FOMC May Meeting Preview: Market bracing for 50 basis point rate hike

- Go back to blog home

- Latest

Expectations are high heading into the May FOMC meeting, which is expected to deliver the Fed’s first 50 basis point interest rate hike in more than two decades.

Speaking during an IMF panel of central bankers last week, FOMC chair Jerome Powell stressed that it was ‘absolutely essential’ to restore price stability, and that rates would need to be raised ‘expeditiously’ in order for the bank to reach its goals. He also noted that a 50 basis point hike ‘will be on the table’ when the bank convenes for its May meeting. A handful of other Fed members have been even more forthright in their views on rates in the past fortnight, including members Bostic, Mester and Bullard. Bostic claimed in mid-April that ‘any action’ was possible this year, with both himself and Mester explicitly vocalising support in favour of multiple 50 basis point rate hikes. Bullard, who has emerged as one of the most hawkish members on the committee, has even put forward the case for rates to reach 3.5% by the end of the year.

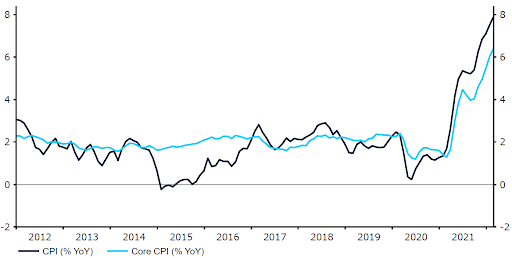

Macroeconomic data continues to support a rapid pace of policy normalisation, in our view, particularly the March inflation print that jumped to a fresh 40-year high 8.5%. Markets are in agreement and, at the time of writing, fed fund futures indicate that investors are expecting around 230 basis points of additional hikes from the FOMC by the end of the year, the equivalent of nine 25 bp moves. This is up sharply from the 150 bps that were expected prior to the 16th March meeting. Investors also now see a 50 basis point hike in May as a certainty, with a high likelihood of additional half a percentage point rate increases at each of the following three meetings in June, July and September.

Figure 1: US Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 29/04/2022

With such an aggressive pace of tightening already priced in by markets, we think that the bar for a hawkish surprise at next week’s meeting is now very high. A 50 basis point hike will be seen as the bare minimum – we think that it is a nailed-on certainty. There will be no updated macroeconomic or interest rate projections – the Fed’s next ‘dot plot’ won’t be released until June. Powell’s communications on additional rate increases, and the bank’s latest view on the inflation overshoot will, however, be closely watched by market participants.

We expect Powell to keep the door firmly open to an aggressive pace of hikes during the remainder of the year. While Powell won’t pre-commit to rate increases at specific meetings on Wednesday, he will almost certainly reiterate that rates could be raised at every meeting in 2022.

How could the US dollar react on Wednesday?

Given the elevated market pricing, we think it will be difficult for the Fed to exceed expectations. During his remarks earlier this month, St. Louis Fed President James Bullard said that a 75 basis point hike cannot be ruled out this year. We see this as a highly unlikely scenario, and assign very little chance of such a move, which would be the first since 1994. Aside from Bullard, there has been an active opposition among FOMC members to move in 75 bp increments, and there appears a general consensus that this would not be an appropriate policy strategy, even in the current inflationary environment. Needless to say, should the Fed shock the market by indeed raising rates by such a magnitude on Wednesday, investors would be caught wrong-footed and we would see an immediate knee-jerk rally in the dollar. Even a mere indication that 75 basis point hikes are possible at future meetings would be bullish for the dollar, in our view.

While we expect Powell’s communications to remain hawkish, any pessimistic comments on growth, or signs of easing concerns over inflation, would be bearish for the dollar. Powell suggested earlier this month that US inflation may have peaked in March, even if he wouldn’t necessarily count on it. Should the Fed indicate increased confidence that this is likely to be the case, then the dollar could fall. Any pushback on market pricing from Powell would also lead to a sell-off in the dollar, although this is not our base case.

We instead think that the Fed will maintain flexibility, and keep its options open to tighten more aggressively than the market expects should inflation continue to surprise to the upside.

We note that the greenback is already trading at very lofty levels leading up to the meeting. The US Dollar Index has risen to its highest level in over five years this week in response to a hawkish Fed and heightened global growth concerns. We do, therefore, see the possibility of a ‘buy the rumour, sell the fact’ scenario, whereby the dollar could reverse some of its recent gains, even in the event of a thoroughly hawkish set of communications from the Fed on Wednesday.

Figure 2: US Dollar Index (2021 – 2022)

Source: Refinitiv Datastream Date: 29/04/2022

The FOMC will announce its latest policy decision at 7pm BST (8pm CET) on Wednesday, with chair Powell’s press conference to follow 30 minutes later.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports