Dollar falls as recession fears recede, yields fall

( 6 min )

- Go back to blog home

- Latest

Risk assets rose worldwide last week as the backdrop turned more supportive.

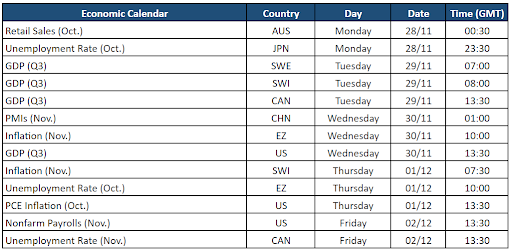

As this is written, news of the anti-lockdown protests in China are dominating headlines and risk assets are opening softer in Asian early morning trading. In addition to the headlines from China, this should be a very busy week for markets. The flash inflation report out of the Eurozone (Wednesday) is expected to remain at record highs, specially in the core indicator, a stark contrast to the wishful thinking we see in the ECB and elsewhere that inflation will somehow go away on its own. The latter part of the week will be dominated by US macro news, including the PCE inflation report (Thursday) and the critical November payrolls report (Friday).

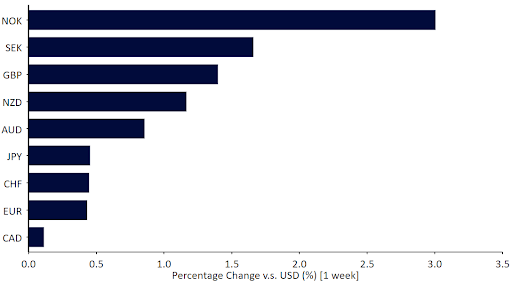

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 28/11/2022

GBP

The pound continues to benefit from the sense of stability brought to UK finances by Prime Minister Sunak. It’s also helpful that market expectations for the terminal rate in the UK continue to creep up towards 5%. A handful of MPC members spoke last week, and there appears a general consensus among policymakers that additional interest rate hikes are required. Last week’s High Court ruling, which deemed that another Scottish Independence referendum cannot take place without Westminster consent, had little impact on sterling.

This week is extremely light in terms of UK data, so risk appetite among investors and a couple of speeches by MPC members (Tuesday and Wednesday respectively) will be the main drivers of trading in the pound.

EUR

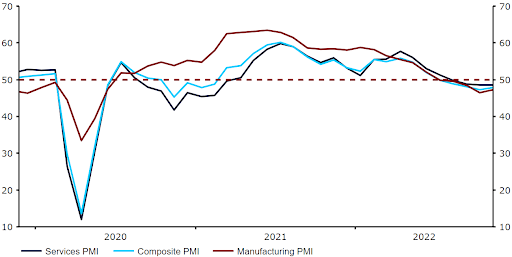

While sentiment in the Eurozone economy remains negative, key surveys last week all came out stronger than expected. This includes the PMI survey of business activity, but also consumer and investor confidence. For now, the weakness in the surveys has not fully shown up in the actual economic numbers, which continue to hold up rather well under the circumstances.

Figure 2: Euro Area PMIs (2020 – 2022)

Source: Refinitiv Datastream Date: 28/11/2022

This week, the focus will be on the flash inflation numbers for November, out on Wednesday. The excitement around the possibility that headline inflation may retreat slightly, while remaining in double digits, should be tempered by the absence of any sign of a pullback in the more persistent core number. The latter will likely remain above 5%, a dizzying and unsustainable 4% above overnight rates in the Eurozone.

USD

The holiday-shortened week in the US had little economic or policy news to drive markets, aside from the publication of the somewhat stale minutes of the last Fed meeting. The minutes reinforced the notion that the Fed is likely to revert back to a 50 bp hike in December, but told us little about the more important question of what to expect next year.

While the payrolls report on Friday should dominate headlines, we think markets are not paying enough attention to the PCE inflation report for October, the Fed’s preferred inflation measure, released the day before. It will be interesting to see whether it confirms the softness of the CPI report that gave so much encouragement to markets, thanks partly to some technical quirks in the report. Should it come out higher than expected we could see some sharp retracement in expectations for the Fed’s terminal rate.

JPY

The yen traded a touch higher on the US dollar last week, though the general improvement in risk appetite meant that the currency underperformed most of its G10 counterparts. Slowly but surely, the Japanese yen is regaining its status as one of the chief safe-haven currencies in the world, a mantle lost due to the Bank of Japan’s ultra-dovish monetary policy stance. Yet, with central banks globally approaching the end of their tightening cycles, the yen is somewhat back in favour again among investors, with the currency rallying this morning on news of the worsening in the COVID-19 situation in China over the weekend.

Japanese inflation data, out last week, came in higher than expected, perhaps a prelude to a slightly less dovish BoJ policy stance. Labour market data (Monday), industrial production (Tuesday), and a speech from Bank of Japan governor Kuroda (Thursday) will be closely watched by investors this week.

CHF

The Swiss franc ended last week little changed against the euro, and around the middle of the G10 currency performance dashboard. News from Switzerland was scarce, and the US Thanksgiving holidays ensured that trading activity was light in the second half of the week.

This week’s economic calendar in Switzerland is unusually busy. Third-quarter GDP growth, sentiment indices, retail sales and PMI data will all be out. The primary focus should, however, be on the latest inflation figures (out on Thursday), as the November print may have the biggest impact on the size of the SNB’s rate hike next month. In the two months prior, the data has surprised to the downside, but at 3% it remains significantly above the SNB’s 0-2% target range.

AUD

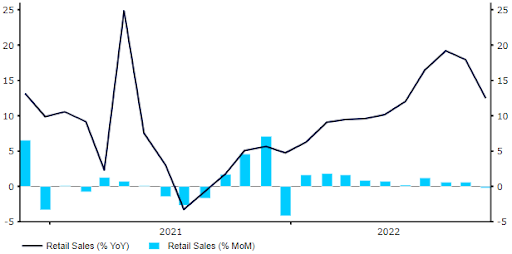

News of anti-lockdown protests in China over the weekend led to a bit of weakness in the Aussie dollar this morning, as investors fret over the possibility of additional mobility restrictions in Asia’s largest economy. AUD does, however, continue to remain well bid against most currencies, as dimming fears over a global recession support high-risk assets. Domestic economic news out last week was a touch on the soft side, which perhaps contributed to the underperformance in AUD relative to its New Zealand counterpart. Both the services and manufacturing PMIs missed expectations, with the latter now at its lowest level since January (47.2). An unexpected drop in this morning’s retail sales print for October (-0.2%) has further clouded the outlook.

Figure 3: Australia Retail Sales (2021 – 2022)

Source: Refinitiv Datastream Date: 28/11/2022

We suspect that headlines out of China, Australia’s largest trading partner, will be the main driver of the dollar during the remainder of the week. Domestic macroeconomic data releases are few and far between, though a speech from Reserve Bank of Australia governor Lowe on Friday could draw some attention.

NZD

In line with expectations, the Reserve Bank of New Zealand raised its base rate by another 75 basis points last week. Some analysts had pencilled in a smaller hike in light of the growing downside risks to growth. While the RBNZ noted that a shallow recession was likely on the way in 2023, it also said that this would be a necessary condition in order for the bank to reach its inflation target. The statement remained rather hawkish. The reference to ‘tighten at pace’ was removed, though the bank noted that rates would need to go higher than previously expected. The committee even discussed the possibility of a 100bp hike at last week’s meeting.

The New Zealand dollar was well supported in the aftermath of Wednesday’s RBNZ announcement – we suspect that growing expectations for hikes could keep the currency well bid this week. The bank’s commitment to bringing down core inflation is notable, and is likely to ensure that it could raise rates deeper into 2023 than most of its G10 counterparts.

CAD

The Canadian dollar once again underperformed most of its major peers last week, ending near the bottom of the G10 performance tracker, alongside the US dollar. Some dovish comments out of the Bank of Canada were partly behind this underperformance, with deputy BoC governor Rogers saying last week that higher rates were causing hardship for households. The BoC delivered a dovish tilt at its last meeting, and it will likely take something extraordinary for anything larger than a ‘standard’ 25bp hike at the last policy meeting of the year in December.

This week is a very busy one in terms of economic data releases in Canada. Tuesday’s Q3 GDP number to expected to show that the Canadian economy expanded at a modest pace in the three months to September. Meanwhile, economists are bracing for a sharp slowdown in job creation in Friday’s labour report for November (+6k expected in the net employment change number).

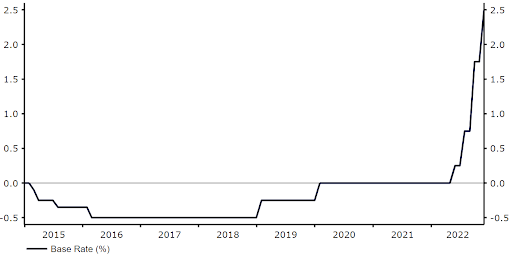

SEK

The Swedish krona appreciated against the euro last week, in line with the general improvement in investor appetite for risk. The outcome of last week’s Riksbank meeting was more or less as expected, perhaps with a slight dovish tilt, which limited further gains for the krona. The Riksbank raised interest rates by 75 basis points to 2.5%, the highest level since 2008. The board stated that the risk of high inflation becoming entrenched is still substantial, and that it is very important that monetary policy acts to ensure a stabilisation around the 2% target within a reasonable time.

Figure 4: Riksbank Base Rate (%) (2012 – 2022)

Source: Refinitiv Datastream Date: 28/11/2022

In addition, the Riksbank also published its new macroeconomic projections. The target CPIF measure was projected to ease from 7.6% this year to 5.7% in 2023, an upward revision from the previous forecast of 5.1%, and then down to 1.5% in 2024, slightly lower than 1.6% expected last time. The bank expects a GDP contraction of 1% in 2023, before growth of 1.0% returns in 2024. As for the terminal rate, the bank puts it at 2.84% in the third quarter of next year. The revised rate path remains somewhat off-market expectations and, in our view, is somewhat conservative.

NOK

In the absence of relevant data last week in Norway, the Norwegian krone traded in line with risk assets, ending the week higher against the euro on improved risk sentiment. Expectations of a more dovish Federal Reserve, and the reduced fear of recessions, have contributed to the improvement in risk sentiment. Indeed, NOK was by far and away the best performer in the G10 last week, largely a consequence of its high-risk status.

No major data will be published this week either. Therefore, we believe that the currency will continue to trade in line with other risk assets. Protests in China over increased restrictions to curb covid may continue to worsen sentiment, which may weigh on risk assets in the coming days, including the Norwegian krone.

CNY

The Chinese yuan was among the underperformers last week. Sentiment toward China has taken another turn for the worse, as domestic covid cases continued to hit fresh record highs. This has prompted officials to introduce local restrictions and mass testing, as a number of cities struggle to contain the spread. This will add to the strain on the Chinese economy and policymakers have rushed to provide monetary support. Last week, commercial banks in China announced fresh credit lines to help struggling property developers. For the first time since April, the PBoC also cut its reserve requirement ratio (RRR) for banks, slashing it by 25 basis points to ensure ample liquidity.

In the coming days, we’ll receive fresh PMI prints for November, which should help us understand the degree of the economic slowdown. The immediate attention in China is, however, on protests against the country’s zero-Covid policy. These protests have erupted in the past few days in response to a number of tragedies, including a fire that killed 10 in Urumqi, the capital of the northwestern Xinjiang region. Protests have taken place in at least nine cities, including Beijing and Shanghai, which has further soured sentiment towards the yuan at the start of this week.

Economic Calendar (28/11/2022 – 02/12/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports