Pound jumps as BoE says UK recession to be less severe than feared

( 3 min )

- Go back to blog home

- Latest

Sterling briefly jumped to just shy of its highest level so far this year on Thursday morning after the Bank of England delivered a more upbeat assessment of the UK economy than the market had expected.

The bank now expects the UK economy to contract by 9.5% this year (less than the 14% pencilled in back in May but still the largest recession on record), with slightly flatter growth over the next two years of 9% and 3.5% respectively (versus 15% and 3% previously expected). We think that the downward revision to the latter largely has to do with the higher base effect, rather than concerns regarding a slower recovery. We will find out more when Governor Andrew Bailey conducts his press conference slightly later on at 11:30am BST.

One of the big concerns among investors going into the meeting was that the MPC may talk up the need for negative interest rates to combat the downturn. While Bailey’s comments on the subject could shift markets later on, the communications released this morning suggest that the bank’s stance towards the use of sub-zero rates has not materially changed.

As we said that they might during the latest episode of our FX Talk podcast, the MPC noted that the use of negative rates would remain ‘under review’. This, we think, ensures that the bank will keep their options open to cut below zero, albeit in the knowledge that this is probably something that they are not giving serious consideration to just yet.

The BoE’s communications were all generally positive news for the pound, notably the apparent lack of appetite for negative rates among the committee. Sterling reacted as one would expect, moving around 50 pips higher versus the US dollar. The move higher in the UK currency was, however, relatively mild. We think this has to do with the more upbeat tone being largely priced in by the market prior to the announcement, with investors also cautious to open up any sizable positions ahead of Bailey’s presser later on this morning.

Euro breaks through 1.19 level amid contrasting economic news

News out of the US economy yesterday was largely mixed, although investors chose to look at the negatives, sending the dollar another half a percent lower versus the euro. The pair briefly rose above the 1.19 level, although retraced some of its gains this morning.

Wednesday’s US non-manufacturing PMI from ISM beat forecasts, unexpectedly rising to 58.1 in July from June’s 57.1. The latest ADP employment change number did, however, massively undershoot expectations. Just 167k net jobs were created in the private sector, nowhere near the 1.5 million that investors had priced in. This does not bode at all well for tomorrow’s much more critical nonfarm payrolls report, which we think could also surprise to the downside.

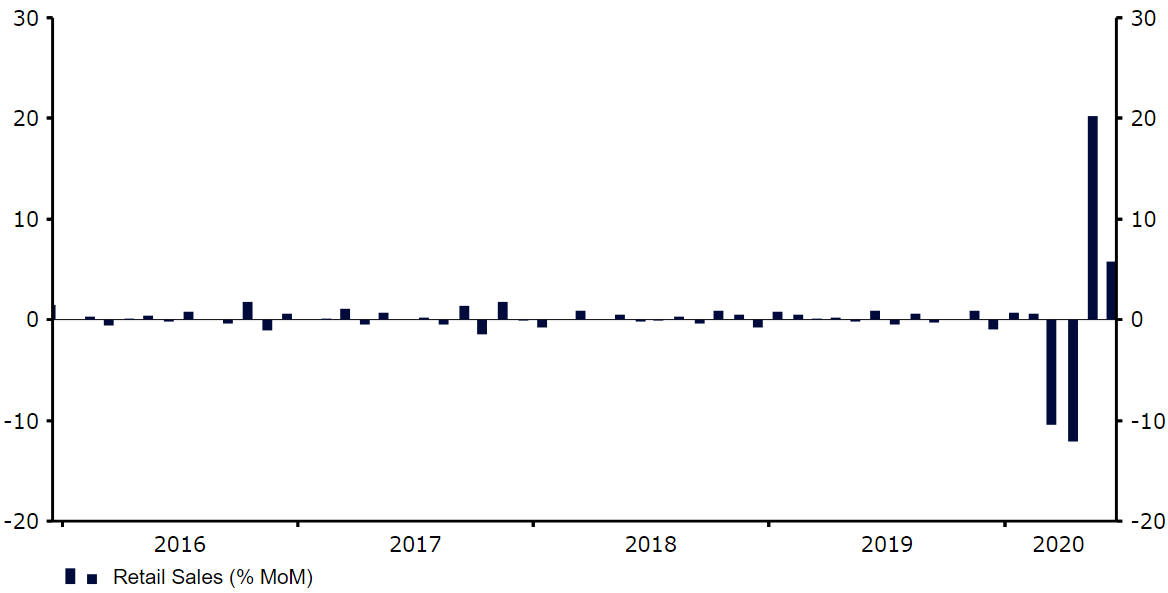

In Europe, the July composite PMI was revised up slightly from the initial estimate to 54.9 from 54.8. There was also some pretty good news on Euro Area retail sales. While the July number fell short of expectations, this was more than made up by a sharp upward revision to the June data, which showed that sales rose by a record 20.3% month-on-month (17.8% initially estimated). This is highly encouraging news that points to evidence of a potential ‘V-shaped’ economic recovery in the bloc.

Figure 1: Euro Area Retail Sales (2016 – 2020)

Source: Refinitiv Datastream Date: 06/08/2020