PMI data points to deep European recession

- Go back to blog home

- Latest

For the first time in a number of weeks, investors had a handful of relevant macroeconomic data releases out of the major economies to digest this morning.

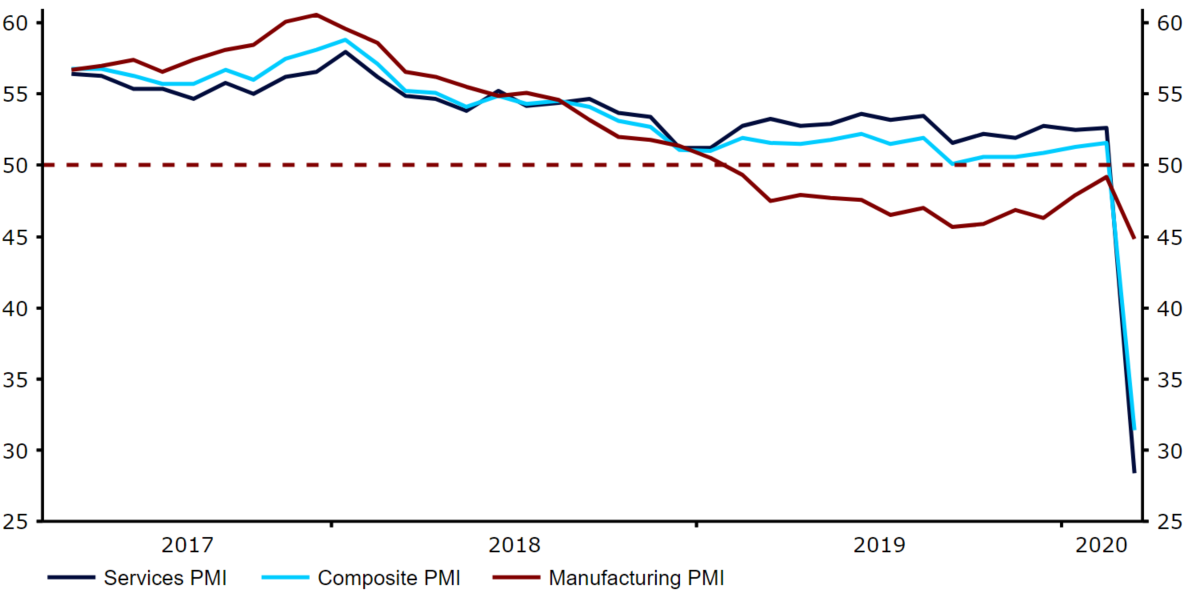

The Euro Area’s services index capitulated to 31.4 in March, by far and away its largest drop on record and below the levels witnessed during the height of the financial crisis. Manufacturing was less severely impacted, with the index for the sector falling to 44.8, which was actually above expectations. According to Markit’s chief business economist Chris Williamson, these numbers suggest that the economy is on course to contract by 2% quarter-on-quarter, although we think that there is scope for an even sharper contraction.

While the magnitude of the drop in overall activity was slightly more violent than the market had priced in, it comes as very little surprise. A number of countries in the bloc are now on full-blown lockdown mode, while in others travel is restricted and people’s way of life is severely disrupted. We had already stated that a Euro Area recession is inevitable. These numbers merely confirm our suspicion.

Figure 1: Euro Area PMIs (2017 – 2020)

As for the euro, the currency has actually rallied in the past 24 hours and is now back above the 1.08 level. This has more to do with the jump in the number of virus cases in the US over the weekend, which leapfrogged Spain to be the third worst affected country in the world. Should this sharp acceleration in confirmed cases in the US continue, we could see a continued retracement in the dollar in the coming few days. The Federal Reserve also unveiling additional monetary stimulus on Monday – more on that in our afternoon note later today.

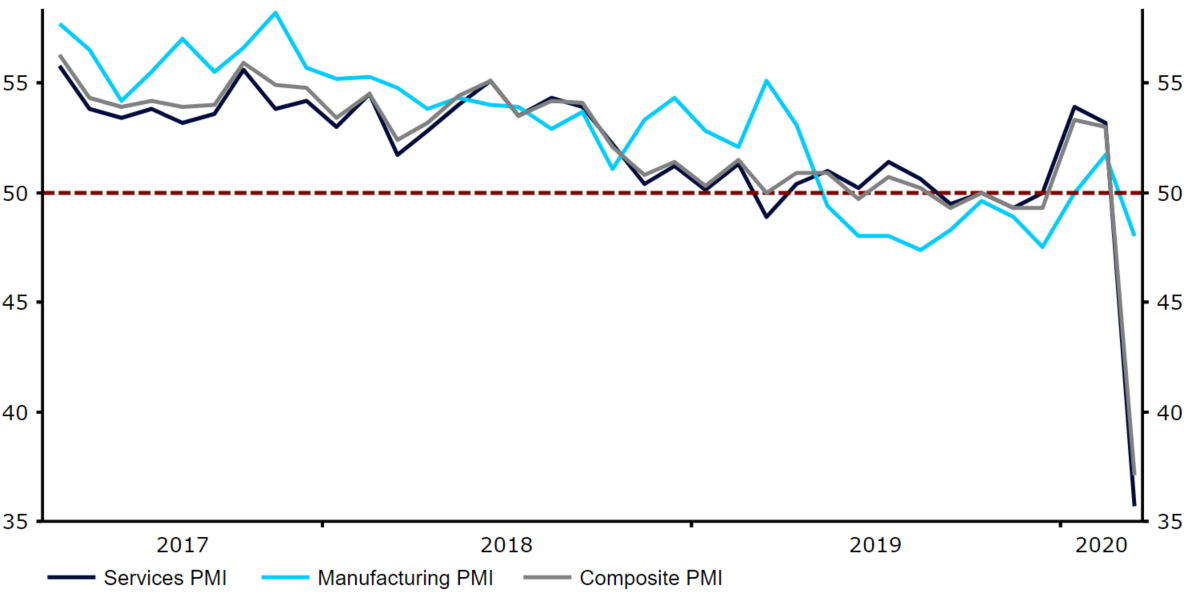

Sterling claws back ground, UK PMIs fall sharply

The aforementioned UK PMI data was similarly suppressed this morning, albeit not quite to the extent of the Euro Area given the two or three week lag that the virus is running in the UK. Services activity, which relies much more on individual consumer demand than manufacturing, slumped to a record low 35.7 this month, well below the level of 50 that denotes contraction.

Figure 2: UK PMIs (2017 – 2020), Mr Williamson’s comments regarding the numbers read as follows:

“The surveys highlight how the COVID-19 outbreak has already dealt the UK economy an initial blow even greater than that seen at the height of the global financial crisis. With additional measures to contain the spread of the virus set to further paralyse large parts of the economy in the coming months, such as business closures and potential lockdowns, a recession of a scale we have not seen in modern history is looking increasingly likely.”

The pound largely ignored the numbers this morning, continuing on its upward trend versus the broadly weaker US dollar. Sterling is now well and truly trading like an emerging market currency, with volatility in the GBP/USD cross reaching levels undreamt of a matter of weeks ago. At the time of writing, the pound is up 2% from yesterday afternoon’s lows. We expect such intense and unpredictable volatility to continue in the coming days, particularly following Boris Johnson’s announcement yesterday evening that the UK is effectively now on lockdown in all but name.