Signs of US slowdown slam dollar; Euro mixed on CB hawkish surprise

- Go back to blog home

- Latest

Disappointing economic data out of the US brought yields down worldwide and removed any chance of a 100 basis point interest rate hike from the Federal Reserve this week.

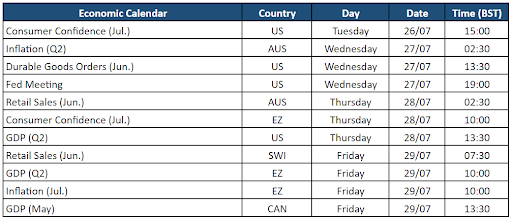

Wednesday’s Federal Reserve meeting will dominate financial news this week. Also important will be the inflation report out of the US and the Eurozone, both out on Friday. The key question for markets is how fast the slowdown in activity evident in most economic areas will translate into downward pressure on inflation data. This will be the key question the Federal Reserve will be grappling with at its July meeting.

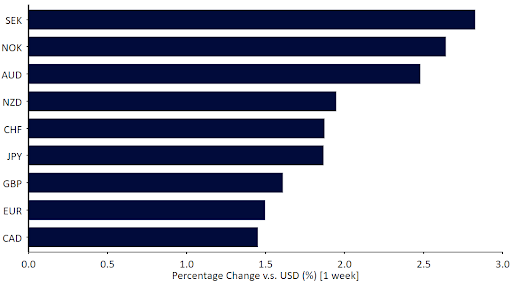

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 25/07/2022

GBP

Macroeconomic news out of the UK took a clear turn for the better last week. Activity surveys surprised to the upside and remain consistent with steady growth. The labor market continued to generate jobs at a healthy clip in May. Finally, while headline inflation remains sky high, core inflation has now declined for two consecutive months. Sterling did not react much, moving mostly with the Euro against the dollar, but this positive newsflow could set the stage for a rally in the next few weeks, especially as valuation remains supportive of the Pound.

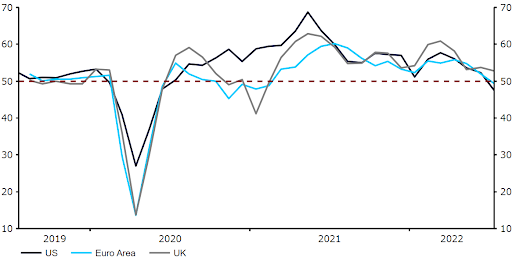

Figure 2: G3 Composite PMIs (2019 – 2022)

Sterling did not react much, moving mostly with the euro against the dollar, but this positive newsflow could set the stage for a rally in the next few weeks, especially as valuation remains supportive of the pound.

EUR

The ECB surprised markets with a 50 basis point rate hike, an event to which we had assigned a 50% probability. The initial positive reaction of the currency faded away somewhat as markets still don’t feel they didn’t receive enough details about the ECB’s new anti-fragmentation tool. On a side note, it did away with forward guidance, part of a much needed move away from relying on its thoroughly inadequate forecasting capacity, on which we have commented often.

This uncertainty, combined with negative surprises in the PMI activity numbers, which suggest that the Eurozone economy is stagnant, capped the euro gains against the dollar and kept it hovering not far from parity. All eyes will now be on Friday’s flash CPI numbers, which are expected to show that core inflation has not yet peaked in the Eurozone.

USD

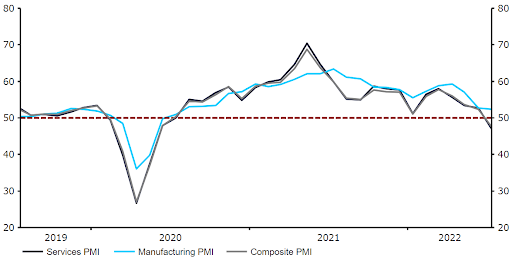

There were undeniable signs of an economic slowdown in the US last week. Weekly jobless claims continue to tick up, albeit from an extremely low level. Higher mortgage rates continue to drive a housing slowdown, though housing starts remain historically high. Most worrisome in our view was the drop in the PMIs to levels consistent with outright contraction.

Figure 3: US PMIs (2019 – 2022)

Source: Refinitiv Datastream Date: 25/07/2022

While central banks worldwide have consistently surprised on the hawkish sidem, we do not expect this to be the case next week at the Federal Reserve July meeting, as signs of a US slowdown should be enough to keep its increase to 75bp. More generally, we think outsize rate increases are now a thing of the past, and we should revert to the 25 or 50 bp of the past after the July meeting, which could cap dollar gains.

CHF

The Swiss franc ended the week around the middle of the pack in the G10 performance tracker. The currency was able to regain its earlier losses against the euro after disappointing PMI prints heightened recession fears in the Eurozone on Friday. SNB sight deposits have increased in the past two weeks, suggesting that the central bank may have intervened to limit the currency’s strength. These increases haven’t been particularly sizable, although they mean that the numbers are worth monitoring. Should this increase in intervention continue, this could indicate that the SNB is not too keen to see the currency appreciating much from current levels.

As the market is currently largely driven by recession fears, we’ll continue to focus primarily on outside news that might affect market sentiment. That said, the country’s KOF leading indicator could be worth watching on Friday.

AUD

The Australian dollar appreciated against the US dollar last week and is trading near one month highs, as poor US data caused the dollar to depreciate against all of its G10 counterparts.

The latest Reserve Bank of Australia meeting minutes, published last week, signalled further monetary tightening was on the way. In the RBA’s view, interest rates are ‘still too low for an economy with a tight labour market and facing a period of higher inflation’. The bank also warned that risks to inflation were tilted to the upside, and that steady increases in interest rates are therefore required in the coming months. We think that this hawkish commentary all but guarantees another 50 basis point rate hike from the RBA at its upcoming monetary policy meeting next week (02/08).

In the meantime, second quarter inflation data will be published on Wednesday. In addition, we will also pay close attention to the June retail sales data to be published on Thursday.

CAD

The Canadian dollar strengthened against the US dollar last week, due largely to the pause in the dollar’s rally following last week’s poor US economic data and the hawkish tightening stance adopted by the Bank of Canada.

Data published last week showed that Canada’s inflation rate rose less than expected to 8.1% in June, although it still reached its highest level since 1983. On a monthly basis, consumer prices rose by 0.7%, below expectations of a 0.9% increase, and easing on the 1.4% jump a month earlier. The fact that inflation remains at very high levels should put pressure on the BoC to continue raising interest rates, although we see effectively no chance that they’ll hike in 100 basis point increments at upcoming meetings, as they did earlier this month.

Together with the May GDP data out on Friday, we think that oil prices and market sentiment will be the main drivers of the Canadian dollar this week.

CNY

The Chinese yuan ended last week little changed against the US dollar, which can be viewed as disappointing considering the broad weakness of the latter. In fact, the trade-weighted RMB CFETS index turned lower, shedding a little more than 1% during the week. Investor sentiment towards China continues to be challenged by covid fears, as the number of new infections hovers around a two-month high. Recently, however, it seems that the property crisis had a similar, if not a stronger, effect on sentiment. A mortgage boycott has added to the strain on the sector that has been under pressure for many months, facing declining property prices and slowing buying. The issue is gathering the attention of Chinese authorities, with the country preparing a sizable real estate fund to help the developers, according to media reports.

Last week’s economic calendar was largely empty. As expected, the loan prime rates were left unchanged. Going forward we’ll continue to focus on pandemic developments and keep an eye on the real estate sector. We’re also waiting for China’s July PMI numbers, with the official readings set for release on Sunday.

Economic Calendar (25/07/2022 – 29/07/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports

🔊 Stay up to date with our podcast FXTalk