Sharp currency moves defy traditionally quiet summer trading

- Go back to blog home

- Latest

The Pound kept alive its losing streak, as MPC member McCafferty stated that there would be additional monetary easing if the drop in UK PMI indices was born out by hard economic data in the coming months.

The star of the week was the Norwegian Krone, which soared after Norwegian inflation surprised massively to the upside, and further buoyed by the rebound in oil prices.

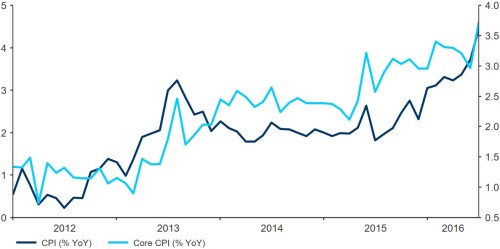

Figure 1: Norway Inflation Rate (2012 – 2016)

Special mention also goes to the Mexican Peso, which is up strongly against every major currency, but the Krone, as the prospect of a Trump victory receded and Banxico stood pat on interest rates.

We look forward to a quiet week of summer trading in FX markets, with the most important news this week being the US July inflation report. There will also be an important speech from FOMC member Lockhart and the minutes from the July FOMC meeting, which should shed some light on the likelihood of a September rate hike.

In the UK, July housing prices, employment and retail sales will be among the first hard economic data to be released post-referendum. The key here will be to see if they are as negative as the earlier confidence surveys indicate.

Major currencies in detail:

GBP

MPC member McCafferty set a weak tone for Sterling right off the bat last Monday. He stated that, should the economy continue to see very bearish readings from the PMI business confidence surveys, more easing would be forthcoming. This could take the form of an additional rate cut and further expansion of the QE target.

Sterling sentiment took a hit on these comments and spent the week trading lower. It managed to stay just above post-referendum lows against the US Dollar but broke down to year lows against the Euro.

This week, the employment report and retail sales for July will give us the first major economic data on the impact of the EU referendum. We note that sentiment is very bearish against GBP; any upwards surprise in UK economic data could bring about a significant short-term rally in Sterling.

EUR

With very little major data either last week or this one, the Euro will continue to trade in tight ranges against the US Dollar unless some major surprise across the Atlantic breaks the range in either direction.

However, we will see of the minutes of July’s ECB meeting. Traders will be looking for comments on the Brexit referendum and any hints as to the likelihood of additional easing in response but we note that these minutes seldom contain market moving information.

USD

Currency markets made much of the downward surprise in US July retail sales, which fell slightly (0.1%) on the month after gasoline and automobile purchases were excluded.

We note that this is perhaps the most volatile figure in the US and that the initial release is subject to significant revisions the following month. The 6-month average is still consistent with near 5% annualised growth.

Therefore, we’d discount the market’s knee-jerk reaction on Friday, which led to the US Dollar ending the week down about 1% in trade-weighted terms.

Receive these market updates via email