Euro leaps above 1.15 on contrasting stimulus news

( 2 min )

- Go back to blog home

- Latest

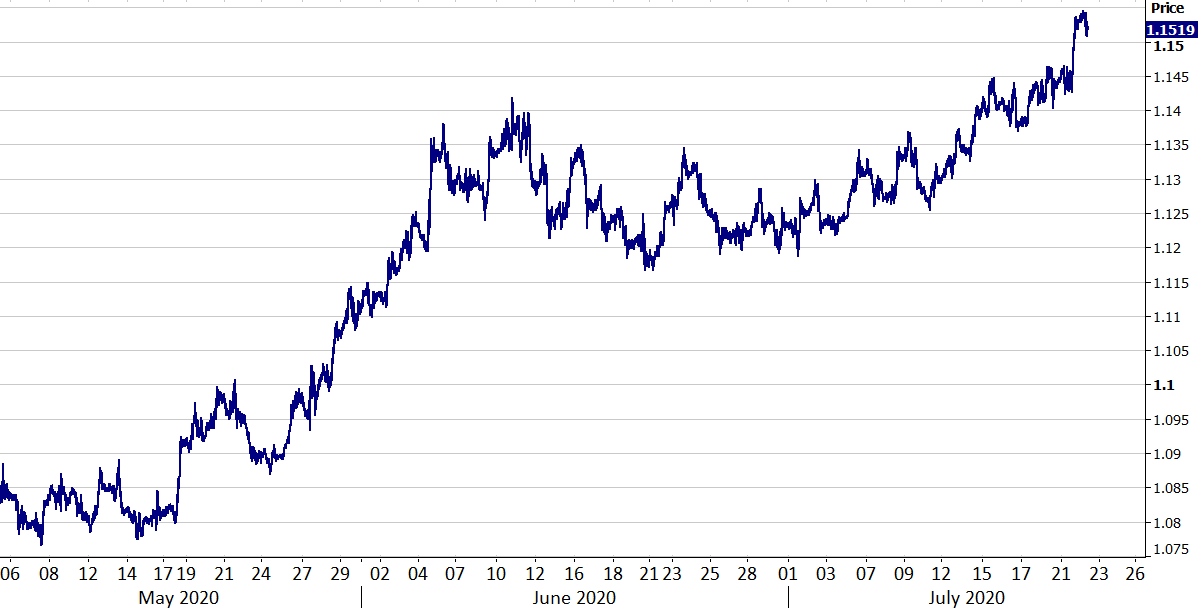

The euro soared against the US dollar on Tuesday, leaping to a one-and-a-half year high amid contrasting economic stimulus plans across both sides of the Atlantic.

The Republicans and Democrats remained some way off during discussions on Tuesday. While Secretary of the Treasury Steve Mnuchin stated that he was optimistic an agreement can be reached by the end of the week, there are certainly no guarantees that it will. Even if a deal is reached this week, there are concerns that there may be a lag before these benefits are made available to those who need it. This could potentially push many millions of Americans off an income cliff in the coming weeks.

Contrasting stimulus news, combined with optimism surrounding vaccine progress and the continued uptrend in US virus cases, has provided a big boost to the euro, and indeed risk assets so far this week. Regarding the latter, President Trump warned yesterday that the virus spread may ‘get worse before it gets better’, as new daily cases hover around the 70,000 mark. While we think that we may see a bit of resistance around key physiological levels, almost everything appears in favour of an even stronger EUR/USD in the coming weeks.

Figure 1: EUR/USD (May ‘20 – July ‘20)

Pound eases off six-week highs versus US dollar

Sterling retreated against the dollar this morning, having yesterday risen to a six-week high above the 1.27 level.

The move higher witnessed yesterday can be attributed largely to the general optimism in the market surrounding both virus vaccine progress and the broad improvements in global economic data. Economic news out of the UK has actually been rather disappointing in the past few weeks, while uncertainty surrounding Brexit is continuing to make gains for the pound that bit harder to come by.

Regarding the former, we’ll get a real sense as to how the UK economy is performing on Friday, with the latest retail sales for June set to be released. We think that this is shaping up to be a highly important data release. A strong number here would allay concerns surrounding the weak GDP number for May, while a disappointing one would bring into question whether the UK recovery is lagging that of its peers.