Pound roars back after BoE steps in to calm bond markets

( 3 min )

- Go back to blog home

- Latest

This week has been another rather extraordinary one in financial markets, particularly in the UK, with gilts, equities and the pound still reeling from last Friday’s openly inflationary budget from Britain’s government.

Summary:

- Sterling sells-off again, only to rally around 3% off its lows after the Bank of England steps in to ease pressure on the UK fixed income market.

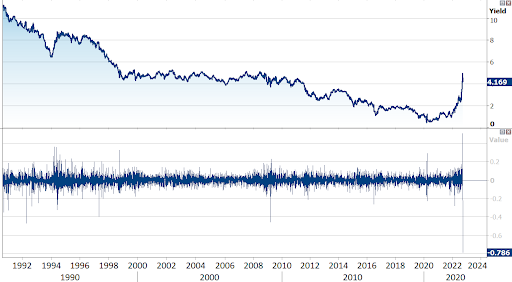

- The UK 20-year Gilt yield experiences its largest decline in 30+ years.

- Improvement in global risk sentiment drives USD lower against most currencies. EUR/USD rallies back above 0.97 mark, its highest level so far this week.

Sterling has managed to stabilise in the past few trading sessions, having sank to its lowest ever level against the US dollar on Monday morning. We attributed part of the rather swift recovery in the pound earlier in the week to expectations that the Bank of England would intervene in some capacity in an attempt to prop up the beleaguered currency, whether that be in the form of an emergency interest rate hike or (far less likely) direct FX intervention. A statement late on Monday that the bank plans to wait until the November MPC meeting before addressing matters was, however, a disappointment for markets.

Inventors also initially reacted in a negative fashion to a fresh statement on Wednesday morning from the Bank of England, which said that it would temporary purchase unlimited amounts of additional long-dated UK bonds in order to address the situation in the UK fixed income market. This is not to be confused with further QE, as the bank intends to delve into its (admittedly small) holdings of FX reserves in order to finance the purchases. The bank also said that it would delay the start of its quantitative tightening process until the end of October. Fixed income markets actually reacted positively to the news, with the yield on the 20-year Gilt falling by around 80 basis points yesterday. By our reckoning, this is by far the largest drop in at least the last 30 years, after Monday saw the largest increase.

Figure 1: UK 20Y Gilt Yield (1990 – 2022)

Source: Refinitiv Date: 28/09/2022

Sterling initially fell off the back of the announcement, as investors were perhaps hoping for a little more, namely an emergency rate hike. Traders did, however, get over this initial disappointment, and the pound actually roared back sharply (up 3% from its lows), to end the London session around the 1.09 level. As much of the sensitivity in the pound in the past week has had to with the turmoil in fixed income markets, the idea that the Bank of England was intervening in order to address the situation ultimately improved sentiment towards sterling over the course of the day. There were even warnings that pension funds could have experienced mass insolvencies on Wednesday had the BoE not intervened.

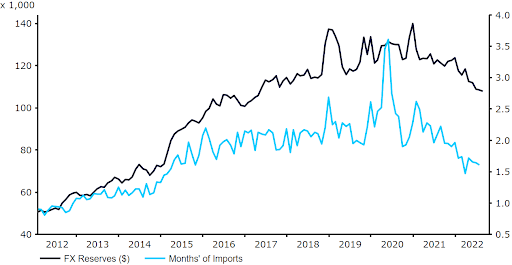

Whether these gains in the pound are sustainable is another question entirely. BoE chief economist Pill appeared to confirm this week that an emergency rate hike is off the table, while the bank has insufficient FX reserves in order to directly intervene (less than 2 months’ worth of import cover). We may have to see some form of fiscal policy U-turn, or a vote of no confidence in Liz Truss, though the government said that it was staunchly sticking by its plans on Wednesday afternoon.

Figure 2: UK FX Reserves (2012 – 2022)

Source: Refinitiv Datastream Date: 27/09/2022

It’s worth noting that much of the recovery rally in the pound yesterday can also be attributed to a broad retracement in the US dollar. Risk sentiment improved in markets yesterday, we wager partly in response to the stabilisation in UK financial markets, which has stoked fears of contagion all week. The euro followed sterling upwards, rallying by almost 2% on the day to back above the 0.97 level – its strongest positions so far this week. Risk currencies such as the Australian dollar and Swedish krona also performed well in the G10. This may, in part, reflect both profit taking and valuation, as these currencies are all trading at extraordinary weak levels against the US dollar. For now at least, developments in UK financial markets are taking centre stage, and may continue to be among the main drivers of global risk sentiment in the coming days.