Markets recover on easing Ukraine concerns, US retail sales in spotlight

( 3 min )

- Go back to blog home

- Latest

Risk assets recovered some of their lost ground on Tuesday, as investors perceived the chances of a Russian invasion of Ukraine as lessened relative to the weekend.

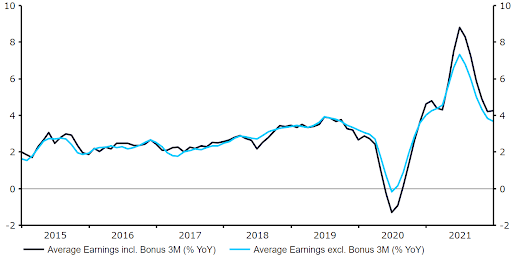

News on the Russia-Ukraine situation looks set to remain the number one driver of currencies during the remainder of the week. We will, however, be paying close attention to a host of economic data releases on Wednesday, starting with the latest UK inflation data for January out this morning. Consensus is in favour of an unchanged reading of 5.4%, although given economists have continued to massively underestimate the extent of the recent global inflation overshoot in recent months, we think that another surprise to the upside here is on the cards. Sterling has been stuck in a bit of a narrow range against the dollar in the past couple of weeks, with the pound only receiving modest support from yesterday’s strong December labour report, which showed another uptick in earnings (Figure 1) and a drop in the number of unemployment benefit claims. An inflation shock today may, therefore, be required to snap the currency out of its recent slumber.

Figure 1: UK Average Hourly Earnings (2015 – 2022)

Source: Refinitiv Datastream Date: 15/02/2022

The most important macroeconomic data release today will, however, be this afternoon’s US retail sales figures. Economists are eyeing a rather sharp bounce back in consumer spending in January following the unexpected slump in the December number – a downturn that we believe was driven mostly by omicron uncertainty and will therefore prove temporary. Consensus is for a +2% advance in the headline number, which would be the fastest rate of growth in sales since the March 2021 boom induced by President Biden’s massive stimulus package. With the bar for an upside surprise rather lofty, and expectations for Federal Reserve interest rate hikes already sky-high, the dollar may struggle to eke out any meaningful gains following the data.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports