BoE June Meeting Preview: Will the MPC hint at 2022 rate hike?

( 4 min )

- Go back to blog home

- Latest

The Bank of England will be announcing its policy decision on Thursday, and while no new projections or Inflation Report will be released, investors will be watching closely.

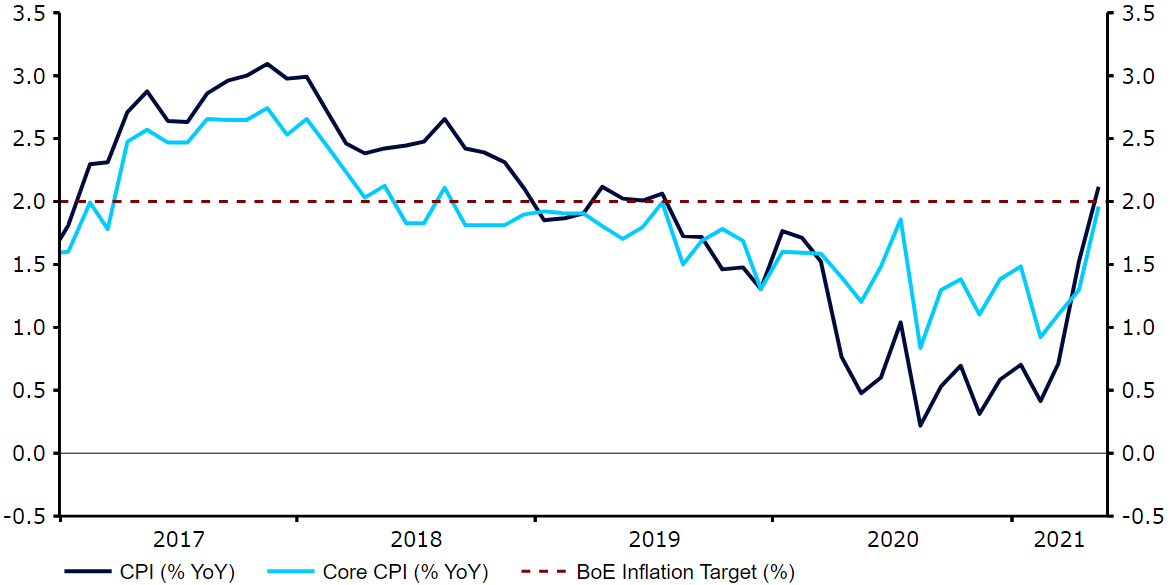

One key question for the bank will, of course, be the recent increase in UK inflation. Prices are rising at a rather rapid pace as the government gradually unwinds lockdown measures. The headline rate of consumer price growth rose above the BoE’s target in May (2.1% year-on-year), with even the typically less volatile core measure of inflation jumping to 2% annually, well above the 1.5% consensus and its highest level since August 2018 (Figure 1).

Figure 1: UK Inflation Rate (2017 – 2021)

Source: Refinitiv Datastream Date: 22/06/2021

In May, the BoE communicated that it expects headline inflation to rise to 2.5% this year, before moderating in 2022. It will be interesting to see whether this view still holds, or if the MPC has seen enough evidence to suggest that the increase in prices may be more entrenched than first anticipated. We doubt that this is the case. We will, however, be looking closely for any suggestion from the BoE that the aggressive spread of the Delta variant and subsequent delayed reopening in Britain could materially affect the UK’s economic recovery – again we suspect that it won’t.

With the next set of macroeconomic projections not due until August, we think that the MPC will probably try not to rock the boat too much on Thursday. We don’t expect any additional policy tweaks to the QE programme just yet, particularly given the MPC announced it would be reducing the pace of its gilts purchases from £4.4bn a week to £3.4bn as recently as the last meeting in May. The real topic of discussion will be the timing for future rate hikes. So far, policymakers have drawn the line at giving any concrete signals as to when this may occur and we expect that to be the case again this time around. A surprise hint that higher rates may be forthcoming as soon as 2022 would, however, likely jolt the market and provide good support for sterling. Yet, with the market already pricing in the first hike as soon as August 2022, we think that such a move would likely be of a relatively contained nature.

The Bank of England’s policy decision, meeting minutes and monetary policy report will all be released at 12pm BST on Thursday (1pm CET).