Bank of England to keep policy steady as UK economy rebounds

( 4 min )

- Go back to blog home

- Latest

This week’s ‘Super Thursday’ announcement from the Bank of England is set to be one of the main focal points of currency trading in the next few days.

With no change in policy expected, investors will instead be keeping a close eye on comments in the bank’s accompanying communications on the state of the UK recovery and potential future policy moves. We outline below three key questions that investors are hoping will be answered on Thursday.

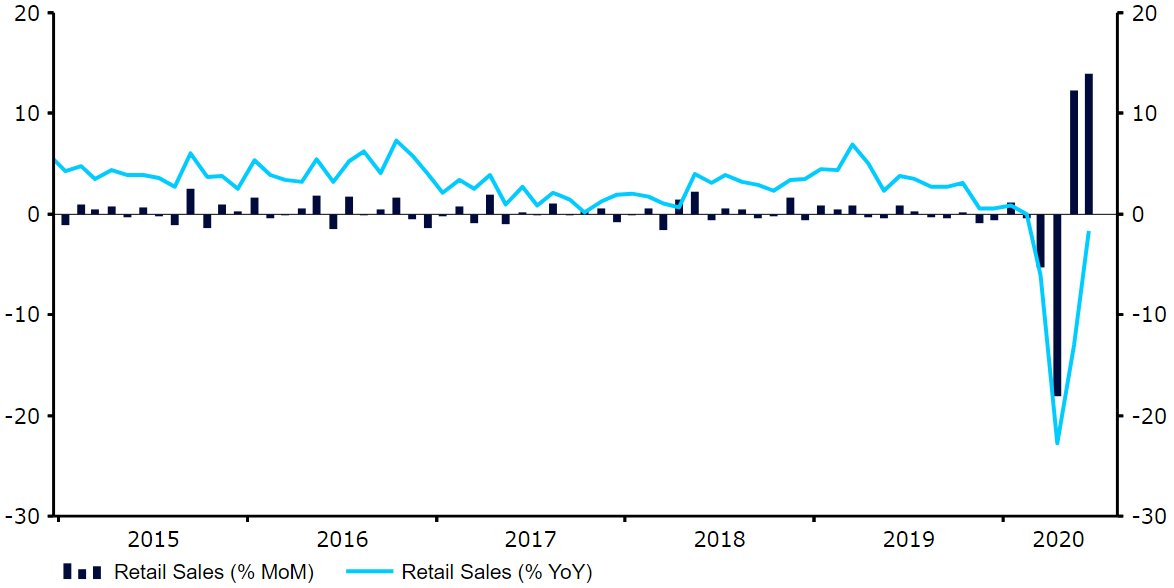

Is the UK economy on course for a ‘V-shaped’ recovery? A lot has changed since the BoE’s last quarterly Monetary Policy Report in May. The UK government has eased lockdown measures as new daily virus cases continue to decline. A range of macroeconomic data has also been released that suggests the domestic economy is bouncing back well from the depths of the downturn. This rebound can be clearly seen in the latest consumer spending figures. Retail sales posted a record 13.9% month-on-month expansion in June (Figure 1), with overall sales down just 1.6% on the same period a year previous. The business activity PMIs have also turned a corner, with the composite index topping all forecasts in July.

Figure 1: UK Retail Sales (2015 – 2020)

Source: Refinitiv Datastream Date: 03/08/2020

Chief economist Andy Haldane, the only member on the MPC to not vote for an increase in the QE programme in June, stated last month that the UK economy was enjoying a ‘V-shaped’ recovery. Given recent data strength, it will be interesting to see whether any other members of the committee are coming around to this view. This week’s Monetary Policy Report will also contain updated projections for both growth and inflation. While the latter will be largely irrelevant, more upbeat-than-expected GDP forecasts would likely provide some support for sterling this week. Regardless, we expect Governor Andrew Bailey to strike a cautious tone over the outlook, highlighting risks to growth posed by a possible second wave of virus infection and potential increase in unemployment once the government’s furlough scheme has expired.

Are negative interest rates a possibility? There has been talk since the beginning of the pandemic about the possibility of the Bank of England slashing its base rate below zero. Bailey even stated that there were discussions on the issue. These expectations have, however, cooled slightly since then, with financial markets currently placing around a one-in-five chance of sub-zero rates before year-end.

While we don’t think that the bank will definitely rule out the possibility of negative interest rates this week, we also don’t think that they will indicate it is on the immediate horizon either. An opening of the door to a negative interest rate policy (NIRP) on Thursday would be a big surprise to the market and could lead to a sharp sell-off in the pound. Should the bank again indicate that NIRP is under consideration, then we don’t think we’ll see too much of a reaction in financial markets.

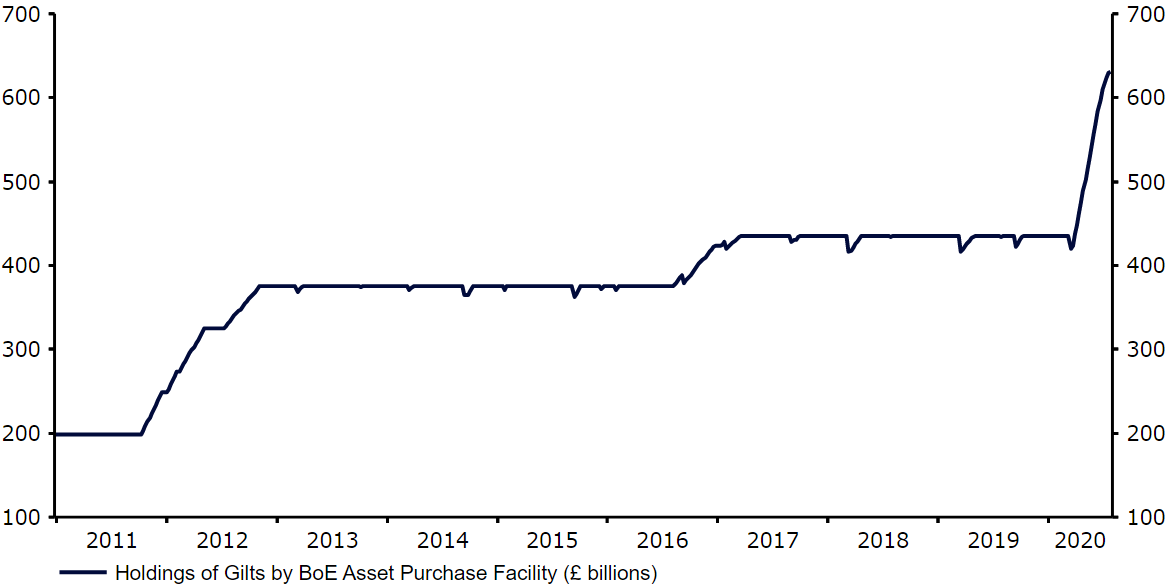

What will the bank do about its quantitative easing programme? At the June MPC meeting, the BoE indicated that future asset purchases would be conducted at a slower pace than at the beginning of the crisis. It will be interesting to see whether Bailey comments on the potential pace of future purchases this week. Should he choose to raise concerns over the outlook and express an openness to increase the pace of purchases then we think investors may be caught wrong-footed. We do, however, think that this is unlikely, with purchases expected to be evenly distributed in the coming months before the programme is potentially increased again at around the November MPC meeting.

Figure 2: Bank of England Gilts Holdings (2011 – 2020)

Source: Refinitiv Datastream Date: 03/08/2020

The Bank of England’s interest rate decision will be announced at 7am BST (8am CET) this Thursday, with Governor Bailey’s press conference to follow at 12:30pm.