Dollar trades higher as US economy posts solid Q4 growth

- Go back to blog home

- Latest

The dollar traded modestly higher against most currencies on Thursday afternoon, as a generally encouraging set of macroeconomic data releases eased concerns over the possibility of a US recession.

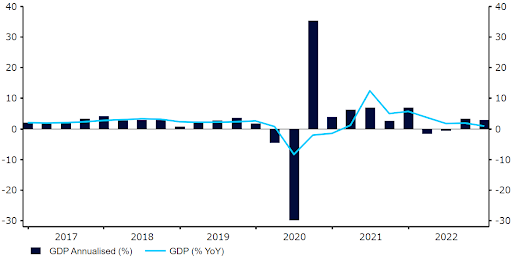

Thursday’s fourth quarter GDP report, weekly initial jobless claims and December durable goods orders data all surprised to the upside. According to the US Bureau of Economic Analysis, the world’s largest economy expanded by 2.9% annualised in the final three months of 2022, marginally above the 2.6% consensus and roughly in line with the pace of growth in the previous quarter. While this is clearly the most noteworthy of the three, the sharp increase in durable goods orders (up 5.6% on the month, vs. +2.5%), and the fresh fall in new unemployment benefit claims (to an eight month low 186k) shouldn’t be underestimated.

Figure 1: US GDP Growth Rate Annualized (2017 – 2023)

Source: Refinitiv Datastream Date: 26/01/2023

Investors reacted to the news by sending the dollar higher against its peers, though in all honesty the extent of the move was rather limited and the greenback continued to trade around its lowest level in seven months. Market participants may perhaps be somewhat wary of bidding the dollar too high ahead of Wednesday’s Fed meeting, which may deliver a dovish pivot. As we will outline in our FOMC preview report next week, we think that a smaller, 25bp rate hike is all but guaranteed, with the key to the market reaction likely to boil down to the bank’s rhetoric on the possibility of a pause following the March meeting. Should Powell and co. indeed hint that this pause is on the way, then we see plenty of room for an additional retracement in the dollar from current levels.

Among the major currencies, the pound actually held up rather well yesterday, ending modestly lower on the dollar during the London trading session. This resilience may be due to technical factors, rather than any fundamental drivers, as news out of the UK has been relatively scarce in the past couple of days. Meanwhile, the euro finished around the middle of the G10 performance tracker. We may see relatively contained levels of volatility in the G3 currencies in the next few days, as investors await the key central bank meetings of the Federal Reserve, European Central Bank and Bank of England on Wednesday and Thursday respectively. In our view, the latter is a particularly tough one to call given the lack of consensus among MPC members. Again, we will be releasing preview reports for all three early-next week.