How did last night’s Fed meeting impact the FX market?

- Go back to blog home

- Latest

US stock markets rose to a seven-week high yesterday after the Federal Reserve indicated that it would be keeping rates at their effective lower bound for the foreseeable future.

There wasn’t too much in the way of new information from Powell and the currency markets were therefore little changed following his press conference. We did see a modest move higher in the euro, which is now back trading above the 1.085 level against the dollar. This, we think, can be attributed to comments regarding the Fed’s ability to continue easing policy at upcoming meetings, with Powell noting that the central bank will continue to use all tools available to foster US growth. The market was suitably satisfied that this implies the Fed has not run out of tools to protect the economy and investors were therefore comfortable in unwinding some of their safe-haven flows away from the dollar.

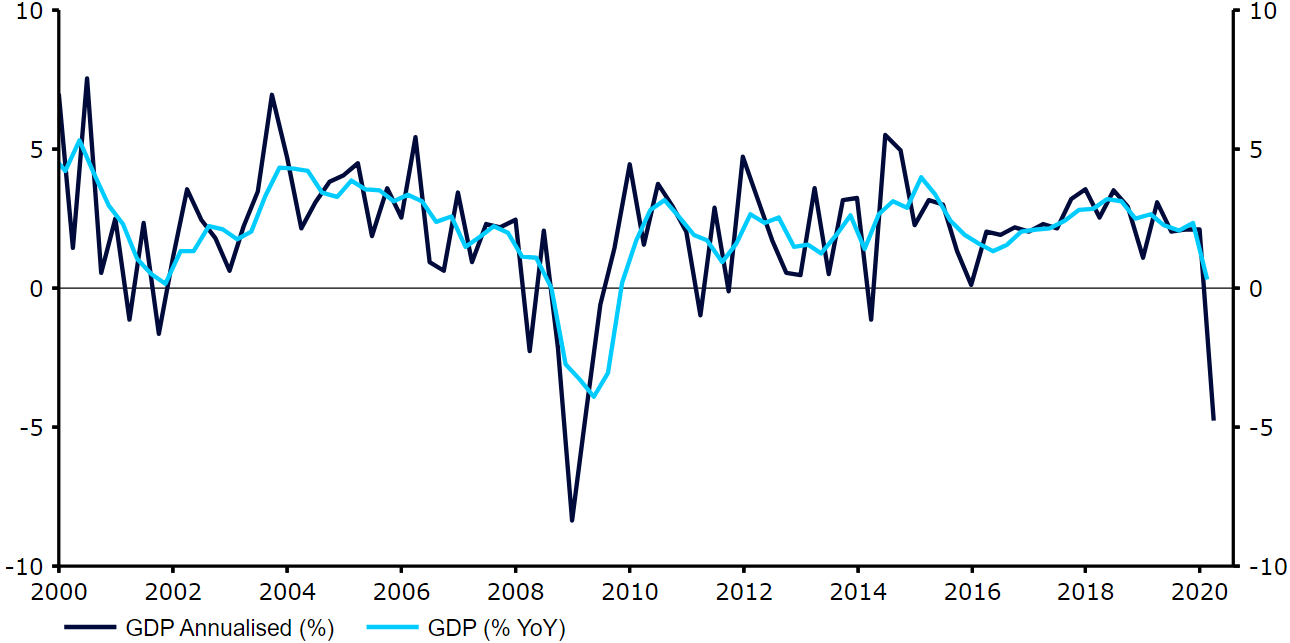

Prior to yesterday’s Fed meeting, the market didn’t react too aggressively to Wednesday’s first quarter US growth number, in part given that it was more-or-less in the ballpark pencilled in by economists’. The US economy contracted by 4.8% annualised in Q1 – its largest contraction since 2008. This is, however, just a taste of things to come, given the outbreak of the virus only began impacting activity in a meaningful way in the last two or three weeks of the quarter. The Q2 number will undoubtedly be far worse.

Figure 1: US GDP Growth Annualised (2000 – 2020)

Source: Refinitiv Datastream Date: 30/04/2020

Will the ECB shift EUR/USD this afternoon?

Next up for currency markets will be this afternoon’s ECB meeting. As we mentioned in our preview report, we think that there is a good chance the bank increases its pandemic emergency bond buying programme this afternoon. While the current envelope of €750 billion is undoubtedly sizable, this still only equates to around 6% of the Euro Area’s GDP, suggesting that there is scope for it to be increased.

Should the ECB both fail to act now and refrain from pledging future action, then the euro would likely sell-off sharply. The second possibility would be for the ECB to hold policy steady for the time being, but make a firm pledge to do more in the summer. The reaction in the currency markets would likely depend on whether Lagarde can convince the market that more easing is genuinely on the cards, although we think that the overall knee-jerk move would be to send EUR/USD lower. The last option, and our base case scenario, would be for the bank to act now by increasing its PEPP. The euro would likely rally under this scenario, particularly given the market currently appears torn over whether immediate action is necessarily on the way.

Regardless, we think that the ECB meeting will trigger much more volatility in the EUR/USD pair than last night’s Fed meeting, so an aggressive move in either direction cannot be ruled out.