G3 FX Update: the impact of Covid-19 so far and short term expectations

- Go back to blog home

- Latest

Trading in the global financial markets has been dominated by news surrounding the COVID-19 pandemic in the past few weeks.

We outline below how the G3 currencies have reacted to the virus, a summary of the key stimulus measures introduced, the impact so far on macroeconomic data and our broad expectations for the three currencies in the immediate term.

US Dollar (USD)

The most basic instincts among currency traders during times of intense market stress and uncertainty is to flock to the safety of the US dollar. The behaviour among investors to this crisis has been no different. The dollar appreciated sharply against just about every other currency in the world in the two weeks or so from 10th March. Emerging markets currencies were hard hit, as were those major currencies whose economies are either heavily dependent on the production of commodities and/or highly reliant on external demand. The severity of the regional containment measures and the number of confirmed domestic cases of the virus have also played a role.

As we have mentioned in the past, our main reasoning for investors favouring the US dollar is as follows:

1) The dollar is the most liquid currency in the world and therefore acts as the safe-haven of choice during times of intense market stress, such as the current crisis.

2) The US economy is less reliant on external demand than much of the developed world, particularly Europe.

3) The spread of the virus was comparatively less aggressive in the US than in Europe and Asia in the early stages of the pandemic. While the number of cases of the virus there has increased sharply in recent days, the number of cases per 1000 people still remains relatively low (1.1 versus around 2.9 in Spain). This is, however, likely due to the US playing catch-up given the less rigorous testing conducted in the States in the early stages of the outbreak, so may not be a true reflection of the actual situation.

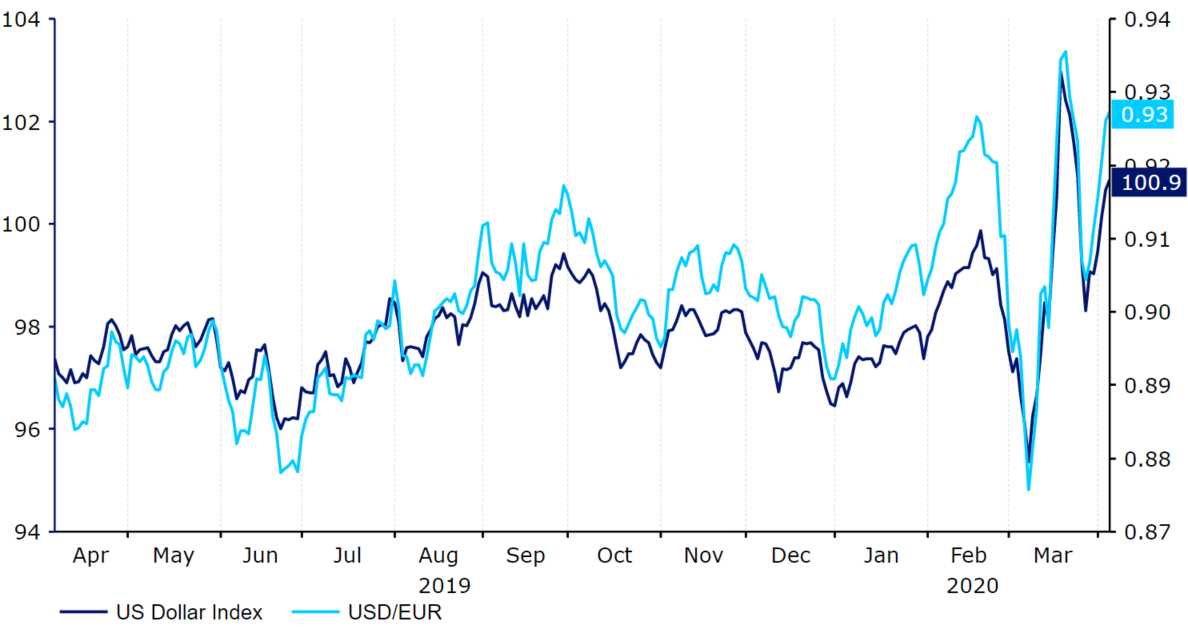

In trade-weighted terms, the dollar rose to its strongest position in four years in mid-March (Figure 1). While the currency still remains well bid against its major peers, it has since given up some of its gains. We attribute this retracement to both the jump in the number of US cases of the virus and the injections of liquidity by authorities to ease pressure on dollar funding.

Figure 1: US Dollar Index (April ‘19 – April ‘20)

The Federal Reserve has eased monetary policy aggressively on several occasions since the outset of the crisis. The central bank slashed its main fed funds rate by a total of 100 basis points to the effective lower bound (0-0.25%), back to where rates were following the financial crisis in 2008/09. They have also unveiled a host of other stimulus measures, which have included but not been limited to the following:

– A relaunch of its quantitative easing programme. This was initially announced as a $700 billion programme, although the Fed has since pledged to purchase an unlimited amount of Treasury and mortgage-backed securities in order to support financial markets and the economy.

– A number of credit facilities that will involve the Fed buying corporate and municipal bonds and asset-backed securities (ABS), in addition to the purchase of US Treasuries. This should help drive down yields, provide liquidity and improve the availability of credit to American households and businesses.

For its part, the US government has also unveiled a massive $2 trillion stimulus package, the largest in history. The package will include direct payments of up to as much as $1,200 to most Americans, a large increase in unemployment insurance and a $367 billion allowance for smaller businesses worst affected by the crisis. The main issue for the US economy is that the government’s job retention schemes are much less effective than many of its major counterparts, including the Eurozone and the UK. This means that unemployment will likely rise faster in the US than much of the developed world as a result of the crisis.

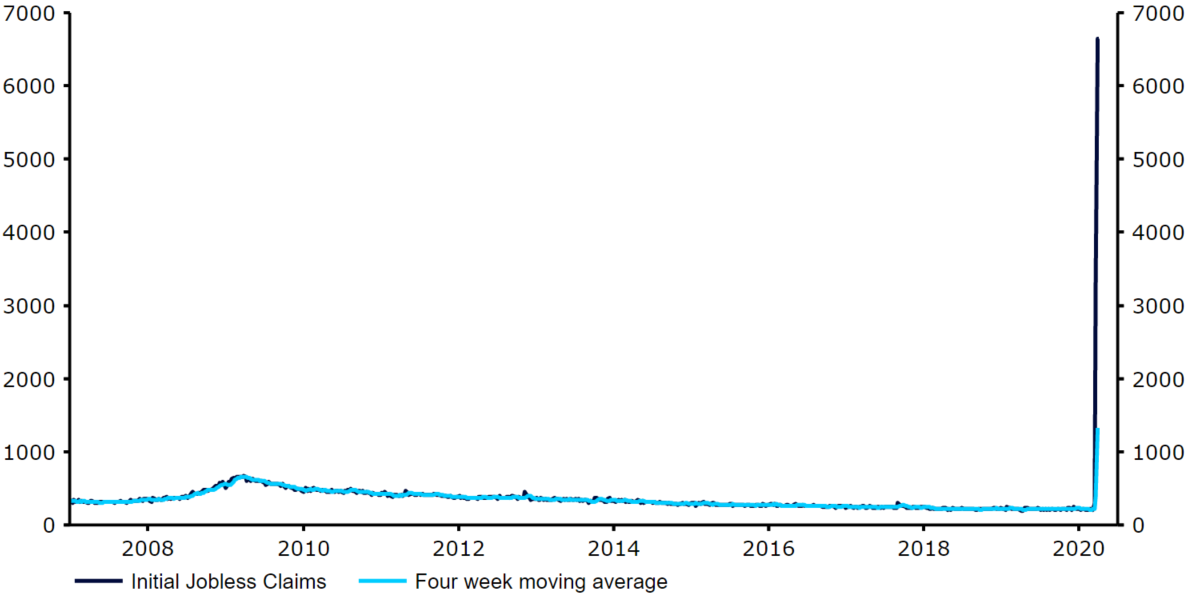

There has, so far, been limited macroeconomic data for investors to digest that shows the true extent of the virus containment measures on the global economy. Data that we have had from the US thus far has, however, shown a sharp deterioration. The composite PMI from Markit fell to a record low 40.5 in March, well below the level of 50 that separates growth from contraction. The timely measure of initial jobless claims has also given a taste of just how significant the impact will be on the US labour market. Initial claims for unemployment benefits totalled almost 10 million in the two weeks to 27th March, equating to around 6% of the overall labour force. The 6.6 million claims in the latter of those two weeks was a fresh record high and around tenfold any level reached during the 2008/09 financial crisis (Figure 2). 701,000 net jobs were lost in March according to the latest nonfarm payrolls report, although this only covers the period up to 12th March (i.e before the strict containment measures were put in place across much of the US). We therefore expect the April report to be significantly worse, with a record high contraction in jobs into the millions and a double-digit jobless rate now highly likely.

Figure 2: US Initial Jobless Claims (2007 – 2020)

A severe recession in the US and globally is now inevitable, in Ebury’s view. That being said, we remain hopeful that the global economy will bounce back sharply once the worst is over and the containment measures are gradually lifted. Unlike in 2008/09, there were no systemic issues in the global financial markets prior to the outbreak that would lead to a prolonged number of years in the doldrums, and the massive state response should prevent the downturn from resulting in a cascade of bankruptcies.

In the immediate-term, we may continue to see the dollar act as the safe-haven currency of choice, although the sharp increase in the number of cases we are seeing in the US may limit the currency’s appeal. We think that support for the dollar could be dented by two developments. Firstly, whether an improvement in the so far inadequate testing procedures across the rest of the US leads to a sharp increase in the number of confirmed cases in some of the least affected areas – signs so far suggest that this is indeed the case. The second factor would be whether this jump in US cases leads to stricter containment measures in more US states – some are so far more relaxed than others.

Euro (EUR)

With the number of new cases of the virus now mostly under control in China, Europe has very much emerged as the epicenter of the COVID-19 pandemic, alongside the US.

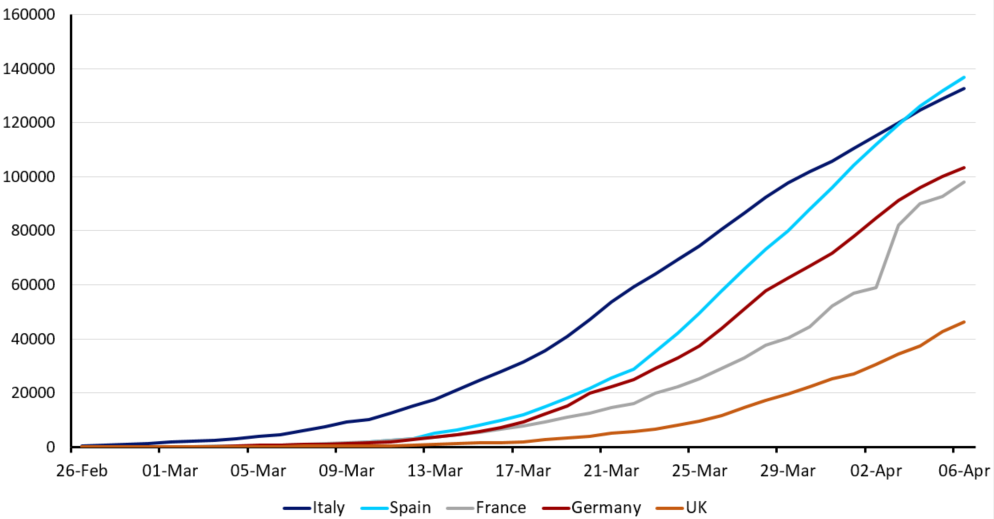

At the time of writing, approximately 580,000 cases of the virus have been confirmed within the EU, almost 469,000 (81%) of which have been reported in the bloc’s four largest economies: Germany, France, Spain and Italy. These four countries alone currently account for around 35% of the total global cases and 54% of the overall deaths caused by the virus. Strict containment measures, including complete lockdowns in some cases, are now in place across almost all of Europe to varying degrees in order to halt the virus’ spread.

Figure 3: COVID-19 Confirmed Cases [Europe] (26/02 – 06/04)

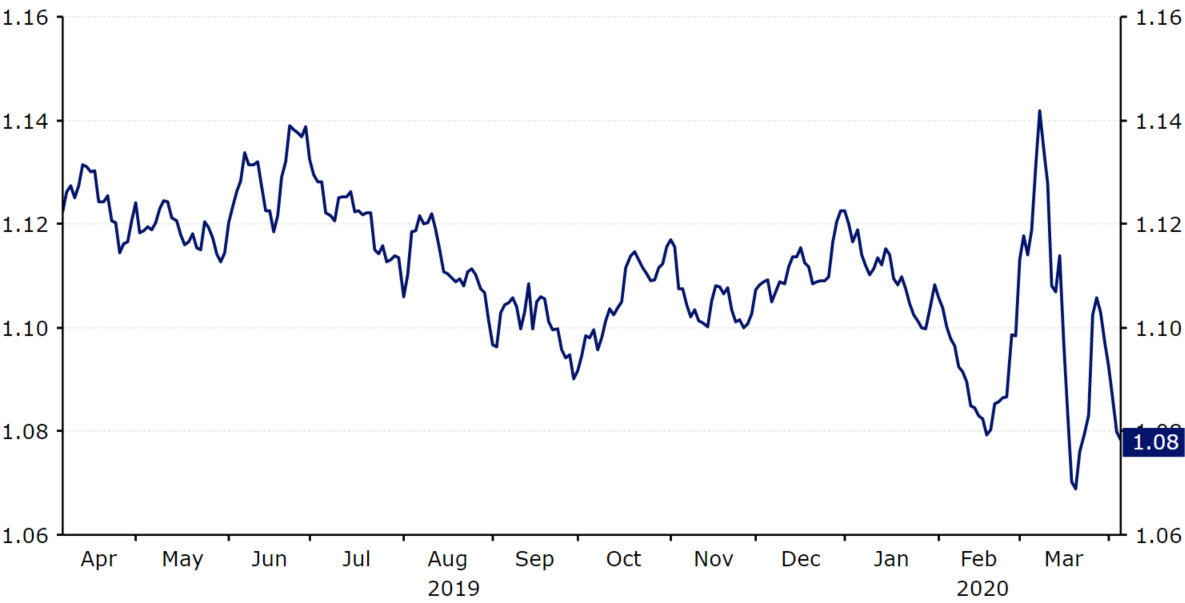

The common currency initially rallied sharply in late-February, early-March as the market began ramping up bets in favour of aggressive interest rate cuts from almost every major central bank. With plenty of scope for Federal Reserve rate cuts and almost no room for maneuver for the European Central Bank (ECB), investors sold their dollar holdings and flocked to the euro. With rates now down at zero in the US, this rationale for the upward move in EUR/USD has evaporated, with the common currency crashing from around the 1.15 mark on 9th March to the 1.065 level ten days later (Figure 4). The pair has, however, since stabilised, largely due to a retracement in the dollar, although the recent stabilisation in cases in Europe has helped the euro’s cause in the last few days.

Figure 4: EUR/USD (April ‘19 – April ‘20)

As mentioned, the ECB has almost no room to cut interest rates to combat the crisis, unlike many of its peers. The Governing Council’s March meeting left the market underwhelmed, with no rate cut and some contradictory comments regarding European bond yields. The bank did, however, increase its existing quantitative easing programme and will now purchase a further 120 billion euros worth of assets before the end of the year, in addition to its existing asset purchases worth 20 billion euros a month. It also unveiled a new scheme, the Pandemic Emergency Purchase Programme (PEPP), which will see the bank buy an overall envelope of 750 billion euros before the end of 2020 in order to keep the financial system liquid. Similar to the existing APP, this will include the purchase of government debt, as well as commercial paper (a short-term debt instrument) from private companies. This vast bazooka of a programme sends a strong signal to markets that the bank stands ready to do whatever is needed in order to support the financial system.

In an attempt to soften the blow to businesses and consumers, local governments within the bloc have also announced large-scale injections of stimulus. Most notable has been Germany’s 750 billion euro programme, which includes direct payments to businesses under threat and favourable loans to corporations. In such a crisis, we think that these measures will be overwhelmingly more effective in protecting jobs and supporting households than a simple interest rate cut. That being said they will, in Ebury’s view, only act to soften the now seemingly inevitable Eurozone recession, rather than prevent it.

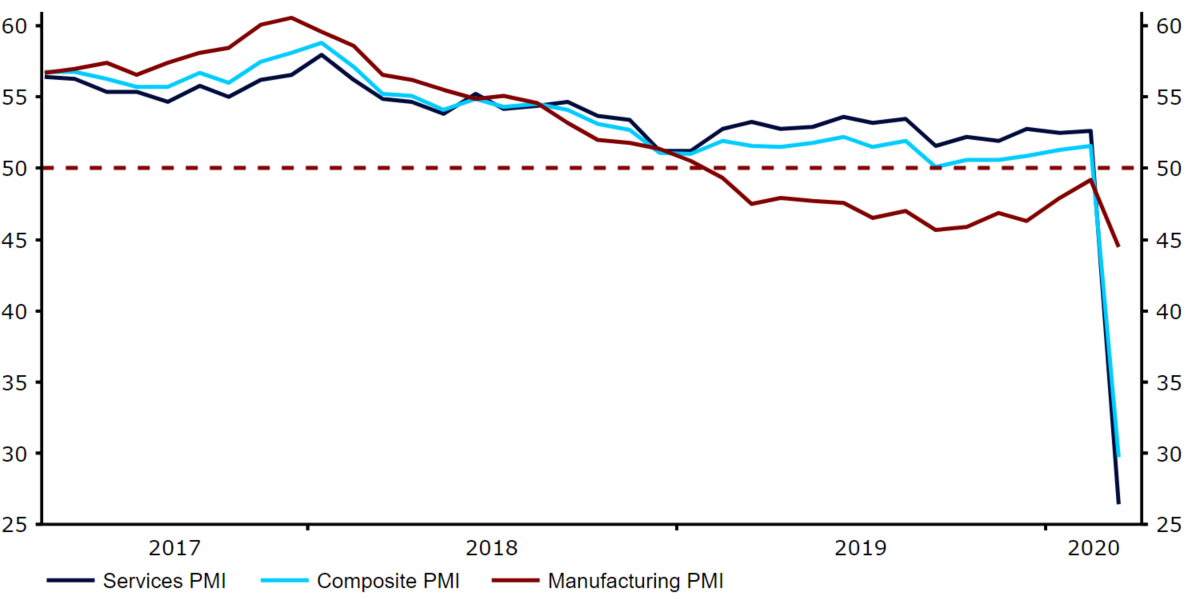

An early warning sign of the unprecedented impact the strict containment measures are likely to have on the Euro Area economy came in the form of the March PMI numbers which, unsurprisingly, showed a massive decline into contractionary levels. The services index, the sector of which relies much more heavily on consumer demand than manufacturing, collapsed to an all-time low 26.4 (Figure 5), dragging the composite index down to a deep recessionary 29.7. This is in line with quarterly contraction of around 2%.

Figure 5: Euro Area PMIs (2017 – 2020)

Given the aggressive spread of the virus and the severity of the containment measures put in place in many of the bloc’s key economies, we think that the pending recession in the Euro Area will be a severe one. Should upcoming macroeconomic data show that this is indeed the case, we think that we could see the common currency on the back foot against many of its major peers in the coming weeks. The absence of job protection and mechanism to regulate and slow the dismissal of workers in the US relative to the Euro Area does, however, provide room for a rebound in the euro versus the dollar, in the view of Ebury Partners.

UK Pound (GBP)

Sterling bore the brunt of the sell-off in higher-risk assets after the aggressive spread of the virus turned it into a full-blown pandemic in early-March.

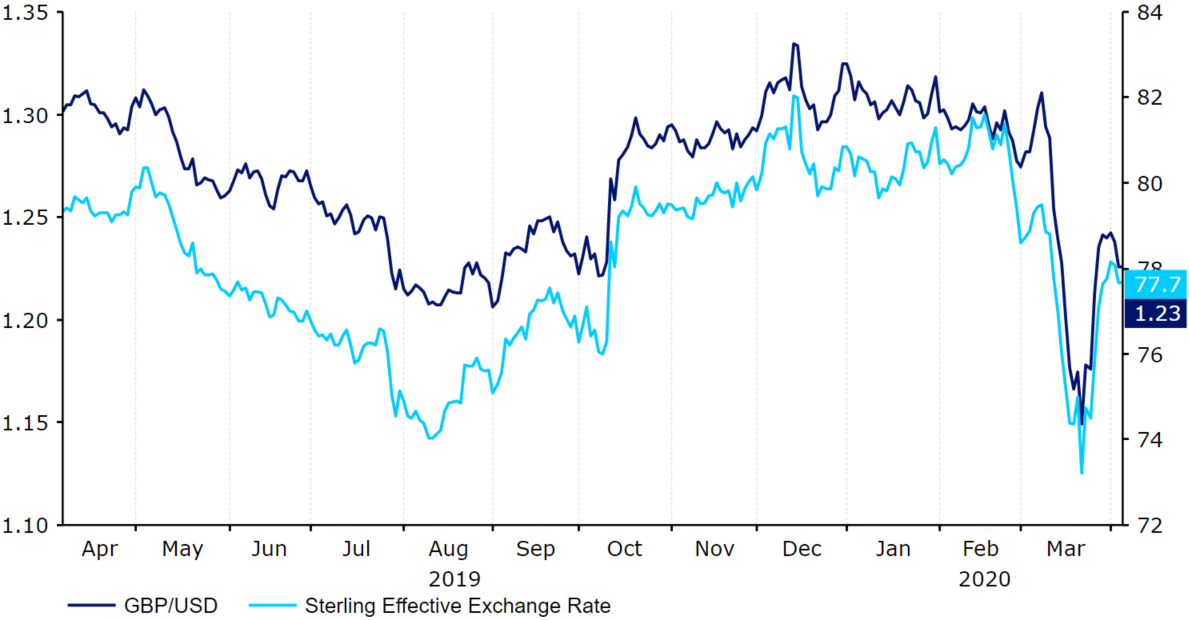

The currency tumbled to its lowest level since 1985 versus the dollar on 19th March, with the GBP/USD cross at one stage shedding around 13% of its value. At the time of writing, the pound has recovered most of these losses, although is still trading 4% and 2.5% lower against the dollar and euro respectively since the beginning of March (Figure 6).

Figure 6: GBP/USD (April ‘19 – April ‘20)

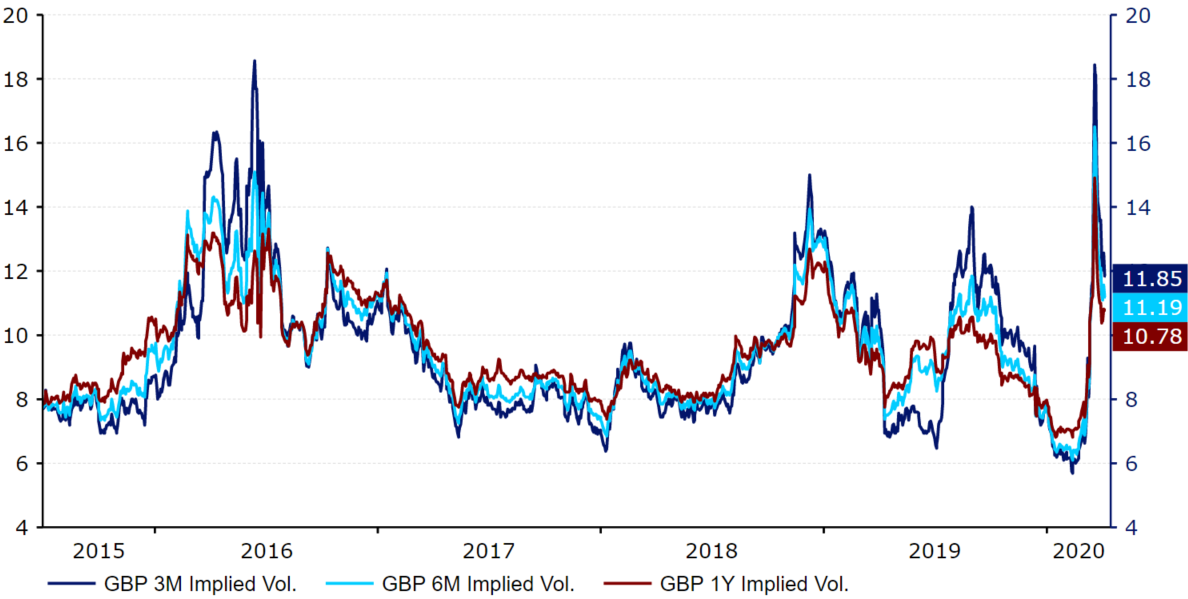

The pound has well and truly returned back to trading like an emerging market currency in the past few weeks, with measures of volatility rising to levels that would have been deemed as unthinkable when the first cases of the virus were reported in Wuhan at the end of last year. Most durations of implied volatility in the GBP/USD cross have breached post-Brexit levels since the start of the crisis (Figure 7). These levels were, at the time, deemed as unlikely to be reached again in a generation.

Figure 7: GBP/USD Implied Volatility (2015 – 2020)

In the view of Ebury Partners, the severity of the sell-off in the pound compared to many of its major peers, namely the euro, can be attributed to the below:

1) The long GBP positions that were put in place following the UK election in December were unwound, evoking the phrase ‘the higher the climb, the harder the fall’.

2) The UK has a large current account deficit, leaving the pound more acutely exposed to shifts in global investor sentiment than some of its major peers.

3) The prolonged uncertainty surrounding Brexit has placed a high risk premium on the UK currency ever since the referendum result in 2016.

Similarly to its major counterparts, the UK government and Bank of England have both launched a host of stimulus packages designed to cushion the economic blow. Out of all the main economies, we think that the measures in Britain have arguably been the most coordinated. Not only has the Bank of England cut interest rates all the way down to a record low 0.1%, but they have also ramped up their QE programme by £210bn to £645bn and announced measures to support smaller businesses by providing cheap loans to SMEs.

We have also seen extraordinary simultaneous measures taken by Boris Johnson’s government, including a £330bn stimulus package (the equivalent of 15% of the UK’s GDP) aimed at supporting households and businesses worst affected by the disruption. These comprehensive measures include business rates and mortgage holidays, grants and favourable loans for smaller companies and a pledge to cover 80% of workers’ wages up to a monthly threshold should they find themselves unable to work due to the virus. These drastic and unprecedented actions should prove absolutely vital in keeping businesses and individuals afloat while the strict lockdown protocols and social distancing rules are in place.

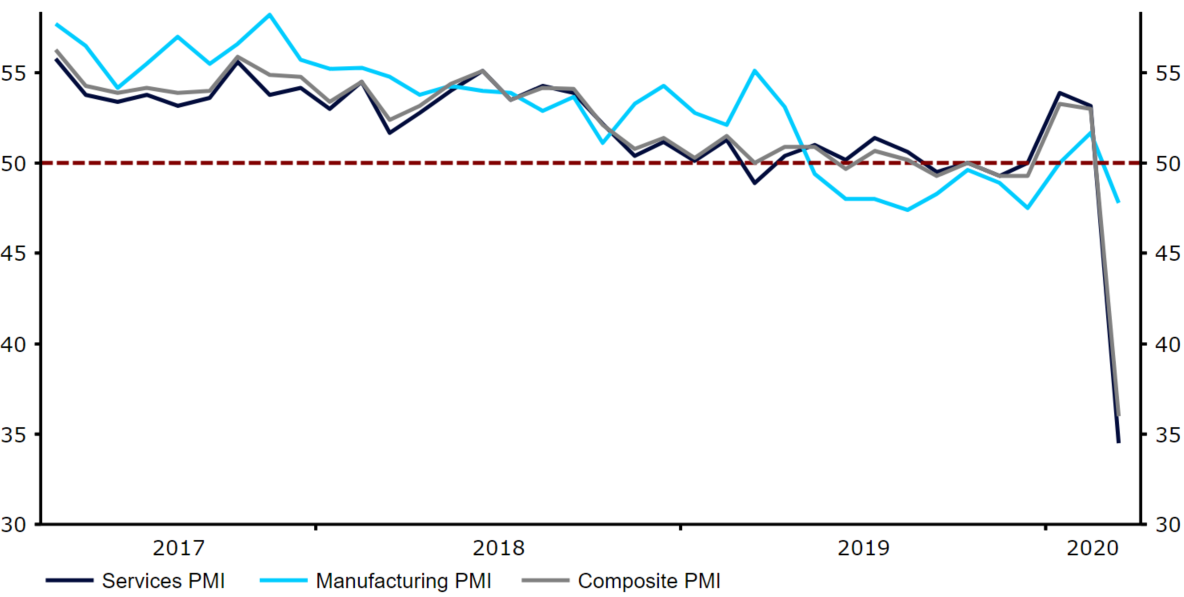

On the macroeconomic data front, the only meaningful news that we have as yet seen that encompasses the period of the crisis is the business activity PMI data from Markit. Similarly to both the US and Eurozone, the March composite PMI slumped to its lowest level since the survey began, 36.0 from February’s 53.0 (Figure 8). This is consistent with quarter-on-quarter contraction of approximately 1.5-2.0%, roughly the speed at which the UK economy contracted during the height of the financial crisis. We expect this number to continue deteriorating in the coming months, in line with the recent tightening in the virus containment measures.

Figure 8: UK PMIs (2017 – 2020)

We think that the sell-off that drove the pound to its lowest level in more than three decades against the US dollar was slightly excessive and driven more by panicked investors that engaged in herd trading. The supportive measures announced by the UK government are comprehensive and, as a percentage of GDP, greater than many similar packages announced elsewhere. While it is, of course, still early days, the spread of the virus has also appeared slightly less aggressive in the UK than many of its European neighbours at the same stage. The recent rebound in sterling to some extent vindicates this view.