Dollar bounces back on strong payrolls report

- Go back to blog home

- Latest

After a steady six-week sell-off, the Dollar finally stabilised last week against the Euro and even managed a creditable bounce back against every other major currency.

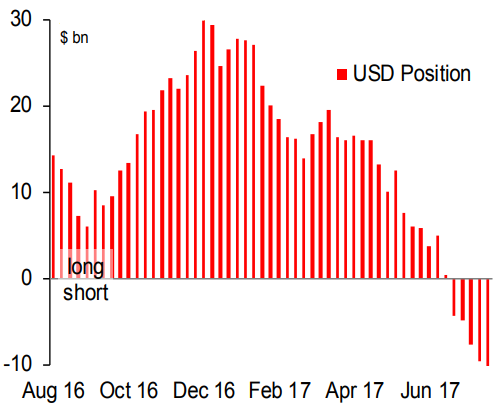

Event risk usually winds down in August. There are few critical releases or policy announcement in the docket until the Jackson Hole conference of central bankers on 24-26th August. We’d expect technical factors to become relatively dominant for the next two or three weeks. In this context, the rather extreme level of long Euro positions among speculators could mean trouble for the common currency (Figure 1).

Figure 1: Aggregate US Dollar Positioning (August ‘16 – August ‘17)

Major currencies in detail

GBP

There was no surprise in the Bank of England decision to hold rates, or the balance of power between hawks and doves, currently at six to two. However, markets saw dovishness in Governor Carney’s comments and press conference. We note that Carney reiterated his explicit disagreement over markets’ assessment that there will be no hikes for the foreseeable future. The negative reaction in Sterling seems excessive, particularly against the Euro.

With only second tier economic data out, Sterling should largely trade in line with Dollar sentiment and market technicals. As for the latter, any rebalancing of stretched speculative positions should be supportive of the Pound.

EUR

The common currency traded higher yet again earlier in the week. Economic data was supportive, although largely as expected. Employment continues to grow, core inflation firmed up a bit, and second quarter growth came out at an annualised 2.1% level, the highest since the aftermath of the financial crisis. In the absence of any meaningful data releases this week, the Euro should trade off events across the Atlantic.

USD

The Dollar sell-off finally stopped after a strong payroll report on Friday. Headline job creation, wage growth, unemployment and labour force participation all came out as or better than expected. This dovetails well with other recent data (such as durable goods orders) that have tended to surprise on the upside.

The only obstacle in the way of another Federal Reserve hike in 2017 is subdued inflation. The CPI release for June this Friday will be perhaps the only significant data point in a languid summer week. With no economist expecting anything higher than a 0.2% monthly increase in the core inflation number, an upside surprise could have a significant market impact.