Pound slips as Hunt charts new era of UK austerity

( 3 min )

- Go back to blog home

- Latest

Sterling was a touch weaker against its major peers on Thursday, after recently appointed chancellor Jeremy Hunt unveiled large tax hikes and spending cuts during yesterday’s Autumn statement.

Summary:

- UK government unveils tens of billions in spending cuts and tax hikes during Autumn Statement.

- US dollar stronger against most currencies, as investors react to largely positive US data.

- Markets eye this morning’s UK retail sales data, and speech by ECB President Christine Lagarde.

In reality, most of the new measures announced were already largely expected by market participants. Rishi Sunak’s government plans to deliver a £55 billion fiscal consolidation, as it aims to plug the massive blackhole in Britain’s budget shortfall. According to Hunt, just under half of this will come from tax increases, with the majority financed by spending cuts. In theory at least, this should aid the Bank of England in its efforts to bring down UK inflation, though a return to the 2% target appears a long way off. The Office for Budget Responsibility (OBR) now expects UK inflation to end next year at 7.4%, almost double the March estimate.

Jeremy Hunt delivered a rather gloomy assessment of the UK economy. The OBR is pencilling in a 1.4% GDP contraction in 2023, with unemployment expected to rise to almost 5%. A move towards austerity ahead of a pending recession would ordinarily been seen as counterintuitive, but the government’s priority has clearly shifted towards bringing down inflation and balancing the books. UK gilt yields were down on the announcement, as the government intends to issue far less bonds than expected in order to plug the budget gap. The 10- and 20-year gilt yields are now actually back below their pre-mini budget levels, which should help bring down both mortgage rates and rents.

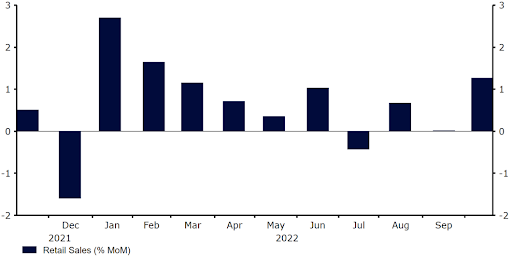

While part of the sell-off in GBP/USD on Thursday perhaps reflected investors view on the news out of the House of Commons, the US dollar was actually broadly stronger across the board yesterday. Economic news out of the US so far this week has been rather encouraging. Wednesday’s retail sales data beat expectations, with sales up 1.3% on the month in October, above the +1% consensus. Data out on Thursday also mostly beat estimates, notably another drop in initial jobless claims and a surprise to the upside in both building permits and housing starts. FOMC member Bullard, who is admittedly one of the most hawkish members of the committee, also said yesterday that he saw US rates between 5-5.25% next year – just above the level priced in by markets.

Figure 1: US Retail Sales (2021 – 2022)

Source: Refinitiv Datastream Date: 16/11/2022

Today is unlikely to be a quiet end to the week. In the UK, this morning’s retail sales print will be closely watched – flat growth in October is expected. European Central Bank President Christine Lagarde will also be speaking this morning, with markets looking for clues as to the possible size of the next ECB rate hike in December. According to Bloomberg reports this week, official are favouring a 50bp move.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports

🔊 Stay up to date with our podcast FXTalk