ECB December Meeting Preview: A turnaround ahead?

- Go back to blog home

- Latest

This week’s ECB meeting is set to be an interesting one, as the bank is expected to shift towards a less aggressive tightening stance.

Commenting on the economic outlook after the meeting, President Lagarde mentioned that the Euro Area economy is expected to decelerate during the remainder of the year. She did, however, once again warn that risks to inflation remain on the upside, while noting that price pressure had broadened and that inflation had been exacerbated by the depreciation of the euro. When talking on Euro Area rates, she mentioned that they may indeed need to be raised at ‘several’ meetings, and that the bank may need to go beyond normalisation.

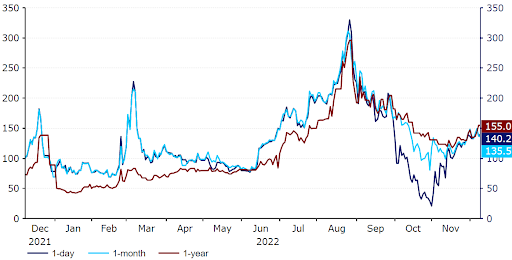

Recent remarks from central bank officials have been mixed. Interestingly, Lagarde’s tone has been rather hawkish of late. Speaking to MEPs in late-November, she advised caution when observing the decline in gas prices, and confirmed that the bank is ‘not done’ with raising rates. The ECB’s chief economist, and a representative of the dovish wing, Philip Lane, indicated that inflation is likely close to a peak.

He also noted that while more rate increases are expected, ‘the starting point is different’ as ‘a lot has been done already’. Hawk Peter Kazimir (who has no voting rights in December) suggested that it’s too early to call an inflation peak and that slowing down the tightening process due to one inflation print ‘wouldn’t be right’.

Figure 1: Dutch TTF Gas Futures [1st month] (2021 – 2022)

Source: Refinitiv Datastream Date: 12/12/2022

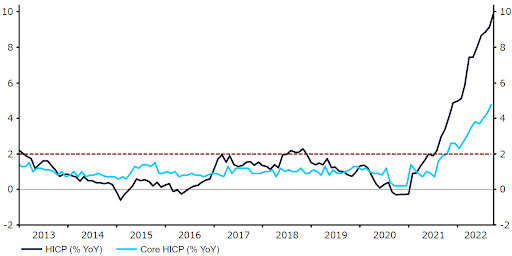

Kazimir was, of course, referring to the recent decline in consumer price inflation, which has slowed more than expected, falling to 10% in November from a record high 10.6%. However, core inflation, arguably a more important number for policymakers, remained glued to a record high 5%, indicating that price pressures, excluding the more volatile components, are yet to give.

Figure 2: Euro Area Inflation Rate (2013 – 2022)

Source: Refinitiv Datastream Date: 12/12/2022

75bp hike not out of the question

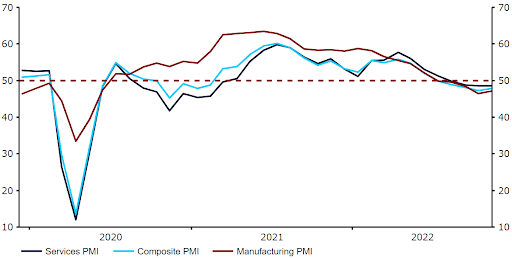

We think that the November inflation miss may be seen by some officials as an argument that supports the return to a 50bp hike. The fall in oil prices, a partial normalisation in gas prices and the recent rebound in EUR/USD could also persuade decisionmakers to step on the brakes. That said, economic data out of the Eurozone has held up better than expected. The labour market is tight, as evidenced by record low unemployment, while the third quarter GDP growth print was recently revised upwards to +0.3% QoQ from the preliminary reading of +0.2%. The more timely and forward looking PMIs also exceeded expectations in October and November, and are only consistent with mild contraction. Even sentiment indicators have taken a turn for the better, albeit they remain depressed – especially those based on consumer surveys.

Figure 3: Eurozone PMIs (2020 – 2022)

Source: Refinitiv Datastream Date: 12/12/2022

In light of the mixed set of arguments and varying rhetoric from policymakers, we believe that Thursday’s rate decision is unlikely to be unanimous. In our view, lower energy prices and the recent decline in inflation will tip the balance in favour of a 50 basis point rate hike. A 75bp increase cannot, however, be entirely ruled out, in our view, particularly given the Eurozone’s relative economic resilience.

Aside from the decision on rates, ECB officials are likely to discuss and present some information on the quantitative tightening process. QT, which is the reversal of the quantitative easing process that lowered market interest rates, is expected to begin in the coming months. We think a 50 basis point rate hike opens the way for a more hawkish QT announcement – we expect it to start at sometime in the first quarter of 2023. It is not fully clear as to the amount of detail we’ll receive on the process on Thursday. This may, in part, be dependent on the size of rate increase, although the ECB is expected to outline at least a broad plan on how it intends to reduce its bond holdings.

The ECB will also unveil its new macroeconomic projections. We think that any adjustments will likely be minor. The 2023 inflation forecast could be upped slightly from 5.5%, while the growth forecast may be brought down closer to 0% from September’s forecast of 0.9%. Additionally, 2025 forecasts will be unveiled for the first time, and they’re also likely to garner some attention.

How could the euro react to the announcement?

With the market only pricing in only around 55bps of hikes, we’d normally assume that a 50 basis point rate increase would have a rather limited effect on the euro. We note that the extent of the rally in the EUR/USD, which has seen the pair appreciate by more than 10% from its lows in late-September could, however, present an opportunity for profit-taking. That said, we don’t believe that a half a percentage point hike is necessarily a done deal, and we see a non-negligible possibility of another 75bp move. Some of the hawks in the council have remained vocal in favour of another jumbo hike since the last meeting, and one could argue that this stance has been supported by recent data.

Needless to say, a 75bp rate increase would likely push EUR/USD to new highs. At the very least, in the event of a 50bp hike, we expect a compromise whereby this faction is reflected in more hawkish forward guidance.

Any signals on QT may also be important for the euro, as will the updated forecasts and rhetoric from the central bank on future policy moves. At any rate, we expect volatility in the euro to be heightened around the meeting, particularly as it will come hot off the heels of Wednesday’s FOMC announcement.

The ECB’s policy decision will be announced at 13:15 GMT (14:15 CET) this Thursday, with the press conference to follow 30 minutes later.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports