ECB December Meeting Preview: Will Lagarde cave in to the hawks?

( 5 min. )

- Go back to blog home

- Latest

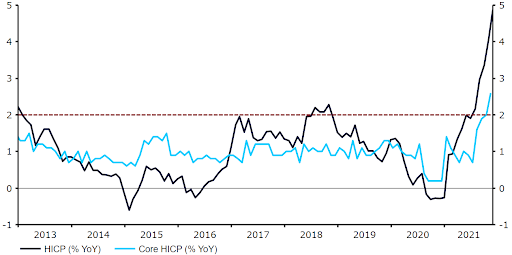

This week’s meeting is set to be one of the most important this year for the ECB, with the bank widely expected to shift towards normalising policy as the Eurozone economy recovers from the pandemic downturn and inflation reaches multi-decade highs.

Figure 1: Euro Area Inflation Rate (2013 – 2021)

Source: Refinitiv Datastream Date: 13/12/2021

The future of QE beyond PEPP

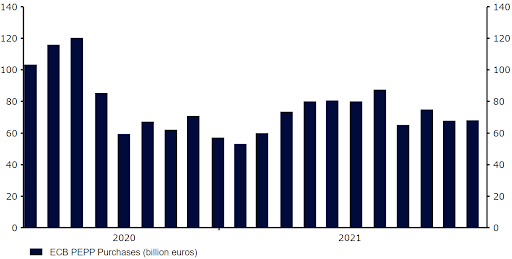

The ECB is expected to move to a process of retiring its pandemic emergency tools, starting with the PEPP programme. After increasing the pace of purchases in March to approximately 80 billion euros a month in order to help the Eurozone economy withstand another wave of COVID-19, the ECB changed tack in September, announcing that it would be moderately slowing purchases under PEPP. The pace has indeed declined over the past few months and was under 70 billion euros in both October and November (Figure 2).

Figure 2: ECB PEPP Monthly Purchases [billion euros] (March ‘20 – November ‘21)

Source: Refinitiv Datastream Date: 13/12/2021

In addition to PEPP, the ECB runs a variety of ‘traditional’ asset purchase programmes that together form the APP, which consists of approximately 20 billion euros of net purchases per month. Retiring the PEPP in March, in line with Lagarde’s recent rhetoric, would mean a rather abrupt shift in policy. Net asset purchases would be lowered from 90 billion euros a month to approximately 20 billion euros, and thus it’s likely that the ECB will opt to smooth out the process. It could do so in a number of ways. The most likely scenario seems to be a trimming in the size of monthly purchases under PEPP through to the end of the programme in March, while announcing a temporary increase in the APP. This would allow for a clear ‘transition’ towards a normalisation of monetary policy and would likely be preferred by the ECB. There’s also a possibility of introducing another temporary asset-purchase programme to replace PEPP or extending the programme, but neither seems likely in our view. The latter is particularly doubtful as Lagarde recently indicated PEPP will end as planned in March despite a new variant threat.

Our base scenario is for a decrease in purchases under PEPP of approximately 20 billion euros from January 2022, before ending the programme in March, while then increasing the APP by 20 billion euros. This, in effect, would mean nearly halving asset purchases from the current pace. That being said, there is a possibility that the ECB might want to be more cautious and delay cutting purchases until the second quarter of 2022. Moreover, whether they would want to commit to a full-year guidance on QE or over a shorter period, perhaps the first half of 2022, remains an open question. We think in the face of the omicron risk they will avoid precommitment beyond H1 2022.

Interest rate increases: still a way go, but we’re getting closer

Looking at swap rates, the market has backtracked on its expectations for interest rate hikes of late, particularly after the detection of the omicron variant, although it still assumes more than a 50% chance of a 10 basis point move in the deposit rate in H2 2022. We think the ECB will instead opt for patience and start raising rates in 2023.

We expect the FX market will take its cue on when to expect rate hikes from the decision on asset purchases, the ECB’s statement and Lagarde’s tone during her press conference, particularly on omicron and inflation. The December meeting will also bring us updated economic projections. We don’t expect many significant changes in that regard, particularly to economic growth, which appears largely on track. When it comes to inflation, we think we may see a modest increase to the 2022 and 2023 forecasts, mostly a reflection of the increase in oil futures since the previous cut-off date. Any significant increase to 2022 or 2023 inflation forecasts could mean that the ECB expects stronger internal price pressures, or that factors assumed to be temporary are now deemed not so temporary after all. It’s worth mentioning that the bank will also introduce 2024 forecasts for the first time.

The tone of President Lagarde’s press conference will be heavily scrutinised. Despite a recent uptick in inflation, and some hawkish noises from a number of ECB members, her tone has remained little changed of late. She has continued to reiterate that an interest rate hike in 2022 is unlikely, but recently said that ‘when the conditions of our forward guidance are satisfied, [the ECB] will not hesitate to act’.

All in all, we expect this week’s meeting to be a significant one. We think we’re going to see an announcement of a gradual reduction in asset purchases going forward, although we don’t foresee a significant commitment beyond H1 2022 nor a change in language regarding potential interest rate hikes. This meeting will be quite interesting as risks to monetary policy normalisation are two-sided and that is likely to create some division within the council. Whether or not we get some hawkish dissent among committee members is likely to be key.

How could the euro react to this week’s meeting?

We think the reaction of the euro will depend on the level of caution the ECB exerts in normalising policy. If the bank pushes through with a reduction in asset purchases of a similar scale to our expectations, and focuses its communication on higher inflation, we think that the euro may receive a boost. This would be particularly the case should it become clear that there is a growing hawkish dissent among the council. If, on the other hand, it chooses a more cautious approach, stressing risks to economic growth from the pandemic, then the currency could sell-off.

That being said, it sets up to be quite a complex event. Markets will take their cue from a number of factors and their behaviour is difficult to predict given that it is not clear what is already priced-in. What seems highly likely, however, is that it will be one of the most interesting meetings in the pandemic period and we should see heightened volatility both around the time of the decision as well as during Lagarde’s press conference.

The ECB’s policy decision will be announced at 12:45 GMT (13:45 CET) this Thursday, with the press conference to follow 45 minutes later.