Euro jumps back above parity ahead of ECB rate decision

( 3 min )

- Go back to blog home

- Latest

The main theme in the FX market this week has undoubtedly been US dollar weakness.

Summary:

- Dollar depreciates for second straight day as markets brace for slowdown in Fed rate hikes.

- EUR/USD rallies back above parity, GBP rises to its strongest position since mid-September.

- UK PM Sunak delays budget plan to 17th November, from 31st October.

- US Q3 GDP data (1:30 BST), and European Central Bank policy announcement (1:15 BST) suggest volatile trading session ahead.

The dollar traded lower against almost every other currency globally again on Wednesday as markets continued to dial back bets in favour of Federal Reserve interest rate hikes following broadly weaker US macroeconomic data, particularly out of the housing market. EUR/USD rose back above parity for the first time in a month, while sterling briefly rallied above the 1.16 level, before giving back some of its gains. Investors still expect the Fed to raise rates by 75 basis points at Wednesday’s meeting, but there is growing speculation that they could deliver a dovish pivot. News of the Bank of Canada hiking by just 50bps (75bp expected), while signalling that an end to the hike cycle was near, may potentially be a prelude to a less aggressive Fed.

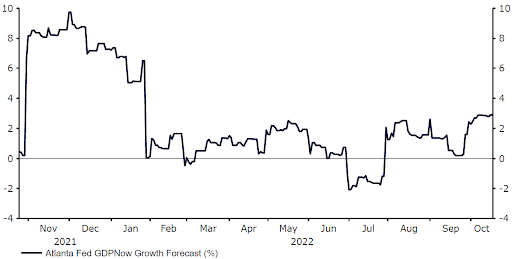

Preliminary Q3 growth data out of the US this afternoon could be a key deciding factor in the Fed’s upcoming policy decisions. The world’s largest economy entered into a technical recession in the second quarter of the year, although growth is expected to return back into positive territory in the three months to September. A downside surprise to the 2.4% annualised consensus could, however, raise fresh concerns over the impact of tighter policy on US activity, and may pressure FOMC members to dissent in favour of a slower pace of hikes during next week’s meeting. For reference, the Atlanta Fed GDPNow estimate is actually tracking slightly higher (+2.9%).

Investors will also have the small matter of the October European Central Bank meeting to look forward to. As we mentioned in our ECB preview report, we think that another 75bp rate hike is guaranteed this afternoon. We believe that the bank’s rhetoric on the pace of hikes beyond the October meeting, notably the level of the terminal rate, will determine the reaction in the euro. Any indication that rates may need to be raised deeper and more aggressively into 2023 than markets expect would drive a sharp rally in the common currency. A more cautious approach, that raises heightened concerns over the growth outlook could, however, trigger a bout of euro weakness. The ECB’s policy decision will be announced at 13:15 BST (14:15 CET) this Thursday, with the press conference to follow 30 minutes later.

Figure 1: US GDPNow Growth Estimate (2021 – 2022)

Source: Refinitv Datastream Date: 26/10/2022

Sterling also touched a six-week high on the dollar on Wednesday, before giving up some of its gains during the course of trading. News that the UK government’s budget plan will be delayed by a few weeks to 17th November had no discernible impact on the pound. While the delay should, in theory, provide politicians with time to get all their ducks in a row, it doesn’t eliminate the challenges currently facing the UK economy, nor does it improve credibility in the current leadership. There’s no macroeconomic data out of Britain’s economy during the remainder of the week, so expect the pound to be driven by events elsewhere, namely today’s European Central Bank meeting.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports

🔊 Stay up to date with our podcast FXTalk