ECB June Meeting Reaction: PEPP ramped up by €600bn

( 3 min read )

- Go back to blog home

- Latest

The European Central Bank (ECB) dug deep into its monetary stimulus toolbox again on Thursday, ramping up its efforts to support the Euro Area economy through the COVID-19 induced economic downturn.

We think these decisions make it clear that the ECB has little tolerance for any increase in European bond yields. Even following the massive stimulus announcement during the height of the pandemic in March, yields among many countries in the bloc, particularly in the periphery (notably Italy), have remained elevated compared to pre-crisis levels. This is a real issue for those countries, such as Italy, that are already struggling with high debt burdens.

Lower yields across the Euro Area should, we believe, therefore provide additional room for regional governments to ramp up fiscal spending in order to support their domestic economies.

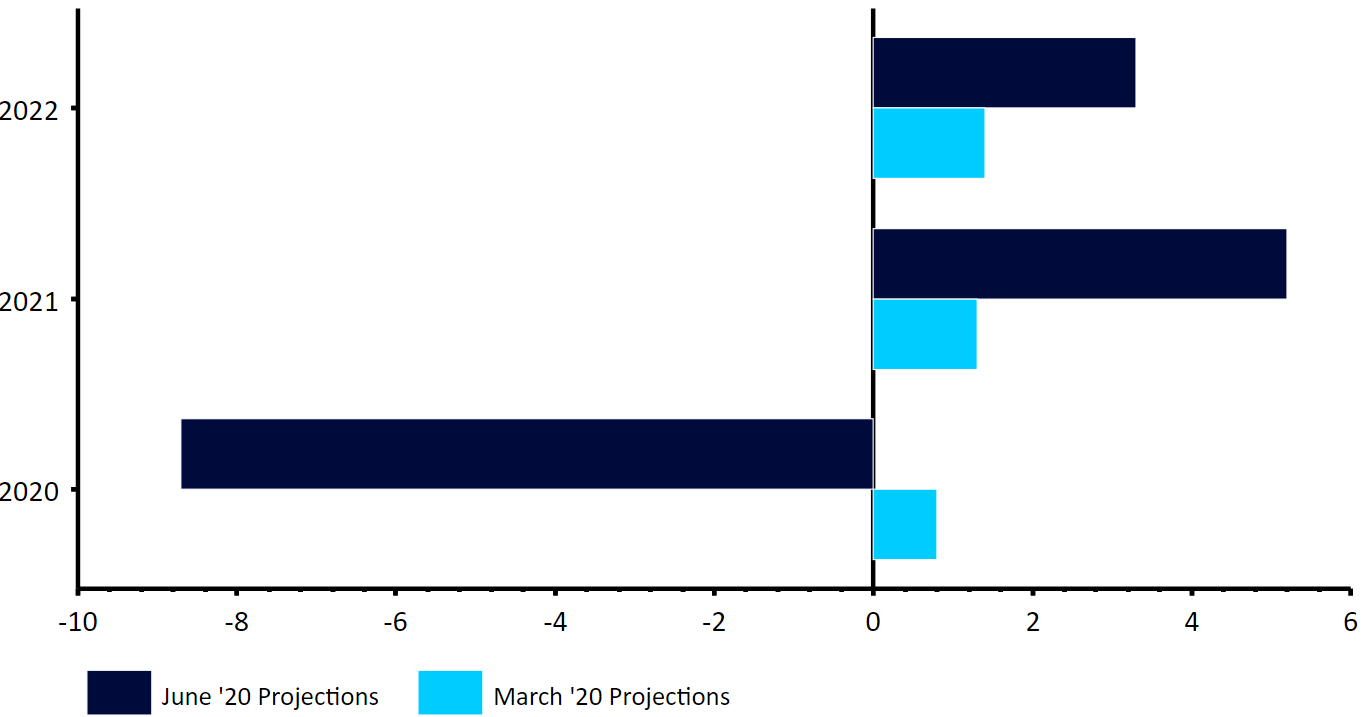

As for the bank’s press conference, arguably the main takeaway was the ECB’s revised GDP projections. The ECB now expects the bloc’s economy to contract by 8.7% this year – around the lower end of its medium-to-worst case scenario outlined by President Lagarde in April. Activity is expected to pick-up in 2021, albeit only partially, with the bank seeing growth of 5.2% next year and 3.3% in 2022 (Figure 1).

Figure 1: ECB’s Euro Area GDP Projections (%) [June 2020]

Source: Refinitiv Datastream Date: 04/06/2020

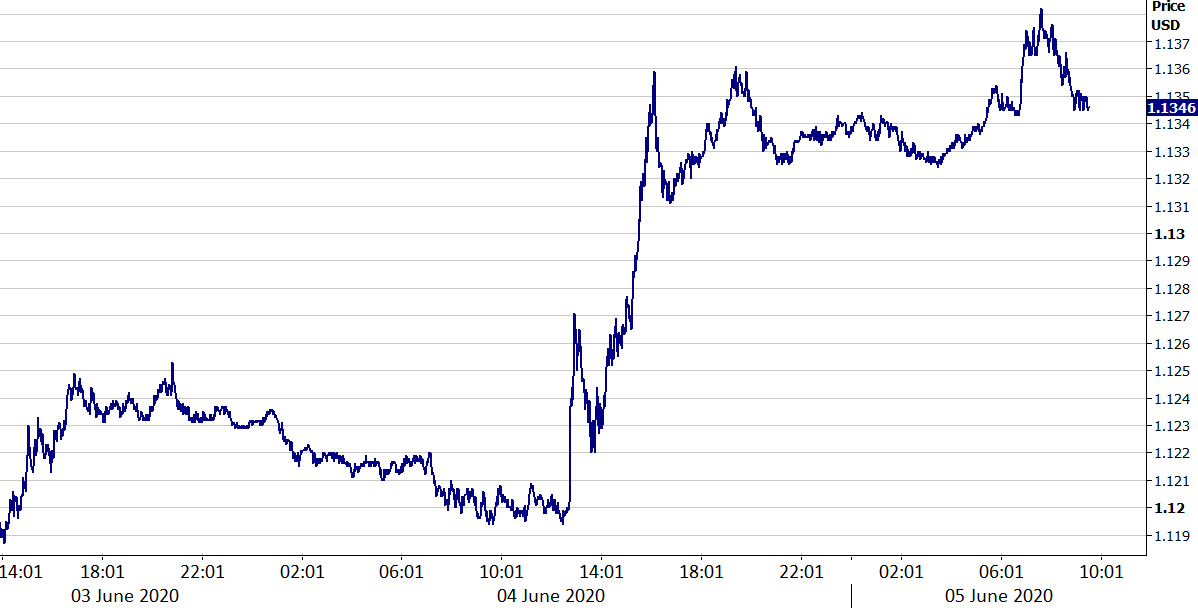

The reaction in financial markets was as one would expect. European government bond yields were sent lower, particularly among the periphery countries – Italy (a 16 bps decline in the 10-year yield), Greece (-14 bps), Spain (-12 bps) and Portugal (-10 bps). As we anticipated, the euro also rallied off the back of the announcement, initially by over half a percent versus the dollar, before extending its gains to over one percent as the day wore on.

We remain optimistic regarding the euro and think that the massive monetary and fiscal stimulus measures announced in the bloc should allow the Euro Area economy to bounce back quicker than its US counterpart.

Figure 2: EUR/USD (04/06/2020)

Source: Refinitiv Date: 04/06/2020

Despite the hefty increase in the bank’s asset purchases, we think that there remains a few tools left at the ECB’s disposal. One such option would be to expand asset purchases to include junk bonds, i.e those below investment grade. While Lagarde claimed that this was not discussed during the meeting, we think it may be a topic of discussion during the central bank’s next policy meeting in July if the economic situation takes a turn for the worse, which we do not expect at this time.