Euro slides to one-month low as EU stimulus package disappoints

- Go back to blog home

- Latest

Thursday’s highly anticipated European Council meeting failed to live up the market’s rather lofty expectations yesterday, sending the euro sharply lower to its weakest position in a month versus the dollar.

The result of the generally underwhelming reception to the announcement was to send the euro lower, down just over half a percent versus the dollar from Thursday’s London open. This sell-off may have been even more pronounced if it wasn’t for another worrisome US jobless claims number. Another 4.4 million new Americans filed for unemployment benefits last week, taking the total since the start of the crisis to in excess of 26 million, around 16% of the total labour force.

While the weekly number of claims appears to be easing it remains sky-high, suggesting that the actual US jobless rate may currently be close to its highest level since the Great Depression of the 1930s. Inadequate job retention policies in the US compared to much of the rest of the developed world are to blame, in our view.

UK retail sales post record decline in March

While yesterday’s dismal PMI numbers were not enough to halt the pound in its tracks, the UK currency was greeted with a bout of weakness this morning following a dire set of retail sales figures.

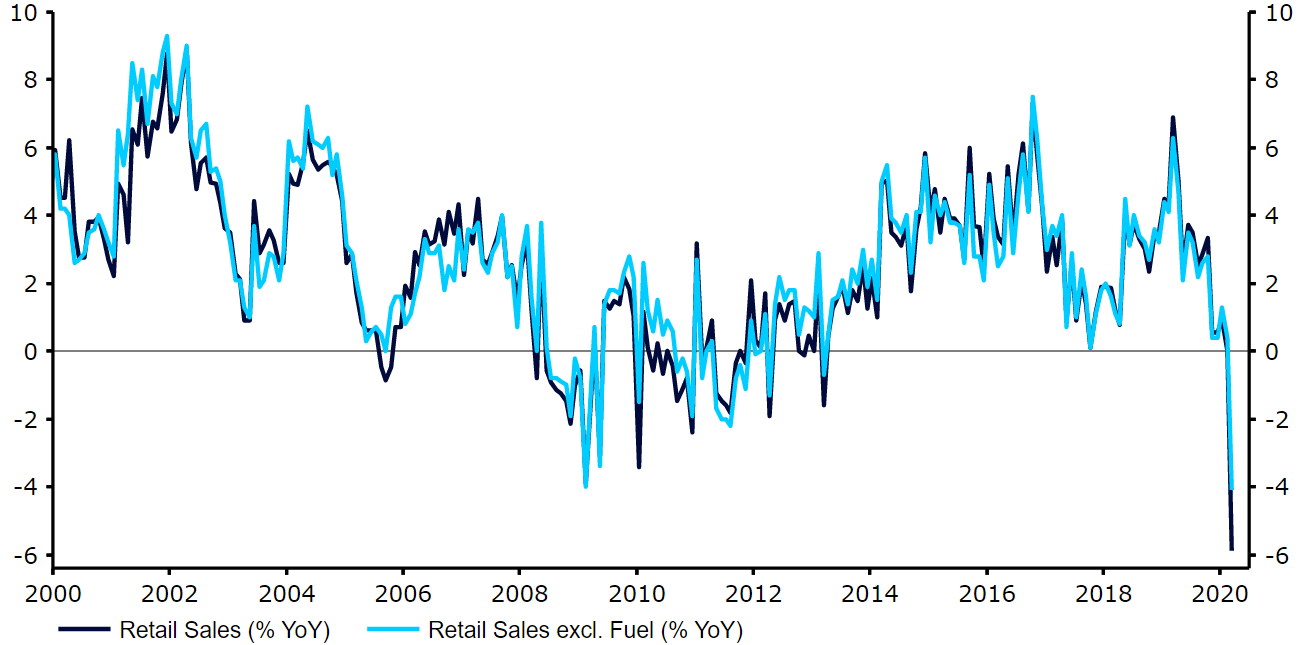

Sales in UK retail stores fell by the most on record in March, down 5.1% from February’s levels (Figure 1). No real surprises here given the unprecedented imposition of the national lockdown that has closed stores and forced consumers to remain in-doors. The concerning point here is that this is merely the tip of the iceberg, with the situation set to get much worse in April and May before it gets better. It is worth noting that the UK lockdown was not implemented until mid-way through the month of March, and is therefore not fully reflected in this morning’s data.

Figure 1: UK Retail Sales (2000 – 2020)

Source: Refinitiv Datastream Date: 24/04/2020

We’ll have more macroeconomic data out this afternoon that covers the crisis period in the form of the March US durable goods orders figures. Aside from that, currency traders are likely to continue focusing on the daily coronavirus numbers and any signs that countries in Europe are closer to finalising plans on how best to gradually begin exiting from their current lockdowns.