Euro rally gets fresh legs after ECB warning

- Go back to blog home

- Latest

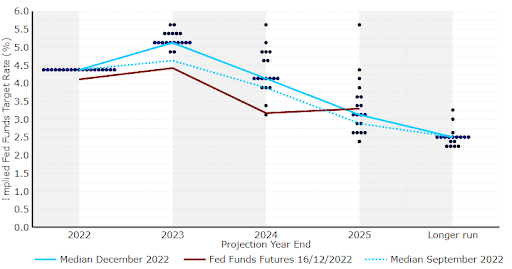

We’d been warning for some time about the large gap between market expectations for future ECB rates and the inflationary reality.

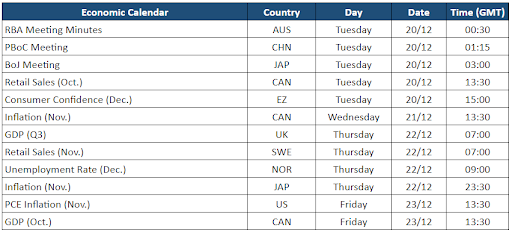

The week before Christmas tends to be on the dull side in financial markets, as traders wind down for the year. In fact, little news of note will come out next week, beyond the PCE inflation report in the US on Friday. However, the market is still digesting the hawkish surprises from last week’s central bank meetings so we still expect an interesting week in currency markets.

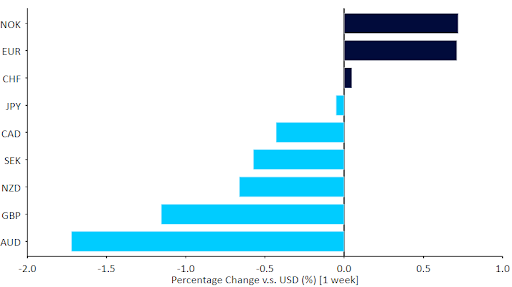

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 19/12/2022

GBP

While rates in the UK were hiked by 50bps as markets expected, there was a three-way split among Monetary Policy Committee members, with one member voting for a 75bp hike and two more voting for no change in rates. This was, at the margin, a dovish split, but on the other hand there seemed to be yet another swing in Bank of England communications, this time towards hawkishness and acceptance of higher market expectations of future hikes.

Overall a muddle message that resulted in an underperforming currency as sterling finished the week right near the bottom of the G10 currency rankings. No major news will be released this week, so expect the pound to move off events elsewhere.

EUR

The ECB sent markets an unmistakably hawkish message last week, validating our view that there was a massive gap between expectations of future hikes and the inflationary realities in the Eurozone. President Lagarde warned of 50bp hikes, harsher and earlier quantitative tightening, and a higher terminal rate for the ECB.

Another positive factor for the euro were the December PMIs of business activity, all of which improved measurably from the previous month. The worst-case scenarios for an energy crisis look increasingly remote, and China’s pivot away from zero-COVID policies only adds to the bullishness (relatively speaking) on the Eurozone economy. However, the common currency has already had a blistering rally of over 10% since its late-September low and perhaps a pause is to be expected in the lead up to the Christmas holiday.

Figure 2: G3 PMIs (2020 – 2022)

Source: Refinitiv Datastream Date: 19/12/2022

Aside from China, Japan has been one of the few countries in the world to adopt an easing bias in the current cycle, so a move away from this at a time when most central banks are delivering dovish pivots would be unambiguously bullish news for JPY. The BoJ will be announcing its latest policy decision on Tuesday, though we see very little chance of any policy changes, or tweak to the bank’s forward guidance.

CHF

The Swiss franc outperformed most G10 currencies last week, although it ended slightly lower against the euro. Last week’s Swiss National Bank meeting largely followed the script, and had little impact on the franc. As expected, the SNB raised its policy rate by 50 basis points to 1% and reiterated its pledge to intervene in the FX market as necessary. President Jordan confirmed that the bank has indeed sold foreign currency in the past few months and that it may intervene on both sides of the market.

The bank’s conditional inflation forecast was little changed from September and the SNB continues to pencil in inflation of 2.4% in 2023. Moreover, the bank expects growth to decelerate from around 2% this year to 0.5% in 2023. Even though price pressures in Switzerland have moderated of late, the fight against inflation is not over and the bank signalled that it may hike rates again. We expect the SNB to maintain its hawkish stance in the near-term, but also think that it won’t be long until the bank considers ending the hiking process. With barely any news from Switzerland on tap this week, the franc may trade off events elsewhere, though volatility may be limited.

AUD

The Australian dollar was one of the underperformers in the G10 last week, with heightened uncertainty surrounding the covid situation in China keeping gains for AUD in check. While news of a possible move away from zero-covid should be keeping the currency well bid, reports of jumps in caseloads have soured optimism. Economic news out of Australia last week was mixed, with a strong jobs report offset by another drop in the composite PMI, which remains in contractionary territory. Most economists, ourselves included, expect Australia to avoid recession in the coming months, though a slowdown appears inevitable, particularly in light of the acute uncertainty abroad.

The latest RBA meeting minutes will be released on Tuesday. Markets see a relatively low possibility of another rate hike at the next meeting in February, so we could see a bout of AUD strength if one were to be alluded to in tomorrow’s minutes.

NZD

Strong third quarter GDP data perhaps contributed to an outperformance in the New Zealand dollar relative to its antipodean counterpart last week. The New Zealand economy expanded by 2% on the previous quarter, more than double expectations, and by 6.4% year-on-year (5.5% consensus). The reaction in markets to the news was, however, rather limited, as economists believe that this jump in activity was driven largely by one-off factors, notably the reopening of borders in August.

We suspect that volatility in NZD will be low this week as we approach the typically subdued Christmas period. Focus in the New Year will revert back to RBNZ monetary policy. The bank is expected to be the most active in the G10 next year, which may provide some scope for a dovish surprise.

Figure 4: New Zealand GDP Growth Rate (2015 – 2022)

Source: Refinitiv Datastream Date: 19/12/2022

CAD

A lack of major domestic news caused CAD to put in a middling performance last week. The modest uptick in global oil prices should be supporting the Canadian dollar, although the Bank of Canada’s dovish policy stance has made gains hard to come in recent months. Inflation and GDP data out on Thursday and Friday respectively could receive some attention this week, though the BoC has indicated that it may have already ended its tightening cycle, which could mean that these data points become slightly less relevant. That said, economists are pencilling in a four-month high in the headline inflation numbers that, if confirmed, could raise the possibility of another 25bp hike in the first quarter of next year, even if we think this is doubtful.

SEK

The ECB’s hawkishness sent the krona to its lowest level in almost two months against the euro last week, although Sweden’s November inflation data perhaps prevented a more aggressive move lower in the currency.

The annual inflation rate increased to 11.5% in November, its highest level since February 1991, following a 10.9% surge in October, while core inflation increased to 9.5%. The continued rise in inflation supports our view that the Riksbank will likely need to raise interest rates further during the next few meetings. This could support the krona, as most other major central banks appear to be nearing the end of their tightening cycles. November retail sales will be released this Thursday. Apart from that, there are no events that are expected to move the currency, and as we approach the festive period we expect market movements to abate.

NOK

The slight rebound in Brent crude oil prices, and last week’s rate hike by Norges Bank, allowed the Norwegian krone to post modest gains against the euro last week. As expected, Norges Bank raised rates by 25bps last week, lifting its key rate to 2.75%. The bank announced that it expects to continue hiking rates further at the next meeting, and that it expects rates to be close to 3% in 2023.

As for the macroeconomic outlook, the bank expects inflation to remain higher than expected for a longer period of time, with the economy set to slow down more than initially expected. As inflation remains well above target, we now expect Norges bank to carry out two additional rate hikes of 25 basis points at the January and March meetings. However, this will depend entirely on the data available until then. The December unemployment rate will be released this Friday, although there are no other events that are expected to move the currency aside from that.

CNY

The Chinese yuan ended last week roughly in the middle of the emerging market currency dashboard, and just a touch lower against the US dollar. Initial optimism about China inching away from zero-COVID appears to be turning into caution as the country is battling through its first winter wave of covid. China’s chief epidemiologist Wu Zunyou expects two more to come, with the latter ending in mid-March. This casts a shadow on the near-term economic outlook – data in the last few days has certainly not helped allay this pessimism. Hard data published last week was overall weaker-than-expected. Perhaps the most disappointing was retail sales, which showed a slight contraction year-to-date.

Following discussions at the Central Economic Work Conference last week, authorities telegraphed that economic stability is their top priority for next year, and also stressed a pursuit of steady progress. The messaging was in line with recent signals from authorities, and confirms they’ll be focused on reviving poor domestic demand and encouraging an expansion of the private sector. This week we’ll continue to focus on covid news, albeit we will also keep an eye on monetary policy. China’s medium-term lending facility rate was kept unchanged last week, albeit the PBoC injected a net 150 billion yuan into the banking system via the facility (after we consider maturing loans). On Tuesday, we await the decision on 1- and 5-year loan prime rates, albeit no change is expected there.

Economic Calendar (19/11/2022 – 23/12/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports