Euro rallies sharply after ECB’s hawkish turn

( 5 min )

- Go back to blog home

- Latest

We have been warning that the ECB’s plans to wait until 2023 before hiking rates were a pipedream in a world of rising inflationary pressures, and our view was fully vindicated last week.

Traders’ focus will keep shifting back and forth between central bank announcements and inflation data, the factors that will dominate currency markets for the foreseeable future. This week, all eyes are on the US inflation report for January on Thursday, with yet another increase to multi-decade records pencilled in by forecasters. Speeches by ECB officials will also be in focus, which could provide further fuel to the euro rally as the hawkish shift from last week’s meeting is confirmed.

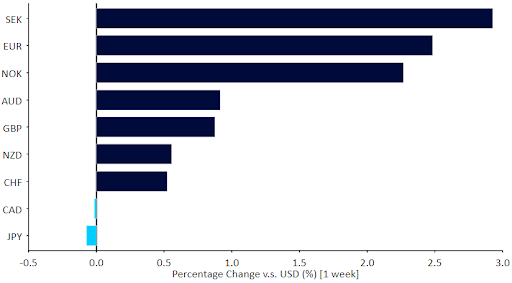

Figure 1: G10 FX Performance Tracker (1 week)

Source: Refinitiv Datastream Date: 07/02/2022

GBP

The Bank of England also had hawkish surprises for the market, though these were somewhat overshadowed by the ECB ones immediately following. Rates went up 25 basis points as expected, but a strong minority almost forced the first 50 bp hike since 2004, losing the vote 5-4. Sterling rose against the US dollar, but had trouble holding its own against the ECB hawkish shift and the massive euro rally.

The focus on central bank policy will continue this week, with speeches by Bank of England Chief Economist Pill (Wednesday) and Governor Bailey (Thursday). Overall, the prospects for aggressive hikes and a still cheap valuation bode well for the pound over 2022.

EUR

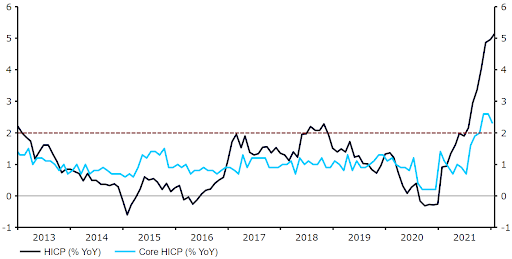

The Eurozone had one of its most momentous weeks in many months. It started with a massive upward surprise in inflation, and ended with a 180 degree pivot on the topic by President Lagarde at the February meeting of the ECB. Not only are assets purchases to be wrapped up earlier than expected, Lagarde also completely abandoned her pledge to wait until 2023 before lifting rates. The Council is now “unanimously” concerned with inflation, and sees “upside risks” in its future path.

Figure 2: Euro Area Inflation Rate (2013 – 2022)

Source: Refinitiv Datastream Date: 07/02/2022

While euro rates had a massive upward move in response, we think that there is still room to go here, and are unsure the ECB can wait until September before raising rates. The euro should continue to remain well supported as markets adapt to the ECB turnabout on policy.

USD

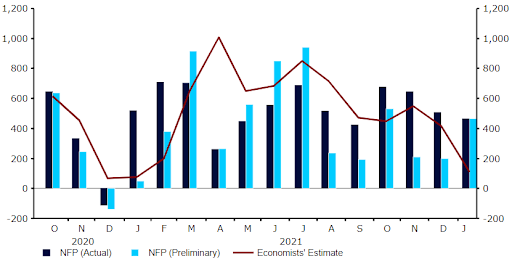

Unusually for a labour report week, the US dollar found itself mostly driven by events across the Atlantic. However, the payrolls report itself appeared very strong in spite of the omicron distortions, with strong job creation, upward revisions to previous months’ data, and wages rising, though not enough to keep up with prices, for now.

Figure 2: US Nonfarm Payrolls (2020 – 2022)

Source: Refinitiv Datastream Date: 07/02/2022

It is clear the US is essentially at full employment and Federal Reserve hikes are the only tool available to try and keep pressure off prices. It is, however, worth noting that monetary policy acts with “long and variable” lags, and we therefore think that rates have quite a long way to go before their impact on prices is felt.

CHF

EUR/CHF rallied sharply after the ECB signalled a possible acceleration of monetary policy normalisation. The pair ended the week more than 2% higher and reached its strongest level since November (1.06). It was one of the most intense periods in terms of EUR/CHF volatility since the SNB dropped the ceiling for the pair in 2015.

Last week’s economic data from Switzerland was quite disappointing, particularly the December retail sales reading, which fell for the first time since July. This week will bring inflation data for January, which may show an increase in price growth to another fresh high. Investors will also likely continue to digest news from the ECB. Attention may, however, once again shift back developments in Russia in the coming days. Any escalation of tensions with Ukraine, and heightened prospects of conflict, could drag EUR/CHF lower.

AUD

The Australian dollar rebounded from its 18-month low last week, ending just above the 0.71 level to the US dollar. As expected, the Reserve Bank of Australia kept its cash rate unchanged at a record low of 0.1% for the 14th month in a row during its January 2022 meeting. Policymakers decided to end the AUD$275 billion bond-buying programmes on 10th February, although the bank declared that its termination does not imply a near-term increase in interest rates. The RBA also revised its inflation outlook sharply higher, although vowed to stay patient before hiking rates as wages growth remains modest. While this was a slight disappointment for markets, we continue to think that this stance on rates cannot hold for much longer.

On Thursday, consumer inflation expectations for February will be published in an otherwise relatively quiet week of economic news in Australia.

CAD

The Canadian dollar was one of only two G10 currencies to depreciate against the US dollar last week. The USD/CAD pair ended the week modestly higher after Friday’s nonfarm payrolls report showed that the US economy unexpectedly added 467K jobs in January 2022.

With regards to domestic data, the Canadian economy expanded by 0.6% month-on-month in November 2021, above market expectations of a 0.3% raise – the sixth consecutive monthly expansion. Friday’s labour report was, however, a disappointment, in large part due to the disruption caused by pandemic. Canada’s unemployment rate rose more than expected in January, up to 6.5% from an upwardly revised 6% in December. This was the first increase in the jobless rate since April 2021, amid a surge in COVID-19 cases due to the spread of the omicron variant. 200k net jobs were also shed in January, the worst month in nine, albeit this downturn is expected to prove temporary.

With no major economic data due this week, CAD may be driven by events elsewhere.

CNY

Last week was quite uneventful for the yuan, which was to be expected considering mainland markets were closed due to the Lunar New Year holiday week. Investors took a break from economic news, and instead focused their attention on the Year of the Tiger celebrations and the Winter Olympics that kicked off in Beijing on Friday.

The start of this week brought new business activity data, with Caixin’s services PMI showing a better-than-expected reading of 51.4 in January, ensuring the composite index printed just above the key 50 level. Both were, however, the lowest since August and, alongside the official PMIs, confirm the economy is struggling amid the COVID-19 resurgence in China. Recent news on that front has been quite mixed, with a lockdown of Baise, a 3.5-million city in the southern Guangxi region, yet another reminder that the economic disruption is not yet over.

China’s economic calendar is mostly empty this week. Early next week, the PBOC is expected to set a rate on medium-term loans, which may bring a small cut for a second time this year.

Economic Calendar (07/02/2022 - 11/02/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports