The ECB’s unambiguously hawkish messaging last week did not stop the euro from sinking to new lows as concerns mount over stagflation or worse.

Economic news will continue to take a back seat to the newsflow from the war on one hand, and the reaction to the fresh supply shock from the world’s major central banks on the other. This week will be the Federal Reserve’s turn. Market expectations for a 25 basis point hike look correct to us, and we also expect an unambiguously hawkish message as the Fed has fallen severely behind the curve. We expect more or less the same outcome from the Bank of England meeting the following day.

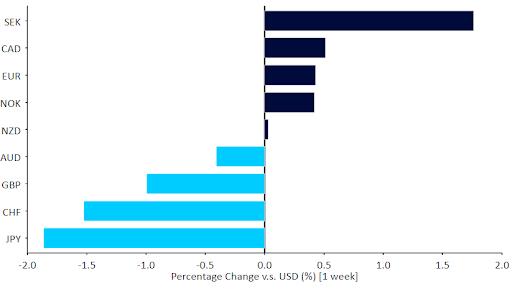

Figure 1: G10 FX Performance Tracker (1 week)

GBP

Very strong monthly GDP data out of the UK confirms that the economy was very strong prior to the war shock. Sterling, however, did not benefit, ending the week near the bottom of the G10 rankings. We are a bit puzzled by the move lower – we think the currency is oversold, and see scope for a rebound.

Figure 2: UK GDP [monthly] (2020 – 2022)

This should be helped along by the Bank of England meeting on Thursday. We expect the MPC to hike interest rates again and join the Fed and ECB in pivoting communications towards an increased focus in taming surging inflation amid the fresh supply shocks. With a 25 basis point move fully priced in by markets, the reaction in the pound will be driven largely by the voting patterns, and communications on both inflation and future rate increases.

EUR

The ECB seems to have finally pivoted to restoring its inflation credibility, but for now markets remain focused on the war threat to the European economy and the euro seems unable to hold above the 1.10 level versus the dollar. This is for now a common struggle to all European currencies, but we think that any significant positive news from the war could lead to a rebound of the oversold common currency.

Meanwhile, a slate of ECB speakers are on tap for Thursday, which should add needed clarity to the ECB’s intended schedule for higher rates. We continue to see a first hike by at least the bank’s September meeting.

USD

February inflation in the US rose to yet another multi-decade high of almost 8% but, for the first time in a while at least, it did not exceed market expectations. Nevertheless, core inflation also rose sharply, up to 6.4% and its highest level since August 1982.

Figure 2: US Inflation Rate (2012 – 2022)

The macroeconomic calendar is light this week, aside of course from the critical FOMC meeting. In principle, the hawkish communications we expect should be positive for the dollar, but the failure of the euro to rally last week suggests that this correlation may have weakened in the wake of the invasion. With a 25 basis point hike fully priced in, we will be paying particularly close attention to the bank’s updated interest rate projections – the ‘dot plot’. We think that a sizable upward revision here is likely in light of the inflation ramifications of the Russia-Ukraine war.

CHF

After dropping below parity against the euro, the Swiss franc gave up its gains, and the EUR/CHF pair returned above the 1.02 level. In an interesting turn of events, the Swiss franc ended the week as the second-worst performing currency in the G10 after the Japanese yen, in line with the improvement in sentiment.

The Swiss National Bank made a rare announcement after the drop below parity, renewing its pledge to intervene in the FX market if necessary. SNB sight deposits (a proxy for intervention) increased by 2.4bn CHF last week – the most since December. We think that the bank’s willingness to intervene further will be limited by the recent inflation surge and upside risks to price growth. We don’t think we’ll see significant interventions unless EUR/CHF makes another break below parity again.

The franc should continue to react to shifts in sentiment in the coming days. The currency remains sensitive to the war in Ukraine, but may also be driven by the latest covid outbreak in China and its perceived impact on global supply chains.

AUD

The Australian dollar ended last week not far from where it started. Even so, it was a volatile week for the currency given geopolitical news and volatility in commodity prices. Also, due to the rise in global commodity prices and increasing pressures on inflation, Australia’s central bank advised last week that it would be prudent to prepare for a hike in interest rates this year. This is a fairly major hawkish pivot after a number of months of indicating that higher rates remain a long way off.

On Tuesday, the latest RBA meeting minutes will be published, followed by the publication of the February unemployment rate on Thursday. Aside from any major surprises here, AUD will likely continue to be driven mostly by events in Ukraine.

CAD

The Canadian dollar fell to a near 3-month low last week, largely due to the continued downward pressure on risk currencies and the retracement in oil prices – Brent crude oil fell back below $110 a barrel from more than $130 at its peak. CAD did, however, manage to rebound from that low at the end of the week, partly in response to a strong labour report out on Friday. February’s unemployment rate came in above expectations, falling to 5.5% from 6.5% in January. This was the lowest jobless rate since January 2020 and only 0.1% above the all-time low of 5.4% hit in May 2019.

February inflation numbers will be published on Wednesday, followed by January retail sales on Friday. Apart from the domestic data, we think that the main driver of the exchange rate will be the situation in Ukraine.

CNY

The Chinese yuan finished last week lower against the US dollar and has performed rather poorly so far today. We link this underperformance to renewed covid concerns. New cases doubled to nearly 3,400 on Sunday, with the country now battling the largest surge since February 2020.

This has caused authorities to ramp up their efforts to contain the virus, placing 17.5 million residents of Shenzen, an important southern tech hub, on lockdown that will last for at least a week. The country has increased testing and built makeshift hospitals in an attempt to allay the impact of the outbreak that has led to hundreds of deaths a day in Hong Kong. This is clearly a downside risk for China’s near-term economic activity, an upside risk for global inflation (given supply-chain disruption), and a near-term downside risk to the yuan.

We’ll focus primarily on the covid situation in China in the coming days, which will likely be more important for the currency than the Russia-Ukraine war. That said, tomorrow we’ll also keep an eye on economic data, as the statistical office is set to release key prints for the January-February period. The data will be far more important than last week’s CPI print that didn’t bring any surprises.

Economic Calendar (14/03/2022 – 18/03/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports