Dollar falls on US Presidential Election jitters, America goes to the polls on Tuesday

- Go back to blog home

- Latest

The US Dollar has had a very difficult time against its G10 peers as increased uncertainty over the outcome of the US Presidential Election took its toll on financial markets worldwide.

Equities, commodities and emerging market currencies sold off throughout last week.

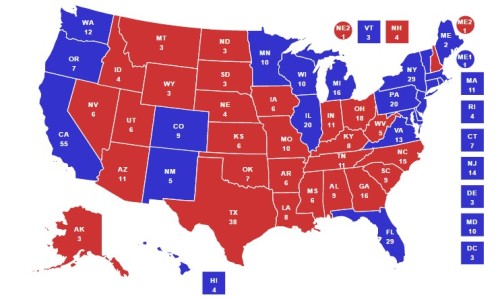

All eyes now turn to US Presidential Election on Tuesday. Polls and early voting indicators over the weekend appear to favour Clinton, who continues to hold a narrow advantage in many of the swing states (Figure 1).

Figure 1: US Electoral College Map

Betting markets are now pricing in an 80% chance of a Democratic victory after the FBI informed Congress on Sunday that Hillary Clinton should face no charges over the content of her emails. This has provided a significant boost to Clinton’s election chances, causing the US Dollar to rally overnight and sending the Mexican Peso sharply higher by over 2%. Well respected statisticians, FiveThirtyEight, peg her chances at roughly 2 in 3, though most other analysts’ estimates are higher.

We will be covering the US Presidential Election thoroughly. In addition to an Election Guide, Ebury’s Market Analysts will keep you informed with live updates throughout Tuesday night.

Major currencies in detail:

GBP

Last Thursday delivered a double boost for Sterling.

Early in the morning, the High Court ruled that Parliamentary approval is needed to trigger Article 50 and start the process of leaving the European Union. Of course, this ruling will be appealed to the Supreme Court, however, it makes clear that it will be very difficult for May’s Government to pursue a hard Brexit, without the political and institutional consensus. This was good news for Sterling.

Then at midday the Bank of England surprised markets by removing its easing bias and announcing that the trade off between inflation and growth was now neutral.

This positive news, the extreme undervaluation of the Pound at current levels and massively short positioning in the markets was enough to fuel a 3% weekly Sterling rally. We think that this rally is likely to continue once we get over the US election on Tuesday.

EUR

The Eurozone remained out of the spotlight last week.

There were a couple of important macroeconomic figures including the first estimate of third-quarter GDP, coming in right on estimates at a sluggish 1.2% annualised rate, and October inflation, which remained at a disappointingly low 0.5% level. Both of these were overshadowed by political developments in the UK and, particularly, the US.

We expect this to continue this week and the Euro will largely trade in response to the result of the US Presidential Election. We continue to expect a Clinton victory and a moderate rally in the Dollar. However, a Trump win would certainly send the EUR/USD rate higher and we’d see an immediate move of around 2-3%.

USD

The US October payrolls report was completely overshadowed by election jitters.

It was a thoroughly solid report, ticking all the right boxes for Federal Reserve hawks. The headline number was slightly under expectations, but this was more than made up by upward revisions to previous months. Unemployment ticked down to 4.9% and wages continued to push higher, now rising at a 2.8% annual rate.

The report confirms our view that, absent a financial meltdown, the Federal Reserve is on track to hike interest rates for the second time since 2008 at its December meeting.

Technical Analysis

EUR/USD

EUR/USD remained pinned under the 1.112 resistance level throughout last week. The next resistance level is at 1.1180/90, with late September highs of 1.1280 a key short term hurdle for the currency pair. Technicals are neutral although have turned moderately bullish.

GBP/USD

GBP/USD has continued to trend sideways after a steep fall following September’s ‘flash crash’. The currency broke through the 1.247 resistance level last week after rallying by over 3% against the US Dollar. The next resistance level is at the 1.262 level. Technicals remain neutral.

Receive these market updates via email