UK data turns a corner; sterling rebound on the cards?

- Go back to blog home

- Latest

Sterling briefly slipped to its weakest position in three months against a broadly stronger US dollar on Thursday, although mounted somewhat of a comeback on Friday following some impressive UK economic data.

Then, on Thursday, the latest figures showed that retail sales bounced back strongly in January following a soft end to 2019. Sales jumped by 0.9% month-on-month, its largest increase since March 2019. While the year-on-year number remained modest at 0.8%, this has more to do with the weak end to last year than anything else.

Figure 1: UK Retail Sales (2015 – 2020)

We also had another solid set of UK PMI figures on Friday morning, which provided a little assistance to the pound. While the services index came in just shy of expectations (53.3 versus 53.4 expected), the sharp bounce higher in the manufacturing PMI back into expansionary territory (51.9 versus 49.7 expected) more than made up for this shortfall.

As we have mentioned on a number of occasions in the past few weeks, we think that growth in the UK economy is set for a decent rebound in the first quarter as consumers and businesses breathe a sigh of relief at the removal of the short-term political and ‘no deal’ uncertainty following December’s general election.

Euro edges off lows on solid PMI figures

Some similarly strong PMI data out of the Euro Area also helped the euro initiate a modest rally against the dollar, with the key EUR/USD pair edging off its lowest level in three years.

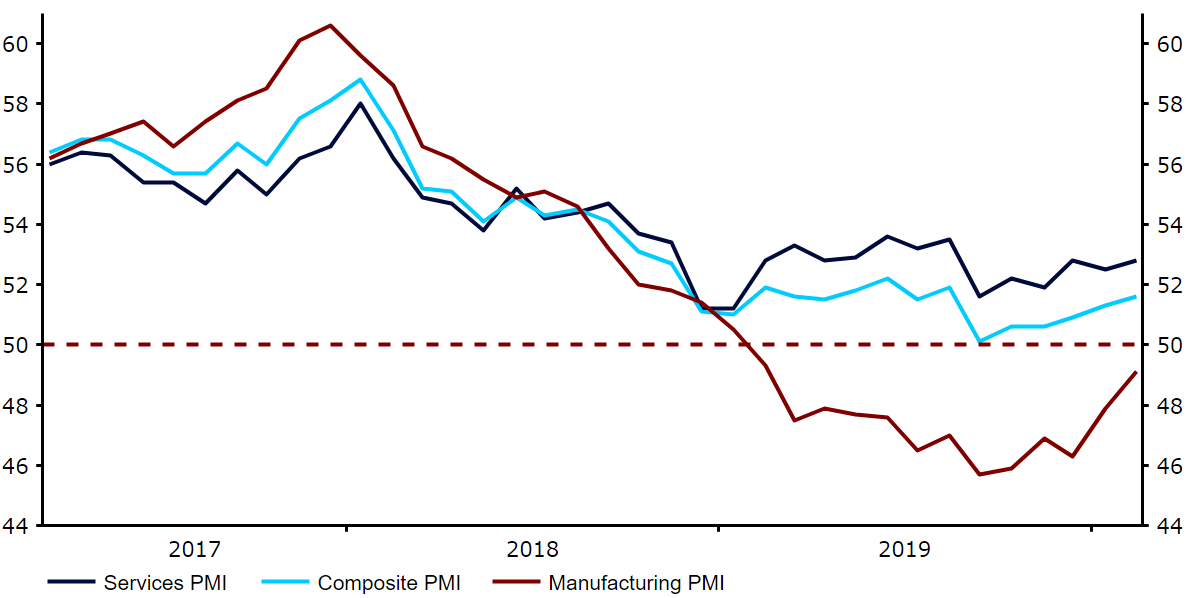

This morning’s business activity PMIs for February were stronger across the board, raising optimism that the recent downturn in European output could prove temporary. Both the services and manufacturing indices increased more than expected to 52.8 and 49.2 respectively (Figure 2), the latter leaping to its highest position in almost a year and just below the level of 50 that denotes contraction. This allowed the main composite index to jump back up to 51.6 this month, its highest level since August.

Figure 2: Eurozone PMIs (2017 – 2020)

The aforementioned data comes in line with our view that recent concerns regarding the health of the Euro Area economy are slightly overblown and driven more by the coronavirus headlines rather than signs of underlying weakness in the bloc’s economy. We think that once this boom in the soft data starts translating itself into an improvement in hard data, we should begin to see a more sustained and meaningful uptrend in the euro, particularly versus the dollar.

The next big test for EUR/USD will be this morning’s Euro Area inflation numbers for January, expected to remain unrevised, and this afternoon’s US PMI figures.