Dollar trades lower, despite jump in US retail sales

( 3 min )

- Go back to blog home

- Latest

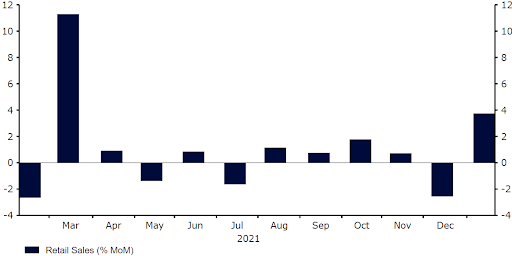

A strong set of US retail sales figures was not enough to prevent the US dollar ending the London trading session lower against most of its major peers on Wednesday.

Figure 1: US Retail Sales (1-year)

Source: Refinitiv Datastream Date: 16/02/2022

The reaction in the US dollar was, however, rather limited. Markets were already pricing in a 50/50 chance of a half a percentage point rate hike from the FOMC at its March meeting, and that was little changed following yesterday’s data. Investors instead traded on growing hopes for a de-escalation in tensions between Ukraine and Russia. There was little new information to report on the matter during London trading on Wednesday, although no news was good news as far as the FX market was concerned, with risk assets posting modest gains at the expense of the safe-havens. Headlines surrounding the Ukraine crisis will likely remain the main driver of currencies, at least during the remainder of the week.

Meanwhile, sterling was one of the better performing currencies in the G10 yesterday, buoyed by yet another surprise to the upside in the latest UK inflation data. Headline inflation rose by 5.5% in January, above the 5.4% expected by economists. It was no surprise to us that economists have once again underestimated another UK inflation print – they’ve done so in 8 of the last 10 months. As we’ve been saying a lot in the past few weeks, the safe bet is to always take the ‘over’, rather than ‘under’ versus consensus when it comes to both inflation prints and interest rates, and that has proved to be the case once again. We are increasingly confident in our call for a 50 basis point move from the Bank of England when it next meets in March, and think that the aggressive pace of policy normalisation in the UK should provide solid support for the pound during the remainder of the year.

Speeches from ECB members Schnabel and Lane will be the worth watching in the Euro Area today. We will be looking for growing signs that policymakers are becoming increasingly more hawkish in the face of rising inflationary pressures in the common bloc.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports