Federal Reserve raises interest rate, signals more hikes in 2017

- Go back to blog home

- Latest

The Federal Reserve hiked its benchmark interest rate for only the second time since the financial crisis on Wednesday, in line with our and indeed the overwhelming market consensus.

While a rate hike in December was fully priced in by the market, the Fed’s stance towards future rate increases was less clear. Policymakers in the US also validated our expectations for a hawkish turn by ramping up the path of future interest rates in 2017 and beyond, sending the US Dollar soaring against major currencies.

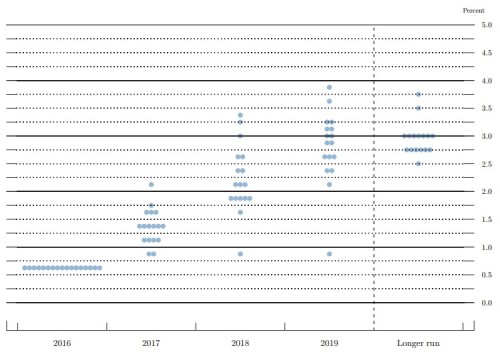

The FOMC’s ‘dot plot’, which outlines where each member of the committee expects rates to be at the end of each year, shows that the committee now expects on average three rate hikes in 2017, compared to just two outlined in September. Overall 11 of the 17 members thought that the Fed would hike on three occasions next year, quite a bit more hawkish than the market had anticipated.

Figure 1: FOMC December ‘dot plot’

Chair Janet Yellen’s press conference remained fairly cautious, downplaying the change in the projected path of future rates as only a modest shift in the thinking of several committee members. She did, however, acknowledge the “considerable” progress the US economy has made, indicating an improvement in the labour market and inflation. The statement made no explicit mention of the effect of Donald Trump’s plans to increase spending and cut taxes next year. There’s little chance the Fed will comment on such changes until Trump’s plans become clearer after his presidency begins in January.

Moreover, the Federal Reserve updated its growth forecast for next year, albeit only modestly. GDP Growth for next year is now expected to reach 2.1% compared to the previous 2.0% estimate, with the 2018 growth forecast unrevised at 2.0%.

The more hawkish than expected stance from the Fed on Wednesday evening sent the US Dollar sharply higher against almost every major and emerging market currency. The US Dollar index soared to its strongest position in 14 years, the Japanese Yen was down 2% to its lowest level in 10 months, while the Euro plunged to its weakest position since March 2015 (Figure 2).

Figure 2: EUR/USD (14/12/2016 – 15/12/2016), We think that the risks are still tilted to a faster than expected pace of interest rate hikes by the Federal Reserve, following the election victory of Donald Trump in November. Trump’s pledges during his election campaign have never been fully clear, however, his promises to increase spending could see as much as $1 trillion spent on infrastructure, combined with a series of widespread tax cuts. While these plans could significantly increase the government deficit next year, the short term effect on growth is likely to be positive, and could encourage the Fed to be even more aggressive in its approach to tightening monetary policy. We think there remains a strong chance that we’ll see hikes on roughly a quarterly basis in 2017.

Last night’s relatively hawkish stance adopted by the Federal Reserve reinforces our view that gradually increasing interest rates in the US will lead to a continued appreciation of the US Dollar against almost every major currency next year. We continue to expect the Dollar to reach parity with the Euro at some point in the first quarter of 2017, and it is clear that the market is now increasingly coming around to that possibility.