Fed to unveil another jumbo hike, but is a pivot on the way?

( 3 min )

- Go back to blog home

- Latest

The US dollar has been broadly stronger since the start of the week, as markets brace for another massive interest rate hike from the Federal Reserve this evening.

Summary:

- Federal Reserve expected to raise rates by another 75bps today, its fourth in consecutive meetings.

- No ‘dot plot’ will be released on Wednesday, but markets will be looking for hints as to the pace and extent of additional tightening beyond this week’s meeting.

- US dollar outperformed most currencies on Tuesday following better-than-expected US PMI data.

- UK financial markets await Thursday’s Bank of England meeting, which is one of the hardest to call in recent memory.

We think that another 75 basis point interest rate hike, the fourth in consecutive meetings, is effectively a done deal at today’s FOMC meeting. Since the last meeting in September, elevated price pressures have continued to validate the case for aggressive policy tightening, in our view, and look likely to persuade policymakers that at least one more supersized rate increase is required. There will be no ‘dot plot’ released today, so in the event that the Fed does indeed raise rates by 75bps, we will be awaiting clues on the below:

- Will the Fed revert back to a 50bp rate hike at the last FOMC meeting of the year in December?

- Could the tightening cycle be drawn to a close at the subsequent meeting in February?

With regards to the former, we do indeed expect the Fed to hint today that a slowdown in the pace of rate increases may be on the way from December, though this will be a very close call. With regards to the latter of the two questions, we believe that we won’t get any clear forward guidance on when the Fed expects to end the hiking cycle – this would be slightly premature in the current environment. Fed fund futures are now only pricing in around a 30% chance of another 75bp rate hike in December (from 75%), so a dovish pivot at this week’s meeting wouldn’t be a complete disaster for the dollar, though it would nonetheless likely lead to a sell-off. Should the FOMC stick to its guns, and leave the door open to another 75bp rate increase in December, then the dollar would probably be very well supported after the meeting.

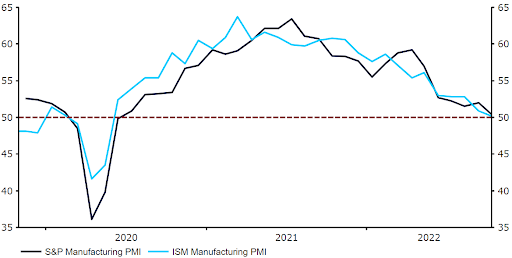

In the lead up to this evening’s Fed decision, the dollar traded higher against most currencies. Tuesday’s US PMI data was mixed, though investors looked at the positives, with both the S&P and ISM manufacturing indices beating expectations and printing above the 50 level – only barely mind you. This was enough to help drive EUR/USD back below the 0.99 level and send sterling to its lowest level in around a week.

Figure 1: US Manufacturing PMIs (2020 – 2022)

Source: Refinitv Datastream Date: 01/11/2022

Undoubtedly the biggest event risk for the pound this week will be Thursday’s Bank of England meeting. Markets are also eyeing a 75bp rate hike from the BoE this week, though the voting split among MPC members, the rhetoric on future policy moves and the updated GDP and inflation projections will also be key for sterling. Given the BoE’s recent track record of surprising to the dovish side, we think that risks to sterling are skewed to the downside once again heading into this week’s meeting. We’ll cover our thoughts on this in more depth during tomorrow’s market update.