BoE December Meeting Reaction: MPC split in dovish vote on rates

- Go back to blog home

- Latest

Thursday’s Bank of England announcement delivered mixed messages for market participants.

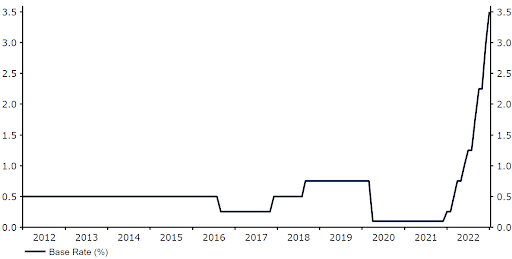

Figure 1: Bank of England Base Rate (2012 – 2022)

Source: Refinitv Datastream Date: 15/12/2022

MPC members are, however, clearly divided over the extent of additional tightening required. As was the case in November, there was another three-way voting split among policymakers. Six of the nine committee members voted for a 50bp hike, with only one member (Mann) in favour of another 75bp move, and two (Tenreyro and Dhingra) in support of no change. This is dovish relative to our expectations – we had pencilled in one or two more hawkish dissents (from either or both of messrs Ramsden and Haskel), and only one vote in favour of unchanged rates. In justifying their stance, the doves Tenreyro and Dhingra noted that the bank rate was ‘more than sufficient’ to bring CPI back to target, and that there was no strong case for tightening on risk management grounds.

In its accompanying communications, the BoE said that the Autumn statement would have a ‘small’ impact on UK inflation, although it would boost GDP by 0.4% over the coming twelve months. The MPC now only expects the UK economy to contract by 0.1% QoQ in Q4 (versus its previous -0.3% projection). This is in line with our view that the UK economy is set to hold up better than the bank had previously warned, and suggests that a technical recession this year is not necessarily a done deal. Perhaps the key takeaway from the bank’s rhetoric was, however, the omission of the line from November that had pushed back against market pricing for UK rates. This is either yet another change of heart, or a reflection that market expectations for rate hikes have eased since then.

The reaction in sterling was muted. The pound sold-off modestly in response to the dovish 6-3 vote on rates, although the lack of a push back against market pricing for rates was seen as moderately hawkish, which is likely to have limited the move lower.

Figure 2: GBP/USD (1 week)

Source: Refinitv Date: 15/12/2022

We think that today’s Bank of England announcement delivered even more muddled messages to markets – a very common theme throughout 2022. As was the case in November, the three-way split vote provides very little clarity as to the bank’s plans for interest rates in 2023. This is not likely to inspire much confidence in UK assets, and we suspect that the pound could underperform in the near-term as a consequence. That said, in not pushing back against market pricing, the MPC has at least suggested that further tightening may be required throughout much of H1 2023 – swaps are currently pricing in around 100bps of hikes through to June, which for now we see as reasonable.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports