ECB October Meeting Preview: December stimulus on the way?

( 3 min )

- Go back to blog home

- Latest

This Thursday’s European Central Bank meeting creates an added risk factor for financial markets this week.

Since the most recent ECB meeting last month, caseloads of the COVID-19 virus have surged higher across most of the European continent. Almost all of the major economic areas in the bloc are now experiencing record high levels of infection. Daily cases leapt above 50,000 in France earlier this week (7x the initial peak), with Italy (4x), Spain (2x) and Germany (2.5x) also struggling to halt rising levels of infection. Localised lockdown strategies have been introduced across the common bloc, with more stricter national measures possibly forthcoming should contagion levels fail to be brought under control. The reimposition of tighter restrictions has already been reflected in the October PMIs of business activity, notably the services index that fell to a five-month low 46.2.

Figure 1: New Daily COVID-19 Cases [Big 4 Euro Area] (March ‘20 – October ‘20)

Source: Refinitiv Datastream Date: 27/10/2020

Given the above, we think that the ECB will, at the very least, stress in its communications that the second wave of the virus presents a significant downside risk to the outlook and that policy will need to remain accommodative in order to combat such a risk. President Lagarde will also likely reiterate that the bank has room to add extra stimulus down the road. We think that she may indicate to the market that such action could be on the cards as soon as the next meeting in December, when the bank will be releasing its updated macroeconomic projections. We think that this would likely include an expansion of the current envelope of purchases under the PEPP and an extension of the programme beyond the current mid-2021 end date, possibly of around six months. They may also consider an extension to other measures, including the APP top-up announced in March that expires at the end of the year.

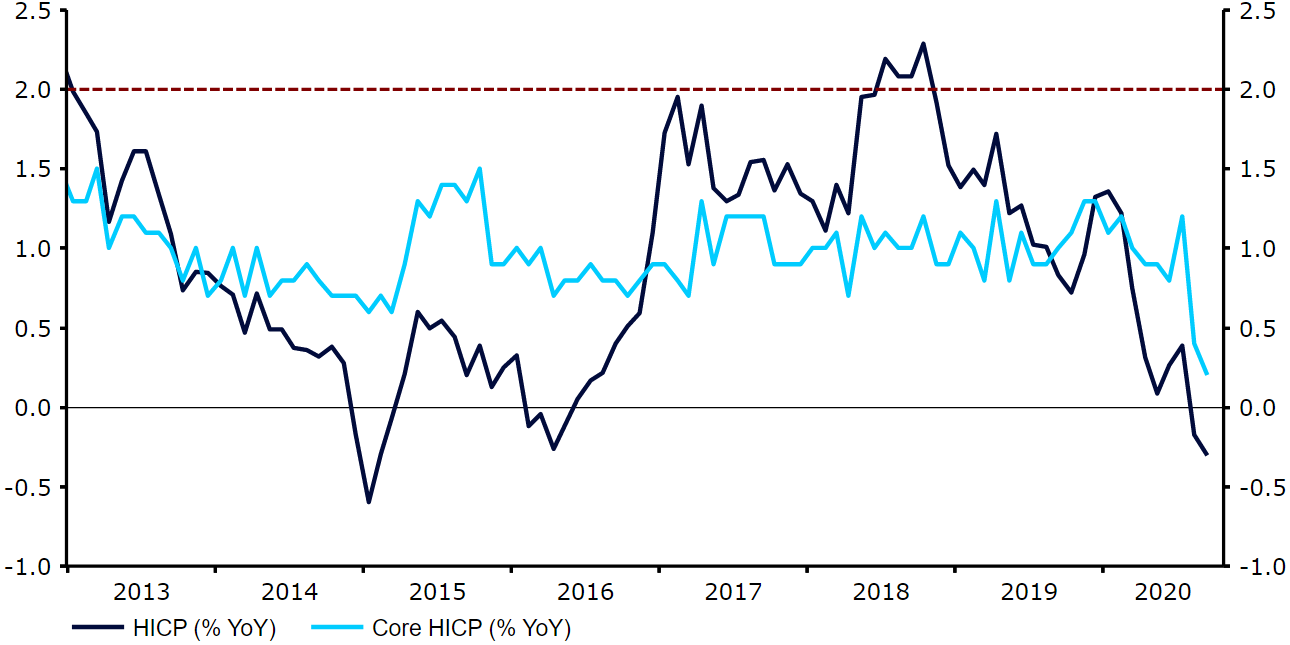

Other than that, we think that focus will shift away from the euro exchange rate at this week’s meeting, having been a central topic of discussion in September. Lagarde expressed an apparent lack of concern for euro appreciation at the last meeting and the euro has been largely flat against both the dollar and in trade-weighted terms since then. The absence of inflationary pressure in the Euro Area is, however, likely to be high on the agenda, particularly the recent downtrend witnessed in core inflation. While the ECB’s September average inflation projections accounted for a downtrend in price growth, we think that a modest downward revision to these forecasts will still likely be needed in December. This, we believe, heaps added pressure on the bank to act before year-end.

Figure 2: Euro Area Inflation Rate (2013 – 2020)

Source: Refinitiv Datastream Date: 27/10/2020

Any indication from the ECB that it is eyeing up an increase in its PEPP stimulus programme in December would likely drive the euro lower on Thursday. A non-committal, wait-and-see stance that plays down the need for imminent action would, by contrast, likely support the common currency, in our view.

The ECB’s policy decision will be announced at 12:45 GMT (13:45 CET) this Thursday, with the press conference to follow 45 minutes later.