US yield curve inverts, is a recession on the way?

- Go back to blog home

- Latest

The US dollar rallied to a ten day high against the euro on Wednesday, despite a closely followed indicator suggesting that the world’s largest economy could be on the brink of falling into recession.

We far from believe that an inverted yield curve guarantees that a recession is on the cards. That being said, with downside risks from abroad growing, namely the US-China trade war and Brexit, investors are beginning to grow increasingly fearful regarding the possibility. It will be interesting to see whether this translates into a broadly weaker dollar today. The US currency has so far proved fairly resilient to the phenomenon, albeit it did shed around three-quarters of a percent of its value against the safe-haven Japanese yen yesterday.

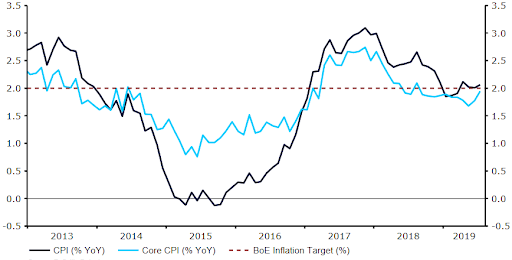

UK inflation rises above Bank of England target

Sterling has spent much of the past 24 hours fairly range bound, ended London trading more-or-less unchanged, despite rallying briefly off the back of Wednesday’s better-than-expected UK inflation print. The headline inflation measure increased to 2.1% year-on-year in July, higher than the 1.9% expected and back above the Bank of England’s 2% target. Similarly, the core inflation measure also rose more than much of the market had anticipated, coming it at 1.9% versus the 1.8% that investors had pencilled in.

As we alluded to in yesterday’s report, we do not think that macroeconomic conditions in the UK necessarily justify looser policy from the BoE. Yet, with Brexit no closer to resolution, investors have started ramping up bets for BoE easing, now placing around a 50% chance of a cut by year-end.

Figure 1: UK Inflation Rate (2013 – 2019)

Eurozone growth confirmed at meagre 0.2%

With much of the Eurozone observing national holidays today, activity in EUR/USD is likely to be driven chiefly by this afternoon’s US retail sales numbers.

We did have some data out of the Euro Area economy on Wednesday, which continued to paint a fairly bleak picture. Second quarter growth was confirmed at just 0.2% quarter-on-quarter, its joint slowest pace of expansion since the Eurozone crisis. Industrial production is also on a fairly worrying downward trend, declining by 2.6% year-on-year in June, its eighth consecutive month in negative territory. We think such weak data all but ensures that the European Central Bank will act by cutting interest rates by 10 basis points at its next meeting in September.