Unveiling 2024: Market Outlook and Key Trends Get your free copy

-

UK

- Australia - English

- België - Nederlands

- Belgique - Français

- Brazil - Portuguese

- Canada - English

- Česká Republika - Čeština

- Deutschland - Deutsch

- España - Español

- France - Français

- Ελλάδα - Ελληνικά

- Hong Kong - English

- Hong Kong - Traditional Chinese

- Italia - Italiano

- Luxembourg - English

- Nederland - Nederlands

- Polska - Polski

- Portugal - Português

- România - Română

- Schweiz - Deutsch

- Suisse - Français

- Sverige - Svenska

- United Arab Emirates - English

-

United Kingdom - English

Contact our experts

Ebury London

100 Victoria Street

London

SW1E 5JL

+44 (0) 20 3872 6670

[email protected]

Ebury.com

ECB June Meeting Reaction: ECB raises growth, inflation projections

( 2 min )

- Go back to blog home

- Latest

11 June 2021

Head of Market Strategy at Ebury Providing expert currency analysis so small and mid-sized businesses can effectively navigate international markets.

Yesterday’s ECB announcement delivered an unsurprisingly non-committal message from President Lagarde, although the meeting itself was far from a non-event.

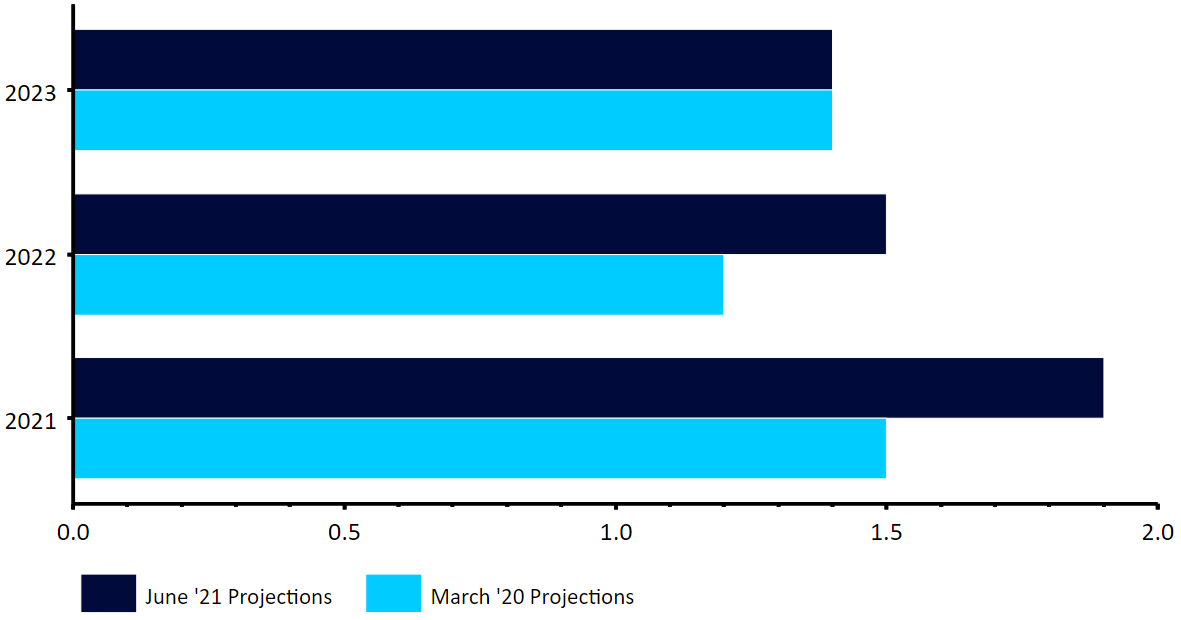

Figure 1: ECB Inflation Projections [June 2021]

Source: Refinitiv Datastream Date: 10/06/2021

Lagarde did, however, seem relatively upbeat about the risk of a spillover in US inflation, which we believe is perhaps a slight underestimation on the ECB’s part. This is particularly the case given the scorchingly hot inflation numbers out across the Atlantic on Thursday afternoon, which showed that US headline inflation jumped by 5% in the year to May.

Despite its upbeat assessment on the outlook, the ECB remained committed to its accelerated pace of asset purchases announced earlier in the year. Investors were also left none the wiser as to whether the bank believes that a tapering in asset purchases will soon be required, and there was no word on whether the PEPP may need to be extended beyond March 2022. We think that decisions on both are being punted to the September meeting, when the ECB will release its next set of macroeconomic projections. At this stage, the ECB should have a much clearer idea as to the state of the health crisis and, more specifically, its impact on Euro Area inflation. Given our expectations that inflation will continue to surprise to the upside, we expect the September meeting to be key. The hawks in the Council will not remain quiescent for long.

As far as the FX reaction is concerned, we’ve not seen too much volatility in the euro on the back of today’s announcement. We think that this is in light of the fact that there were no major surprises from the ECB today – the upgrade to the growth and inflation forecasts were largely expected and there very few in the market bracing for any immediate news on a possible tapering of asset purchases.

Cookies and Privacy

This site uses cookies to ensure you get the best experience. For more information see our Privacy NoticeAccept Settings Reject

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cf_use_ob | past | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _ga_P8154YCRDP | 2 years | This cookie is installed by Google Analytics. |

| _gat_gtag_UA_51187572_50 | 1 minute | Google uses this cookie to distinguish users. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| _hjFirstSeen | 30 minutes | This is set by Hotjar to identify a new user’s first session. It stores a true/false value, indicating whether this was the first time Hotjar saw this user. It is used by Recording filters to identify new user sessions. |

| _hjid | 1 year | This cookie is set by Hotjar. This cookie is set when the customer first lands on a page with the Hotjar script. It is used to persist the random user ID, unique to that site on the browser. This ensures that behavior in subsequent visits to the same site will be attributed to the same user ID. |

| CONSENT | 16 years 4 months 14 hours 27 minutes | These cookies are set via embedded youtube-videos. They register anonymous statistical data on for example how many times the video is displayed and what settings are used for playback.No sensitive data is collected unless you log in to your google account, in that case your choices are linked with your account, for example if you click “like” on a video. |

| pardot | past | The cookie is set when the visitor is logged in as a Pardot user. |

| Cookie | Duration | Description |

|---|---|---|

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| yt-remote-connected-devices | never | These cookies are set via embedded youtube-videos. |

| yt-remote-device-id | never | These cookies are set via embedded youtube-videos. |

| Cookie | Duration | Description |

|---|---|---|

| _lfa | 2 years | This cookie is set by the provider Leadfeeder. This cookie is used for identifying the IP address of devices visiting the website. The cookie collects information such as IP addresses, time spent on website and page requests for the visits.This collected information is used for retargeting of multiple users routing from the same IP address. |