BoE February Meeting Reaction: 50bp hikes a thing of the past

- Go back to blog home

- Latest

The pound traded a touch weaker against its major counterparts on Thursday afternoon, as the Bank of England hinted that its rate hike cycle may soon be nearing an end.

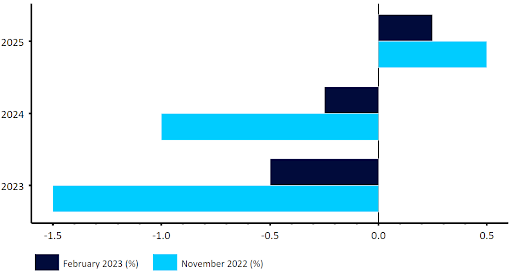

In its statement, the bank stressed that inflation risks are ‘skewed significantly to the upside’, while saying that further tightening would be required if UK inflation were to prove persistent. The bank also revised upwards its GDP projections through 2024. According to its updated forecasts, the UK economy is expected to have grown by 0.1% in the final quarter of 2022, before contracting by 0.5% this year (up from -1.5% in November) and 0.25% in 2024 (from -1%). We had said at the time that the bank’s November GDP projections were far too pessimistic, a view that we believe has been vindicated by recent resilient UK macroeconomic data.

Figure 1: BoE GDP Projections [February 2023]

Source: Refinitv Datastream Date: 02/02/2023

The initial reaction among investors was to send sterling higher, a reflection of the above rhetoric, the upwardly revised GDP projections and the hawkish voting pattern among committee members. Markets were also not fully pricing in a 50bp hike prior to the meeting (approximately 46bps were expected by swaps), while a number of economists (some 30% according to a recent Retuers poll) were even eyeing a surprise 25bp move. Sterling was, however, unable to hold onto any of its gains, and by the end of the bank’s press conference, the pound was trading roughly unchanged against the US dollar.

Figure 2: GBP/USD (1 week)

Source: Refinitv Date: 02/02/2023

In our view, this retracement largely has to do with the tweak in the bank’s stance on additional policy tightening. The MPC gave the clearest indication yet that it is approaching an end to its hiking cycle, dropping from its statement the word ‘forcefully’ when referring to future rate increases. We see this as a clear signal that 50bp hikes are a thing of the past, and expect the bank to revert back to a ‘standard’ 25bp move from the next meeting in March. In a similar fashion to the Federal Reserve, the BoE appears keen to keep its options open beyond the next meeting. In his press conference, governor Bailey noted that inflation had ‘turned a corner’, while also appearing to place greater emphasis on the lack of a recovery in UK labour force participation. When asked about the change in language on rates, he did, however, stress that it was ‘very early days’, and it seems that the MPC will maintain a highly data-dependent approach beyond the March meeting.

We view today’s Bank of England announcement as mildly hawkish relative to our expectations, although we are beginning to see clear signs that an end to the hiking cycle is approaching. As mentioned, we are pencilling in another 25bp hike in March, with the possibility of a final one at the May meeting, which would be more aggressive than currently priced in (32bps expected through June). As with the Fed, the extent of additional tightening remains highly dependent on upcoming inflation prints, which will continue to be of the utmost importance for currency markets.