Fed upgrades growth forecasts, but dollar slide continues

- Go back to blog home

- Latest

Last night’s FOMC meeting announcement was slightly less dovish than much of the market had anticipated.

The main takeaway from the announcement was, however, the Fed’s view on growth in 2021. As we thought that he might, FOMC chair Jerome Powell struck an optimistic note over the outlook for the second half of next year, citing the progress that has been made towards the multiple COVID-19 vaccines. The roll-out of the Pfizer vaccine has already begun in the US, with that from Moderna also close to being signed off as safe and effective (an announcement could be on the way as soon as Friday). Output this year is expected to contract by just 2.5% versus the 3.7% predicted in September, with activity to rebound strongly in 2021 (4.2% growth vs. 4% previously anticipated). Unemployment is also expected to be lower over the forecast horizon (5% in 2021, 4.2% in 2022 and 3.7% in 2023).

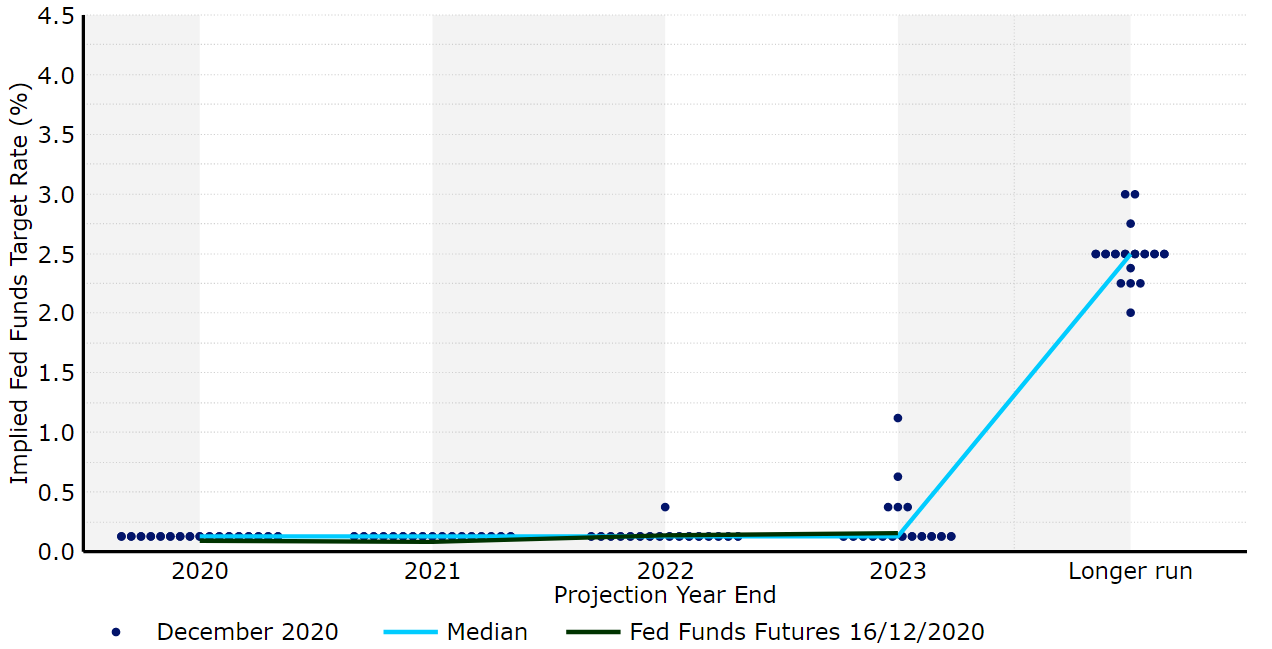

There was little change to the bank’s dot plot. As was the case in September, there were zero dots in favour of hikes in 2021 and just one for 2022. An extra member voted in favour of hikes in 2023 this time around (an overall of five), although there was no change in the median dot (Figure 1).

Figure 1: FOMC December 2020 ‘Dot Plot’

Source: Refinitiv Datastream Date: 17/12/2020

The US dollar initially rallied on the mildly hawkish announcement, but was soon on the back foot again, tumbling back below the 1.22 level. This has less to do with the Fed and more to do with investors largely ignoring the upbeat message in favour of the general increased appetite for risk that we’ve seen from markets since the beginning of last month.

Pound surges towards 1.36 level on Brexit optimism

Sterling has also continued to go from strength to strength this week and has made a march towards the 1.36 level versus the US dollar this morning. This has been fuelled largely by Brexit optimism. Comments out of EU officials in the past few days suggest that a deal could be done by the end of the week, with bookies now placing around an 80% implied probability of a deal.

Next up will be this afternoon’s Bank of England meeting. As we mentioned yesterday, with Brexit talks ongoing, we expect policymakers to stand pat and wait for news of a deal before thinking of making any sweeping changes to policy or forward guidance. The impact on sterling could, therefore, be relatively minimal.