Euro soars as virus triggers flurry of Fed rate cut bets

- Go back to blog home

- Latest

Today marks the last trading day of the month and it’s safe to say that February has been a very bizarre one as far as movements in the FX market are concerned.

EUR/USD spent the first three weeks of the year selling off relentlessly in what appeared to be a response to diverging economic news between the US and Euro Area and investors shorting the euro as part of the ‘carry trade’ strategy. We have, however, seen a remarkable resurgence of the common currency in the past week or so. The currency has rallied by over 2% versus the dollar since 21st February and now looks on course to end the month roughly where it began it following six straight days of gains. A good gauge of the magnitude of the wild swings in the market is the level of one-month implied volatility in EUR/USD, which is now at its highest level in a year.

So what has been behind the rally in the euro and the sharp sell-off in the US dollar?

The primary catalyst for the move has, unsurprisingly, been the coronavirus. The virus has spread aggressively across Asia and Europe and there is a general feeling that the US may be next to announce a spike in the number of confirmed cases. So far, only around 400 or so people have been tested for the virus in the US compared to more than 7,000 in the UK alone, so there are likely to be many existing cases that have not yet been reported.

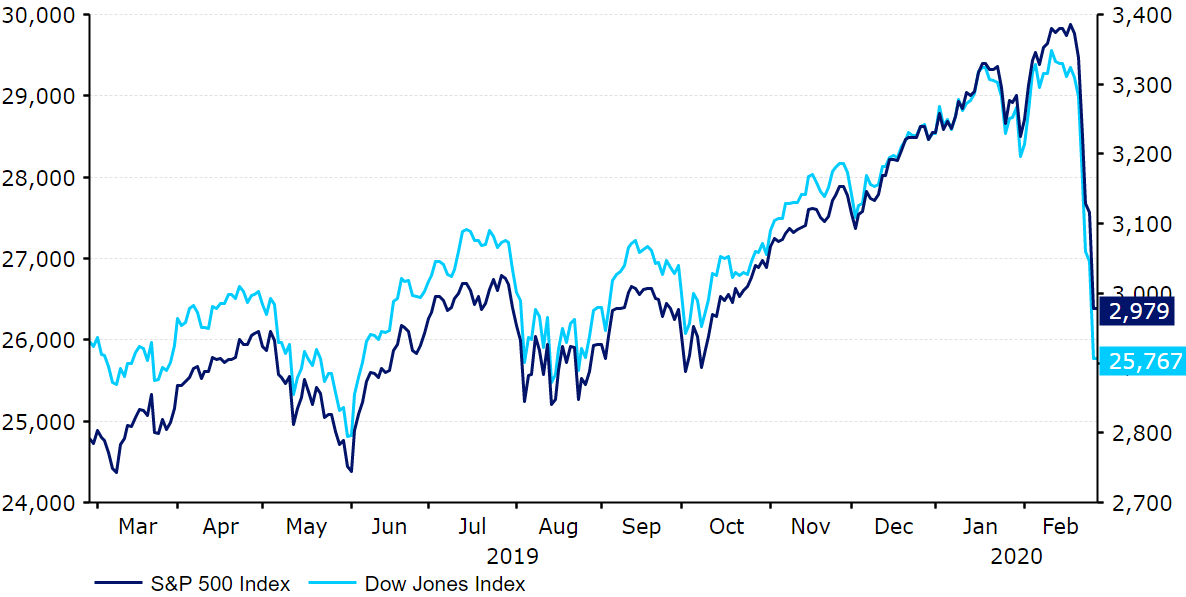

President Trump’s efforts to get a grip on the situation were also greeted with a resounding thud by the market. During his press conference yesterday, the US President continued to talk down the seriousness of the outbreak, causing investors to fret that he may be ill-equipped to deal with the severity of the situation. This triggered another wave of selling in equity markets – the Dow Jones and S&P 500 indices fell again and are now trading at an eye-watering 12% lower in the past week alone. Government bond yields have also fallen as investors flock to low-risk assets – the US 10 year yield is down a similarly remarkable 40 basis points to just 1.7%.

Figure 1: S&P 500 and Dow Jones Indices (Feb ‘19 – Feb ‘20)

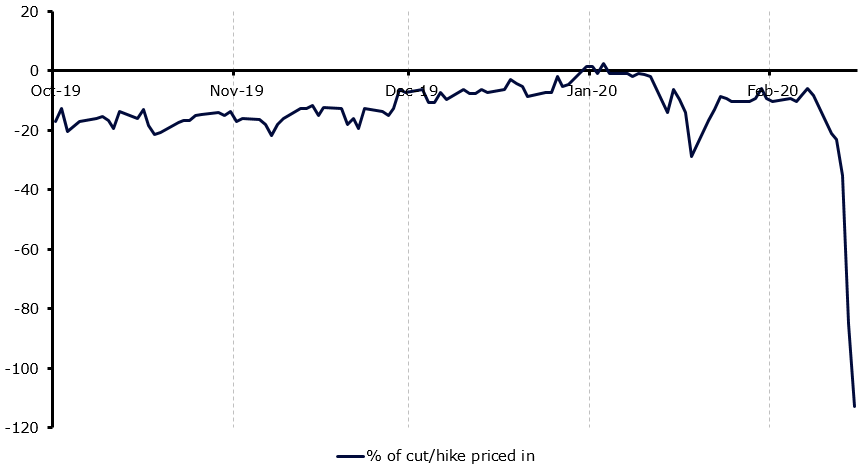

The fall in US equity markets and bond yields are far from helping the dollar’s cause at present. To make matters worse, interest rate markets have gone into overload, with investors beginning to price in aggressive central bank interest rate cuts across the G10. These ramped up expectations have been most prevalent in the US, with money markets now fully pricing in a 25 basis point cut from the central bank at its next meeting in March. An analysis of Fed fund futures shows that the market is now placing a 100% implied probability of a 25 basis point cut next month and around a 13% chance of a 50 basis point rate reduction (Figure 2).

Figure 2: Market Pricing for Change in Fed Funds Rate (Oct ‘19 – Feb ‘20)

FOMC Chair Jerome Powell has yet to comment on the situation in interest rate markets. While we think the above market repricing is a bit excessive, Powell is likely to at least note that cuts are possible when he makes his next public appearance. We will be closing monitoring comments from all Federal Reserve and ECB members in the coming days to ascertain whether current market pricing is overly aggressive, or in line with the view of central bankers around the world.