Dollar collapses as soft inflation print eases pressure on Fed

( 3 min )

- Go back to blog home

- Latest

After a strong start, Thursday was a torrid day for the dollar, which collapsed against its peers following a much softer-than-expected US inflation print.

Summary:

- USD collapses by almost 2% against its major peers, after October US inflation data falls well short of market expectations.

- Investors expect the Fed to revert back to a 50bp rate hike at the bank’s December FOMC meeting.

- EUR/USD rallies back towards the 1.02 level, helped by hawkish comments from ECB members.

- Sterling ends London trading on Thursday as one of the best performing currencies in the world. Traders eye this morning’s Q3 GDP data (-0.5% QoQ expected).

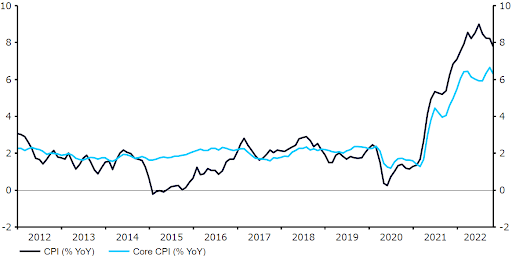

Arguably the main theme in the global economy in the past twelve months has been the relentless stream of scorchingly hot inflation prints, which have time and time again come in well above economists’ expectations. Thursday’s US CPI data very much bucked the trend. The headline inflation number unexpectedly dropped to 7.7% in October, below the 8% priced in, and its lowest level since January.

The drop in the headline number was once again partly driven by a decrease in natural gas prices (down 4.6% MoM), while prices of core goods, which include apparel, cars and alcohol, also dropped by 0.4% MoM. Core price pressures, which were yet to show any clear signs of a peak prior to today, also appear to be abating as the index excluding food and energy fell back to 6.3%.

Figure 1: US Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 10/11/2022

Earlier in the week, we had built up the importance of Thursday’s US inflation data, and the reaction in currencies speaks volumes as to just how important it really was. Prior to its release, the dollar was actually broadly stronger, perhaps in anticipation of another stellar report. These gains were, however, wiped out in no time, and then some, with the US dollar index ending the London trading session almost 2% lower than where it began it. EUR/USD briefly appeared to be heading above the 1.02 mark for the first time since August, ending yesterday just below that level. GBP/USD also leapt to a two-month high above the 1.165 threshold, with effectively every other major and emerging market currency trading much higher, most by 1% or more.

Of course, the real reason as to why the dollar put in such a weak performance yesterday was the impact of the inflation data on Federal Reserve policy. Last week, the FOMC indicated that US rates may need to go higher, and stay higher than had been previously anticipated. Yet, investors believe that Thursday’s data will significantly reduce pressure on the Fed to tighten policy at anywhere near their recent pace at the next few FOMC meetings. In our view, another 75bp hike in December now seems unlikely. We are due the November inflation report, and NFP data, before the meeting, though we would probably need to see blowouts in both in order to convince Fed members to stick with a 75bp rate increase. Beyond then, the debate turns to when the hiking cycle will end. So long as this data point wasn’t merely a one-off, that could lead to a dovish pivot in December and an end to the hike cycle in February.

Two of the best performing currencies yesterday were actually sterling, and the euro, though for different reasons. Unlike in the US, inflation in the Euro Area is yet to show any signs of peaking, and markets think that the ECB still has some way to go before it takes its foot off the pedal. ECB members Vasle and Schnabel both struck a hawkish tone during speeches yesterday, which may have helped the common currency on its way. As for the pound, the high risk premium on the currency leaves it susceptible to wild swings in the exchange rate during shifts in risk sentiment. We suspect that today will be a quieter session for the UK currency, though this morning’s Q3 GDP data will be released, and could prove a market mover. A 0.5% QoQ contraction is priced in by market participants.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports