Mystery ‘flash crash’ sends Sterling plunging, collapses 6% in 2 minutes

- Go back to blog home

- Latest

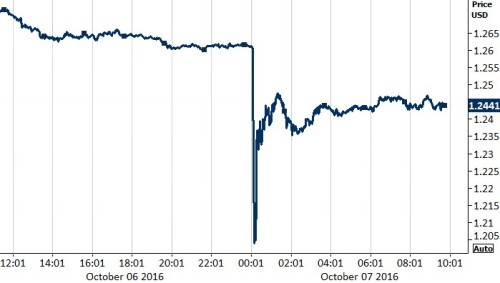

The Pound went into freefall during Asian trading last night, plunging by over 6% in a matter of only 2 minutes against the US Dollar after a mystery ‘flash crash’ led to the worst intraday drop in the currency since the Brexit vote.

Figure 1: GBP/USD (07/10/2016)

Many put last night’s freak spike down to a ‘fat finger’ error, which caused a series of stop-loss orders to be automatically triggered. This followed comments from French President Francois Hollande that European leaders should take a ‘firm’ negotiating stance with the UK when it comes to Britain’s exit from the European Union.

Sterling was unsurprisingly the worst performing currency in the world yesterday, with concerns over the pending Brexit continuing to sour sentiment towards the currency. There could be more misery to come for Sterling in the coming weeks, with last night’s ‘flash crash’ effectively removing every major support level for the currency.

The Euro also fell for the second day against a broadly stronger US Dollar following the release of the European Central Bank’s meeting accounts from September. Yesterday’s minutes implied that the Governing Council’s large scale quantitative easing programme could be extended beyond the existing March 2017 timeframe.

Focus in the currency markets today will be on this afternoon’s labour report out of the US. Traders will of course be paying special attention to today’s nonfarm payrolls number, which is expected to come in at around the 175,000 level. We think this very healthy level of job creation should be more than sufficient to convince investors that a December interest rate hike by the Federal Reserve is a firm possibility.

A surprise drop in unemployment or increase in average earnings would also provide good support for the US Dollar this afternoon and no doubt heap further downward pressure on an already weak Sterling.

Major currencies in detail:

GBP

Sterling hit its lowest level against the Dollar since March 1985 overnight, opening this morning 1.5% lower from last night’s London close.

Britain’s recently appointed Finance Minister Philip Hammond looked to boost confidence in the UK economy yesterday. Hammond claimed during a CNBC interview that Britain’s economy remains ‘fundamentally strong’ and could even gain an economic advantage from the pending exit from the EU in the long term.

Bank of England Governor Mark Carney also spoke in Washington yesterday at an IMF panel, although added little on the topic of monetary policy.

Industrial and manufacturing production and trade balance data this morning could shift the Pound when released this morning. However, the Pound appears to be completely overlooking economic data, with Brexit concerns almost exclusively driving the currency.

EUR

The Euro dipped 0.5% against a broadly stronger US Dollar on Thursday.

The single currency received little help from yesterday’s fairly dovish set of meeting accounts from the European Central Bank. The minutes claimed that underlying price pressure in the Eurozone lacked ‘a convincing upward trend’. This reinforces our view that the ECB will extend the timeframe of its QE programme by at least six months at the central bank’s December meeting.

In terms of economic data, factory orders in Germany came in better-than-expected in August. Orders rose 1% in the month and 2.1% on a year previous.

With no major economic news or announcements out of the Eurozone today, the single currency will be driven almost exclusively by this afternoon’s nonfarm payrolls report.

USD

Investors continued to pile into the US Dollar on Thursday, with strong economic news bringing forward expectations for the next interest rate hike by the Federal Reserve. The Dollar index rose 0.3%.

Jobless claims data out of the US yesterday boded well for this afternoon’s nonfarm payrolls report. Initial claims fell to just 249,000 last week, suggesting that the US labour market continues to remain healthy. The four-week moving average declined to just 253,500, its lowest level since December 1973.

We think this strength will manifest itself into an improvement in employment growth over the next few months and allow the Federal Reserve to hike interest rates before the end of the year.

The monthly labour report at 13:30 UK time this afternoon will be the main event risk in the currency markets this week.

Receive these market updates via email