view for now and we saw a very modest sell-off in the Euro off the back of the news.