FX markets remain volatile as central banks announce further measures

- Go back to blog home

- Latest

Financial markets worldwide continued to look past the grim economic news and focus instead on the massive state and central bank interventions that are announced on a weekly basis.

The focus this week will be twofold. On the one hand, traders will be focused on the pace of decline of new coronavirus infections in Europe, the gradual economic recovery in China, and confirmation that US cases are peaking. On the other, high frequency economic measures, such as weekly jobless claims and monthly retail sales in the US, will be scrutinised closely in order to assess the extent of the damage wreaked by the pandemic.

GBP

In the absence of major timely data releases, the key to sterling performance this week may be the Government’s announcement on the duration of the UK’s lockdown period. The government’s first lockdown review will take place this Thursday, as is required by law every three weeks that the measures remain in place.

While the lockdown so far appears to be working to some extent, it is far too soon to judge whether the UK is past the peak of the virus. An extension to the current lockdown, possibly by another three weeks, is now almost certain. This is probably already priced in by markets, and hence sterling may therefore track the Euro’s moves against the dollar fairly closely next week.

EUR

The Eurozone added an international fiscal rescue package roughly 4% of the combined Eurozone GDP to the battery of measures intended to mitigate the economic impact of the pandemic. While this figure is more modest than those being considered in the US, it must be remembered that it is in addition to more substantial stimulus measures being undertaken by the individual states with the explicit support of the ECB.

By contrast, US individual states are unable to provide much fiscal stimulus of their own and must rely almost exclusively on Federal programmes. We remain impressed by the scale and speed of the Eurozone’s overall response, and think that sooner or later this will filter through to a higher euro.

USD

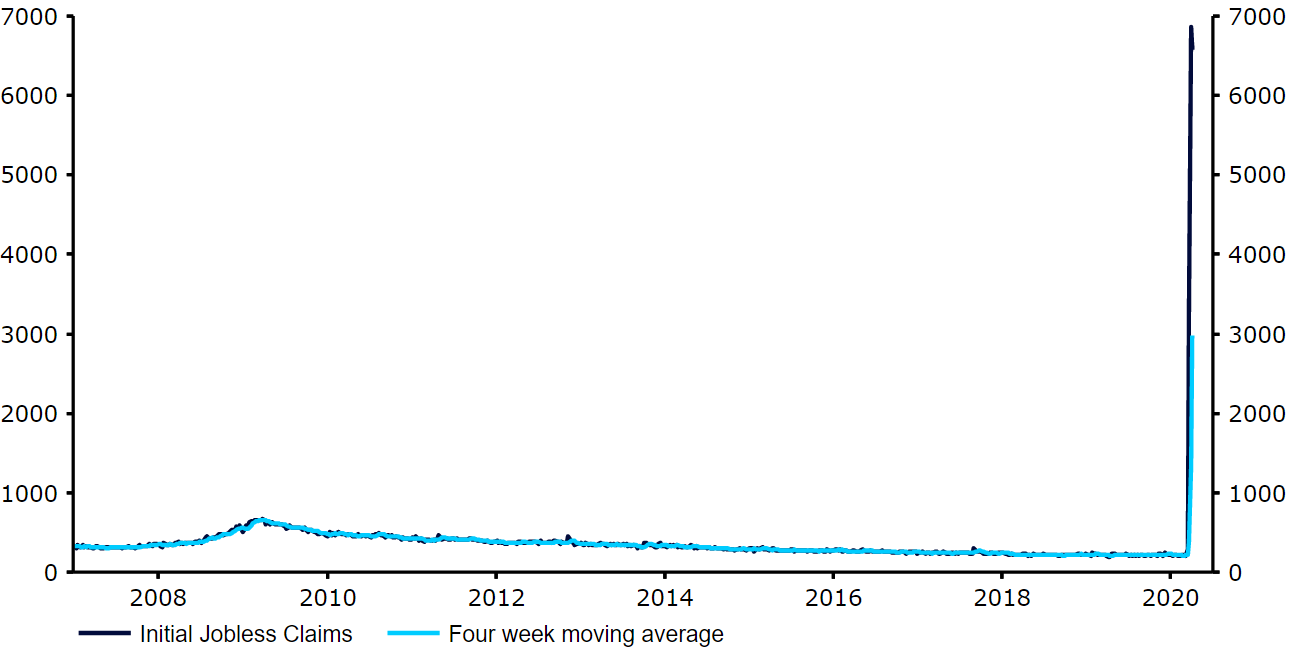

The Federal Reserve launched yet another massive loan program to support the economy last week. The new package includes loans to local and state governments, a critical piece of the support puzzle given the downturn in tax revenues and their inability to run deficits on their own. However, the most timely indicator of the damage brought by the crisis, weekly jobless claims figures, continues to blow out even the most pessimistic of expectations – claims last week once again exceeded the 6 million mark (Figure 1).

Figure 1: US Initial Jobless Claims (2005 – 2020)

While the fiscal and monetary response in the US is commensurate to the size of the problem, we still expect the US contraction to be deeper and longer than in Europe, and maintain our positive view of the euro.