FOMC March Meeting Preview: Fed set for first pandemic era rate hike

( 3 min )

- Go back to blog home

- Latest

The Federal Reserve looks set to raise interest rates for the first time since the onset of the COVID-19 pandemic on Wednesday, with uncertainty surrounding the future path of hikes ensuring that this week’s meeting will likely be a highly important one.

Prior to Russia’s invasion of Ukraine, we had pencilled in a 50 basis point hike from the Fed at this month’s meeting. Developments in the past few weeks have, however, tempered our expectations somewhat, and we see anything more than a 25 basis point move as unlikely. Financial markets appear to be in agreement – fed fund futures are currently fully pricing in a quarter of a percentage point move in rates, with a negligible chance of a half a percentage point hike. Indeed, Jerome Powell himself has indicated that he is inclined to support a 25 basis point move, although he said he would be ‘prepared to move more aggressively’ should inflation not abate as fast as anticipated.

We therefore expect the reaction in the US dollar following the meeting to be driven largely by the Fed’s communications on inflation and its accompanying macroeconomic and interest rate projections.

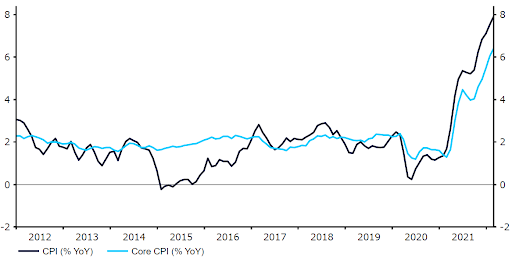

In its last set of rate projections in December, known as the ‘dot plot’, FOMC members indicated that they expected to raise interest rates on three occasions in 2022. Since then, inflationary pressures have continued to mount, and we think that warrants an upward revision to the median dot. The headline measure of consumer price growth has continued to march to fresh multi-decade highs, increasing to a forty year-high 7.9% in February (Figure 1). The war in Ukraine has additional inflationary implications, in our view, in large part due to the increase in global commodity prices and supply-chain disruptions. We expect the ‘dot plot’ to show members expect at least five interest rate increases in 2022, with rhetoric that would open the door to an even more aggressive pace of hikes should conditions warrant. Anything less than that would likely be perceived as bearish for the US dollar, while six or more hikes would be seen as bullish, and would likely trigger an immediate sharp move higher in the greenback.

Figure 1: US Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 15/03/2022

In its macroeconomic projections, we expect an upward revision to inflation and a modest downward revision to growth. While the US economy rebounded very strongly from the omicron uncertainty, a number of risks to growth remain, notably the significant supply-chain disruptions caused by the Russia-Ukraine war. We do, however, expect the US to experience a smaller economic hit than Europe, given its relative isolation from global demand and limited reliance on Russia for imports of oil and gas (only around 8%). Meanwhile, we see an upward shift to inflation as inevitable given both the continued surprise to the upside in recent inflation prints, increase in commodity prices and the further imbalancing in global supply and demand triggered by the war in Ukraine. As with the ECB, the inflation forecasts will likely be the most closely scrutinised by investors. A sharper-than-expected upward revision here would probably see the US dollar rally.

Chair Powell’s comments during his press conference will, as always, also be closely watched by market participants. While Powell won’t pre-commit to hikes at specific meetings on Wednesday, we do expect him to leave the door firmly open to an aggressive pace of hikes during the remainder of the year – we are currently pencilling in six 25 basis point moves, slightly less than market pricing. His comments on a reduction in the Fed’s massive near $9 trillion balance sheet will also be interesting. We think it is too soon for Powell to outline a specific target date for quantitative tightening to begin, although an indication that this could be on the way at some point in Q2 may trigger a bout of dollar strength. Ultimately, however, the bar for a hawkish surprise is rather high and the dollar is already trading at rather lofty levels – near May 2020 highs against its major peers (Figure 2). This may limit gains in the currency, even in the event of a hawkish surprise from the FOMC.

Figure 2: US Dollar Index (2021 – 2022)

Source: Refinitiv Datastream Date: 15/03/2022

The FOMC will announce its latest policy decision at 6pm GMT (7pm CET) on Wednesday, with chair Powell’s press conference to follow 30 minutes later.