Risk currencies got off to a strong start to the week on Monday and Tuesday, with the US dollar extending its losses against most of its major counterparts.

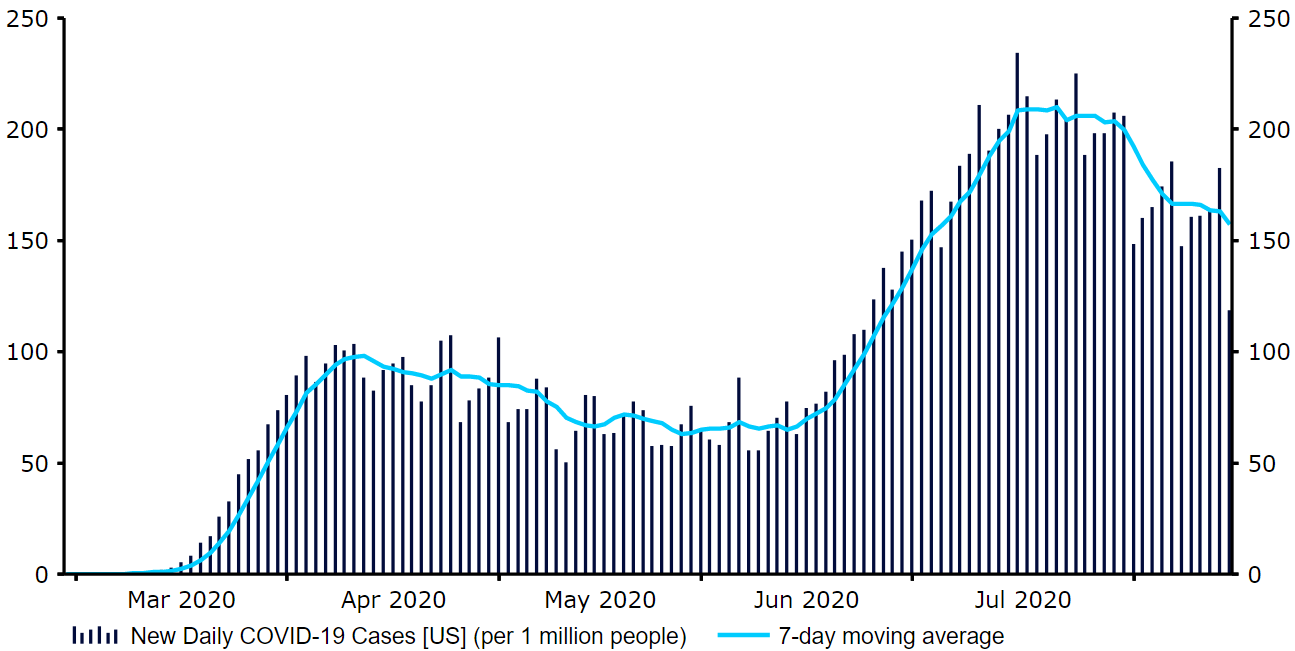

Figure 1: US New Daily COVID-19 Cases (March ‘20 – August ‘20)

Source: Refinitiv Datastream Date: 18/08/2020

The limited news and data that we have had in the past few days has also been broadly negative for the US dollar. Yesterday’s New York Empire State Manufacturing index massively undershot expectations, declining to just 3.7 after investors had eyed a reading of 15. News over the weekend that the review of the US-Sino ‘phase one’ trade deal, due to have taken place on saturday, was postponed has led to an unwinding in safe-haven bets. This delay has actually been treated by investors as a positive sign, given that it gives China more time to fulfil its promised purchases of US goods as part of the agreement – purchases that have, of course, been disrupted by the covid pandemic. While no date has yet been set to complete the review, comments from US officials have been encouraging of late, suggesting that they have no plans to abandon the deal.

US Paper Currency, Stock Market and Exchange, Currency, Finance, Graph

With short dollar positioning becoming increasingly stretched, it will be interesting to see whether this trend of dollar weakness continues in the coming days or if there emerges any catalyst for a reversal. Wednesday’s FOMC meeting minutes could provide such a catalyst, although we don’t expect too much in the way of new information from the Federal Reserve this week. As far as the euro and sterling are concerned, a host of European and UK data out this week could stop both currencies in their tracks should they surprise to the downside. We will be paying closest attention to the Euro Area PMI data for August and UK retail sales for July, both out on Friday.