BoE March Meeting Reaction: MPC hikes rates, dovish on future moves

( 3 min )

- Go back to blog home

- Latest

Thursday’s Bank of England announcement was much more dovish than we had anticipated.

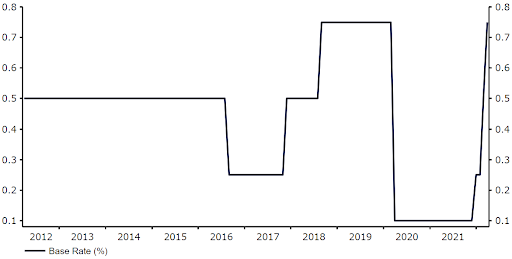

Figure 1: Bank of England Base Rate (2012 – 2022)

Source: Refinitv Datastream Date: 17/03/2022

We think that even more significant was the toning down of the language on interest rates in the bank’s statement. In its statement, the BoE noted that further tightening in policy ‘might be appropriate’, a downgrade on its February communications when it stated that it was ‘likely to be appropriate’. The bank revised upwards its near-term assessment of UK inflation. The MPC now expects inflation to reach 8% in the second quarter, and possibly higher later in the year, although this is expected to suppress economic activity during the remainder of the year. The minutes are also much more dovish on long-term inflation than we had anticipated, noting ‘further out, inflation was expected to fall back materially and possibly to a greater extent than had been expected in February.’

Overall, a dovish message that suggests policymakers are growing increasingly concerned about the impact of rising prices on consumer demand, particularly higher commodity prices that are out of the bank’s control. We continue to think that further interest rate hikes are on the cards, including at the next meeting in May – the labour market is tight and inflation is set to increase further as the war in Ukraine drives energy bills higher. We do, however, think that the pace of hikes will perhaps not be as fast as we had previously anticipated, in light of the bank’s growing focus on slower UK growth. The MPC may even announce a pause in the hiking cycle after the May meeting, which could make it difficult for the bank to raise rates as aggressively as the market is currently pricing in. According to swaps, investors expect the equivalent of five more 25 basis point rate increases over the course of the remaining six meetings this year. This may now be a little bit of a stretch.

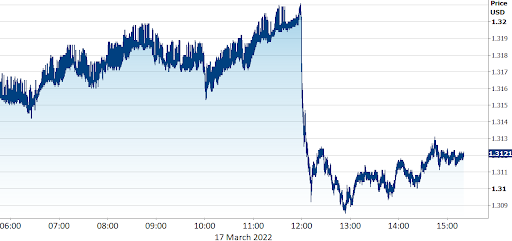

Sterling reacted to the dovish message in an unsurprising fashion, falling by almost three quarters of a percent on the dollar, albeit cable merely returned to Wednesday’s levels. We see bearish medium-term implications of the Bank of England’s dovish turn, and will be revising our GBP forecasts lower in recognition of this.

Figure 2: GBP/USD (17/03/2022)

Source: Refinitv Date: 17/03/2022

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports