Promising COVID-19 vaccine trial results boost markets

( 3 min )

- Go back to blog home

- Latest

The euro surged to its strongest position in four months against the US dollar this morning, with other risk assets also rallying on signs of progress towards a COVID-19 vaccine.

As we mentioned yesterday, this week is a busy one in terms of European policy announcements. Investors now appear reasonably confident that the EU’s proposed 750 billion euro fiscal rescue package can be forced through during this Friday-Saturday’s summit – confidence that can also be attributed to some of the recent strength in the euro. Chancellor Angela Merkel has stated this week that they will push for a compromise, suggesting that there is a good chance it gets forced through on Saturday. You can hear more about our thoughts ahead of the summit and Thursday’s ECB meeting on this week’s episode of Ebury’s FX Talk podcast.

There was enough positive news yesterday for the euro to completely overlook the latest economic data, which was actually rather disappointing. Industrial production increased sharply, although rose by a less-than-forecast 12.4% (15% expected). The ZEW economic sentiment index also edged up only marginally to 59.6 after investors had eyed a jump to 78.1. Aside from tomorrow’s ECB meeting, intention will now shift to Thursday afternoon’s US retail sales.

Figure 1: Euro Area Industrial Production (2014 – 2020)

Source: Refinitiv Datastream Date: 15/07/2020

Pound brushes aside GDP data, UK inflation rises

Sterling quickly brushed aside the disappointment of yesterday’s GDP data for May, recovering all of its losses for the week amid the general improvement in market sentiment. Investors will be hoping for better news at this Thursday’s UK labour report, which will show the latest unemployment data for May and the claimant count number for June. We think that the latter will be more important, given that it is more timely and will account for the period after the lockdown was eased.

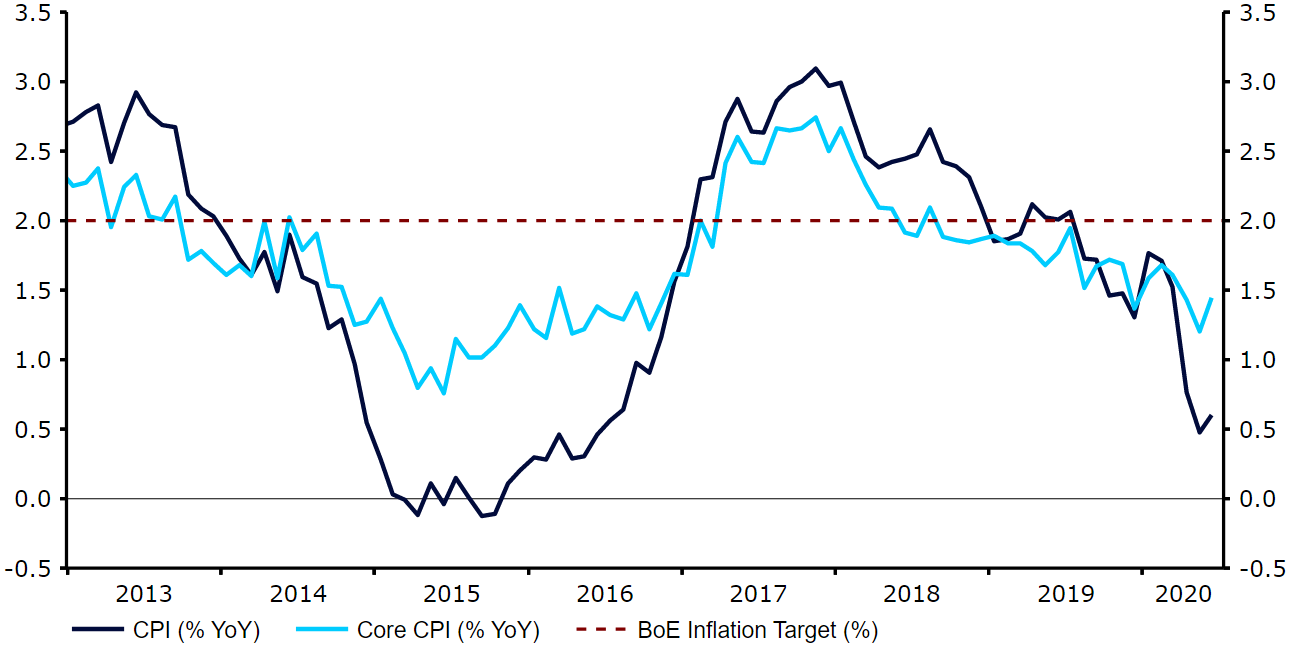

Meanwhile, this morning’s UK inflation data rose more-than-expected, a positive development that suggests consumer spending activity may be picking up pace from the lows during the height of the lockdown. The headline rate of inflation remained low, although picked up to 0.6% YoY from 0.5% (Figure 2), with core inflation also back up to 1.4% from 1.2%. While official retail sales data for June has not yet been released, a report from the British Retail Consortium on Tuesday suggested that last month saw the largest increase in sales in more than three years.

Figure 2: UK Inflation Rate (2013 – 2020)