Dollar rebounds on solid US economic data; all eyes on ECB

( 3 min )

- Go back to blog home

- Latest

Some positive data out of the US helped to allay concerns about growth last week.

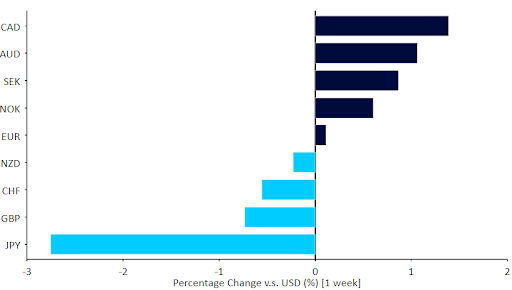

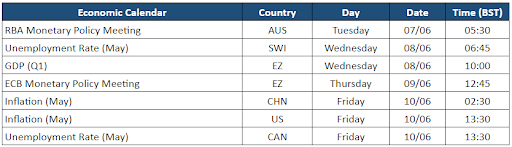

Most currency market moves were subdued, as traders await a crucial two weeks of central bank meetings. First up is the European Central Bank on Thursday. Markets expect the institution to go further in its hawkish pivot. The question now is not whether or when to hike (it will be July) but how much rates will go up at each meeting after June. US inflation data for May on Friday will be the last crucial data point there before the Federal Reserve meeting the following week.

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 06/06/2022

GBP

Sterling put in a dismal performance during the jubilee-shortened trading week. There was no major data to justify the somewhat puzzling move, although uncertainty surrounding Boris Johnson’s leadership, which will be put to a confidence vote this evening, is unlikely to have helped the currency.

The pound remains historically cheap and traders positioning looks increasingly stretched as shorts have piled up on the currency. The bet on a lower sterling appears very dependent on a dovish bank of England defying market expectations to hike at every meeting into 2023. Any hint of a hawkish turn in the Monetary Policy Committee next week could lead to a sharp rally in GBP, which we see as one of the most undervalued currencies in the G10.

EUR

The ECB is set to announce an early-July end to quantitative easing this Thursday, paving the way for its first hike since 2011 at the July meeting. The main question is whether that hike will be 25 or 50 basis points, and we expect the press conference after the meeting to focus squarely on that. The ECB will also release its revised growth and inflation forecasts, but its dismal track record in this area probably means that they will be mostly ignored by markets.

We expect Lagarde to punt on Thursday and leave all options on the table for the July meeting. Given current expectations of around a one-in-three chance of a 50 basis point hike in July, this should support the common currency, as expectations for ECB hikes continue to be pushed upwards across the curve.

USD

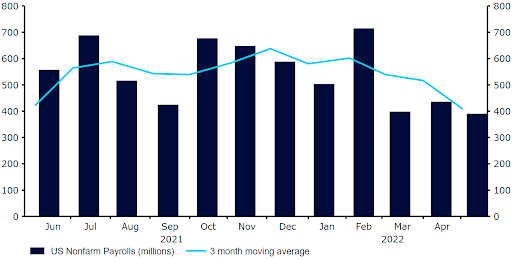

The strong payrolls report out of the US seemed to confirm the optimistic outlook on the US economy evident in the publication of the Federal Reserve’s Beige book a couple of days earlier. Jobs continue to be created at a fairly rapid clip, the US economy is operating at or perhaps even above full employment, and while wages are going up, they are not quite keeping up with inflation.

Figure 2: US Nonfarm Payrolls (2021 – 2022)

Source: Refinitiv Datastream Date: 06/06/2022

With rates still far below inflation and no hint of fiscal tightening from Washington, we remain of the opinion that a recession is very unlikely in the near term. While the ECB meeting will steal the spotlight this week, the inflation report on Friday will be important to see whether core inflation continues to stabilise around the 6% level, which would be very unwelcome news for the Federal Reserve.

CHF

The Swiss franc sold-off against most peers last week. We think its weakness had to do with rising US yields, which tends to work against the currency. The scale of the decline was limited, however, particularly against the euro, with rising expectations for SNB policy normalisation helping to cap the franc’s losses.

Last week’s data from Switzerland caught the attention of market-watchers. Of particular interest was inflation, which printed at 2.9%, its highest level since 2008 and noticeably higher than expected. First-quarter GDP also surprised to the upside. At the same time, forward-looking indicators of activity disappointed. The KOF Economic Barometer, a composite indicator that predicts the near-term performance of the Swiss economy, dropped sharply below its long-term average to 96.8, its lowest level since January 2021.

This week we’ll focus on SNB sight deposit data (a proxy for interventions), out on Tuesday. This could give us a better idea of the bank’s approach towards policy tightening. While we don’t expect an immediate interest rate hike, noises from the central bank suggest next week’s SNB meeting will be one of the more interesting ones in recent years.

AUD

An increase in commodity prices, some robust domestic economic data and expectations for an aggressive tightening cycle by the Reserve Bank of Australia provided solid support for the Australian dollar last week, which ended as one of the better performers in the G10.

Last week’s growth data was on the strong side, with Australian GDP increasing by a larger-than-expected 3.3% on a yearly basis in the first quarter of the year, and by 0.8% on a quarterly basis. The data provides an indication that the Australian economy is continuing to hold up rather well, despite the recent increase in inflation.

The Reserve Bank of Australia is set to meet on Tuesday. Markets are already fully pricing in a 25 basis point move, although we think there is a chance of a larger hike and we do not rule out a move of 50 basis points. This would catch market’s wrong-footed, and would likely trigger a fairly sharp move higher in AUD.

CAD

The increase in commodity prices, and another interest rate hike from the Bank of Canada, drove the Canadian dollar to its highest level in a month against the US dollar last week.

The Bank of Canada continues to tighten monetary policy, raising interest rates by another 50 basis points last week, as it did at its previous meeting, to 1.5%, while signalling further hikes ahead. The BoC’s communications were, on the whole, rather hawkish, with policymakers noting that the bank stands ready to ‘act more forcefully’ in order to achieve its 2% inflation target. In its statement, the bank said that ‘global and Canadian inflation continue to rise, driven largely by higher energy and food prices’, and that ‘interest rates will have to rise further’. The tone of the communications make us increasingly confident that additional 50 basis points hikes are on the way during at least the next two meetings in July and September.

The May unemployment rate will be released on Friday. Aside from that CAD will be driven by events elsewhere.

CNY

The Chinese yuan outperformed most of its peers last week, as positive news from China sparked optimism towards the currency. The two-month lockdown of Shanghai was brought to an end, with Beijing also set for an easing of restrictions. An unwinding in measures should help the economy get back on track, and we think its performance should improve, particularly in the second half of the year.

So far, however, PMI data continues to point to weakness. The key indices rose in May, although again came in below the level 50 that separates expansion and contraction. Interestingly, the official and Caixin prints diverged quite a bit. This could reflect a difference between the types of firms polled (with official ones oriented towards large, public companies), but the gap is still worth watching in the coming months.

In the next few days we’ll continue to focus on news on an easing of covid curbs in China. On Friday, consumer and producer inflation data will be worth watching, with the gap between the two gauges expected to close further. Speaking of inflation, China’s reopening is welcome news from the standpoint of supply disruptions, albeit an economy on its way back to growth may further boost global inflationary pressures. This seems to already be the case, with oil prices appearing to react to the easing of lockdowns.

Economic Calendar (06/06/2022 – 10/06/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports