Euro hovers around six month high after French Presidential Election

- Go back to blog home

- Latest

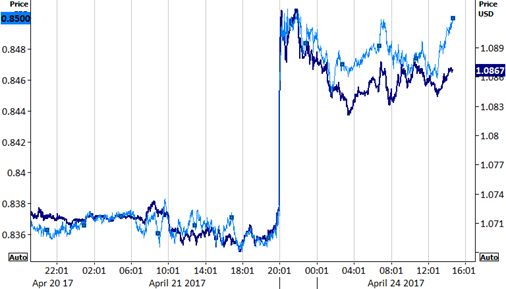

The Euro traded around its highest level against the US Dollar since November on Monday.

Figure 1: EUR/USD (20/04/17 – 24/04/17)

The result saw a significant relief rally in the Euro against every major currency. Right in line with our forecasts prior to the vote, the Euro spiked by a little under 2% against the US Dollar following the news that the market friendly Macron had made it through to the run-off election. While this was the most likely scenario going into the vote, markets were clearly wary that either Fillon or our worst case scenario for the Euro, Melenchon, could have sneaked through with Le Pen into May’s second round. We have also seen a fairly significant rally in emerging market currencies, notable European ones, with a reversal in safe-haven flows sending the Japanese Yen around one percent lower for the session.

We think the outcome of the first round ensures we’re now almost certain to see an election victory for Emmanuel Macron in the second round vote on 7th May. Every opinion poll for a Macron-Le Pen run-off has shown a commanding lead for the En Marche! leader. A survey from Harris on Election Day projected Macron would win the run-off by close to 30% at 64% to 36%, with additional polls from Ipsos yielding a similar result. With financial markets now fully pricing in such an eventuality, we think the Euro will instead be driven largely by this Thursday’s European Central Bank meeting rather than expectations for May’s run-off vote.

Major currencies in detail

GBP

Sterling wasn’t spared from the sell-off against the Euro, sinking by over one percent against the common currency in the immediate aftermath of the French vote. This has effectively returned the Pound to the levels it was trading against the Euro before Theresa May announced she was calling for a snap General Election last week.

Eyes will begin to turn to this June’s election once the French vote is out of the way. The latest poll from ICM gave Theresa May’s Conservative Party a comfortable 22 point lead over Labour at 48% to 26%.

Public sector borrowing figures will be the only economic data release on the docket in the UK today.

EUR

Markets breathed a sigh of relief as centrist Marcon made it through to the second round French Election vote. The latest bookmaker odds currently give Le Pen around a 16% chance of defeating Macron in May’s vote. We think this is fairly notional, and baring a significant political development, we think Le Pen will be defeated by a comfortable margin in a couple of weeks’ time.

With Italy and Portugal both observing a public holiday on Tuesday, trading could be on the thin side today. With no economic data releases at all in the Eurozone, traders will instead turn their attention to Thursday’s ECB meeting. The Governing Council are certain to keep the central bank’s policy unchanged, although it will be interesting to hear Mario Draghi’s comments on the overall health of the Euro-area economy following the general improvement in economic data.

USD

The US Dollar is likely to take a back seat to European political developments this week, with fairly limited news scheduled for release across the pond.

Investors will look to Thursday’s durable goods orders and Friday’s GDP data as a reasonable indication of the possible tone of Federal Reserve communications ahead of the central bank’s next meeting on 3rd May. Financial markets are currently placing a 65% chance of a hike at the central bank’s June meeting, although we think even this is slightly low.

Consumer confidence and home sales this afternoon could shift the Dollar if they defy expectations.