ECB October Meeting Preview: No let up in tightening just yet

( 3 min )

- Go back to blog home

- Latest

We expect another jumbo interest rate hike from the ECB this week, as it continues to play catch up to almost every other major central bank in the G10.

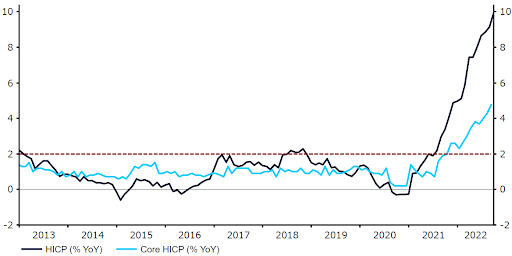

Financial markets were disappointed by Lagarde’s remarks on the 75bp hike, which she suggested could be a one-off, although ECB ‘sources’ were quick to correct her. We think that developments in the interim have cemented the case for another 75bp hike at this week’s meeting. Since the September meeting, economic conditions have remained broadly consistent. Euro Area inflation has hit fresh highs, consumer confidence has dropped to another low, and the PMIs of business activity are in line with a mild contraction. The uncertainty surrounding the European energy crisis presents a downside risk to growth, but we think that policymakers will overlook this and prioritise bringing down inflation.

Figure 1: Euro Area Inflation Rate (2013 – 2022)

Source: Refinitiv Datastream Date: 24/10/2022

In our view, another 75bp hike is all but guaranteed this Thursday – anything less would be a significant disappointment for markets as this is currently fully priced in. With that in mind, we believe that the bank’s rhetoric on the pace of hikes beyond the October meeting, notably the level of the terminal rate, will determine the reaction in the euro. We have been saying for some time that the Governing Council may need to raise rates deeper into 2023 than markets expect. As things stand, there appears to be a general view among policymakers that the terminal deposit rate may land somewhere around 2%, which we think is far too low. Any indication that rates may need to be raised deeper and more aggressively into 2023 than markets expect would drive a sharp rally in the common currency.

Any news on the start date for quantitative tightening (QT), the process of unwinding the bank’s massive holdings of government and corporate bonds, could also shift the euro on Thursday. Lagarde has said in recent communications that the debate on QT has already begun among policymakers, and it’s likely that discussions will be had once again during the October meeting. That said, we think that it is still too soon for any concrete details on a start date.

The ECB has already said that this won’t take place until rates are at a neutral level, which appears a long way off given the inflation outlook, while the UK’s premature QT announcement and general uncertainty in global financial markets may elicit caution. Other than that, we could get word on tweaks to the bank’s targeted longer-term refinancing operations (TLTROs), though this should have minimal implications for the FX market.

There will be no fresh macroeconomic projections from the ECB this week, which could lead to a more muted response in markets relative to previous meetings. The bank’s comments on the state of the bloc’s economy, particularly in light of the ongoing uncertainty surrounding the European energy crisis could, however, guide market expectations. Should the GC indicate that growth may undershot its September projections, which we think is likely, and suggest that the pending recession could impact the tightening cycle, then the euro would sell-off. Conversely, a firm commitment to bringing down inflation at all costs would be perceived as unequivocally hawkish. Of the two scenarios, we favour the latter.

Unlike many of its major peers, most notably the Bank of England, the ECB has delivered hawkish surprises in most of its recent monetary policy meetings. We think that the bar for another hawkish surprise this week may be slightly higher, as committee members appear to have done a better job in guiding market pricing. As mentioned, we do, however, still contest that markets are underestimating the pace that rates will need to go up in the Euro Area next year. In our opinion, this presents room for a higher common currency in the medium-term, even if the ECB fails to acknowledge this at Thursday’s meeting.

The ECB’s policy decision will be announced at 13:15 BST (14:15CET) this Thursday, with the press conference to follow 30 minutes later.