The US dollar lost ground against almost all of its major peers on Thursday, slipping perilously close to the 1.10 level versus the euro following some more underwhelming domestic data.

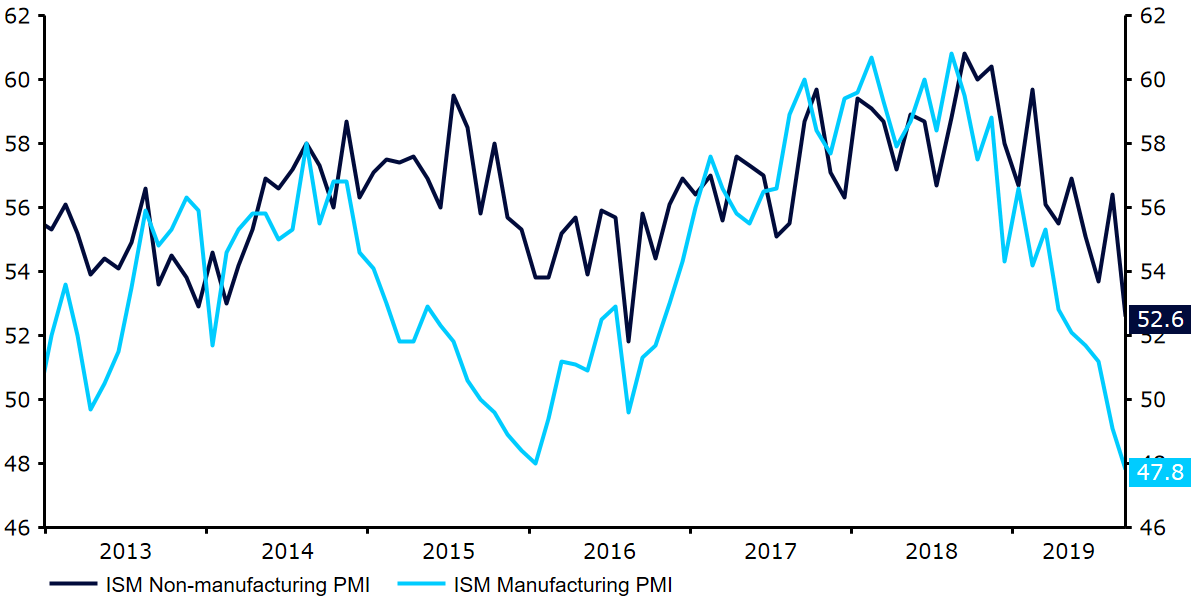

Figure 1: US ISM Non-Manufacturing PMI (2013 – 2019)

The aforementioned data suggests that the outlook for the US economy has worsened since the Federal Reserve last met in September. While policymakers at the time were divided regarding the need for additional rate cuts, recent macroeconomic prints may well tip the balance in favour of more easing before the year is out. Fed fund futures are now placing as high an 87% chance of another cut as soon as the October FOMC meeting. While we still think this is slightly too high, there is no doubt that another cut in 2019 is looking very much live.

All attention now inevitably turns to this afternoon’s payrolls report, which will no doubt again shift investors expectations for future Fed policy action. Economists are eyeing a relatively weak headline number around the 140k mark.

Pound ignores soft data on Brexit optimism

The pound had a good session yesterday, rising almost one percent from market open at one stage before giving up around half of its gains on renewed Brexit optimism. Boris Johnson made last ditch attempts to strike a deal with the EU that would avoid a ‘no deal’ Brexit at the end of October. While the market is pretty sceptical this can be achieved, investors did at least see this as a step in the right direction that could help yield a deal at some point in the not too distant future.

With Brexit news continuing to completely dominate proceedings, investors almost entirely overlooked yesterday’s warning signs that the UK economy could be heading towards an imminent recession. The monthly services PMI, seen as one of the leading indicators of the UK economy’s overall wellbeing, unexpectedly dropped into contractionary territory in September. The index fell to 49.5 last month, comfortably below expectations. This has raised further speculation that the Bank of England may have to cut interest rates, even if a ‘no deal’ Brexit is avoided.