ECB April Meeting Preview: Biding time until June meeting

- Go back to blog home

- Latest

This Thursday’s meeting of the European Central Bank is expected to be uneventful for the FX market, but will be closely watched by investors nonetheless.

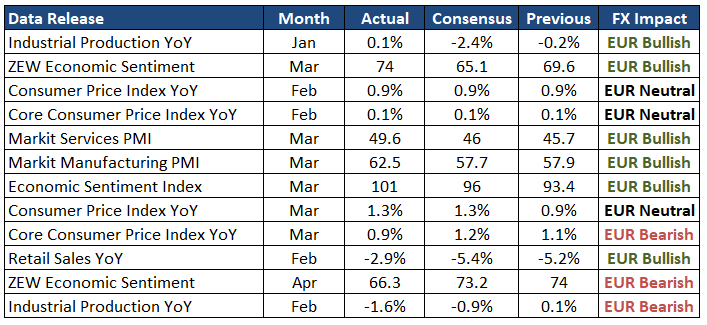

Since the March meeting, macroeconomic data out of the Euro Area has been largely resilient (Figure 1). The business activity PMIs have ticked higher, retail sales grew more than expected in February and the monthly sentiment indices have generally surprised to the upside. There is also now broad optimism about the bloc’s vaccination programme, which is expected to pick-up pace significantly in the second quarter of the year following an inauspicious start. Around 400 million vaccine doses are now expected to be made available in the EU the second quarter of the year after less than 80 million were administered in Q1.

Figure 1: Key Macroeconomic Data Releases [Euro Area] (since 11/03/2021)

Source: Refinitiv Datastream Date: 20/04/2021

That being said, there remain a handful of reasons why we may see a modestly dovish tilt in this Thursday’s communications. New virus cases have risen in the Euro Area during the third wave of infection and many nations in the bloc, notably Germany and France, have either extended lockdown measures or reimposed tougher virus restrictions. It remains likely that the majority of Europe won’t be in a position to significantly unwind lockdown measures until a few months down the road, thus delaying the economic recovery. With this in mind, we expect President Lagarde to state that the outlook of the bloc’s economy remains ‘broadly balanced’. We also think that the Governing Council will reiterate its commitment to maintaining a greater pace of asset purchases in Q2, and see little risk of a return to the previous 60 billion euros a month level until either the June or September meetings.

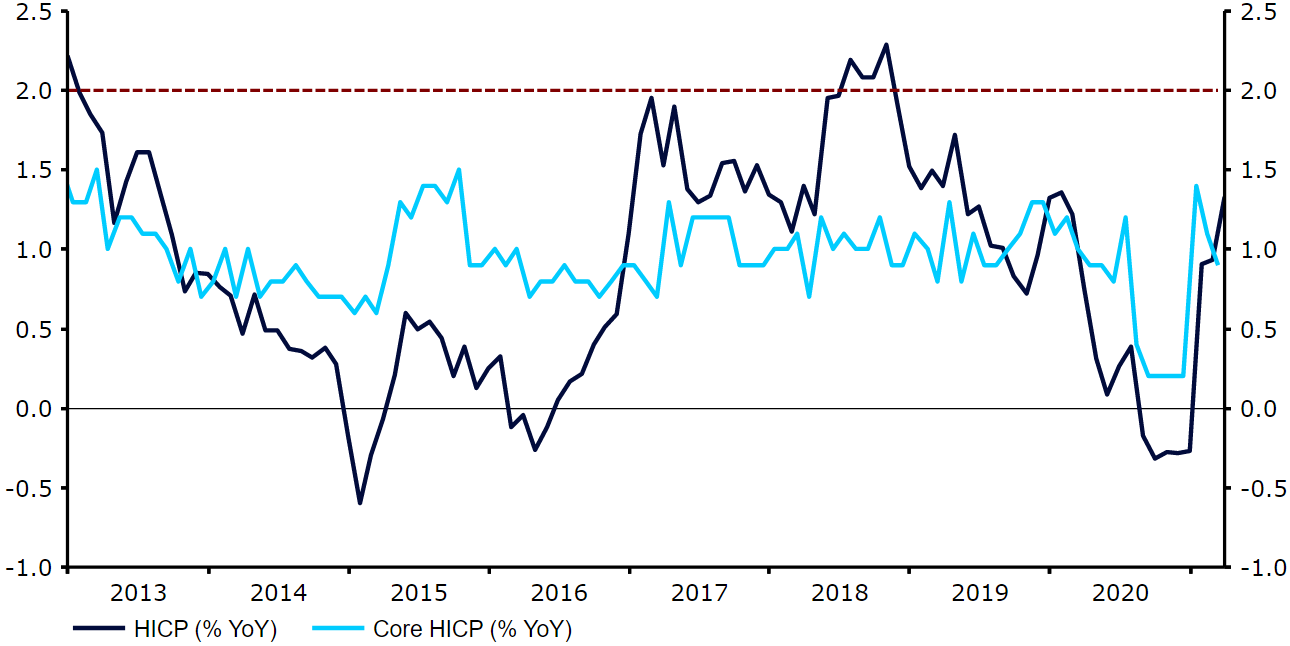

Regarding the future of the PEPP, we think that it is far too early for the bank to begin discussing policy normalisation. The programme is currently set to run until March 2022, but we are unlikely to see any change in forward guidance until later in the year. At this point the bank will have a much clearer idea as to the state of the health crisis and, in particular, its impact on Euro Area inflation, which continues to print well short of both the bank’s long-term target and its near-term expectations (Figure 2).

Figure 2: Euro Area Inflation Rate (2013 – 2021)

Source: Refinitiv Datastream Date: 20/04/2021

Overall, we think that the market reaction to this week’s ECB meeting may be muted and we don’t expect any sweeping changes to the bank’s recent rhetoric. More upbeat communications about growing vaccine optimism may, however, further support the euro’s recent rally that has seen it surge back above the psychological 1.20 level versus the US dollar.