Special Report: Chinese Yuan (CNY)

- Go back to blog home

- Latest

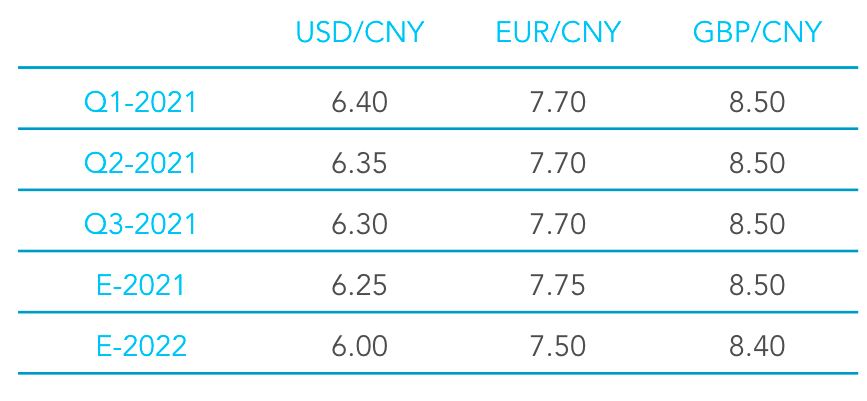

The Chinese yuan (CNY) has been one of the most resilient emerging market currencies in the world since the outbreak of the COVID-19 pandemic in the first quarter of 2020.

Figure 1: CNY/USD vs. JP Morgan EM FX Index (Jan ‘20 – Jan ‘21)

Source: Refinitiv Datastream Date: ##/01/2021

We think that much of the outperformance in the yuan has been due to the ability of authorities in China to control the spread of the COVID-19 virus. The country imposed strict restrictions as early as January 2020, registering a peak in cases soon afterwards. The 7-day average of new cases has remained below 100 since mid-March, only crossing this level in mid-January this year. As a percentage of the population, China has registered less than 65 cases per 1 million people, significantly less than almost every other country in the world. This number is strikingly low compared to the US (77,000 per 1M), the UK (53,000 per 1M), and Germany (25,000 per 1M), but also the similarly populated India (7,000 per 1M).

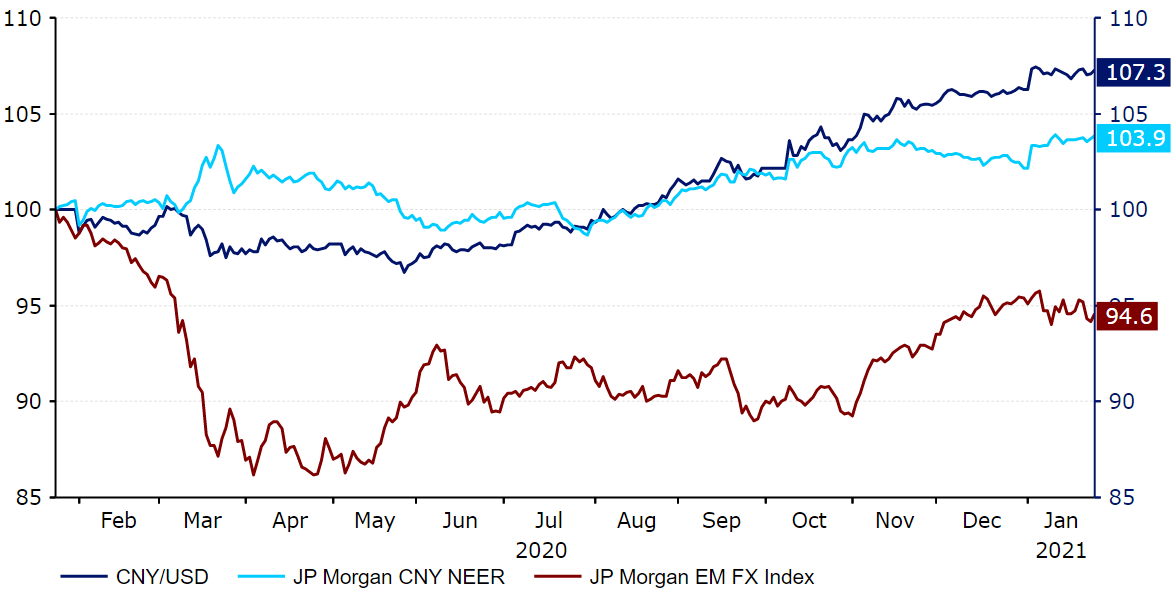

While China has historically intervened in the FX market, it appears that the moves we have witnessed since the beginning of the crisis have reflected a largely undisturbed market mechanism. The PBoC’s effort to closely manage the currency and ensure a no more than a 2% daily deviation in the exchange rate has, however, ensured that the currency remains one of the least volatile EM currencies in the world. Policymakers at the PBoC have pledged to keep the currency stable against the CFETS RMB index since early-2018. This basket of currencies has been periodically altered to reflect shifts in China’s international trade relationships. In this context, the most meaningful recent alteration in the basket is the decreasing share of the US dollar (down from 26.4% in 2015 to 18.8% in 2021). The second-largest weight is assigned to the euro (18.15%), with the remaining two-thirds composed of an additional twenty-two other currencies. This index has increased by around 5% since the beginning of 2020 (Figure 2).

Figure 2: CNY CFETS Index (2017 – 2020)

Source: Refinitiv Datastream Date: ##/01/2021

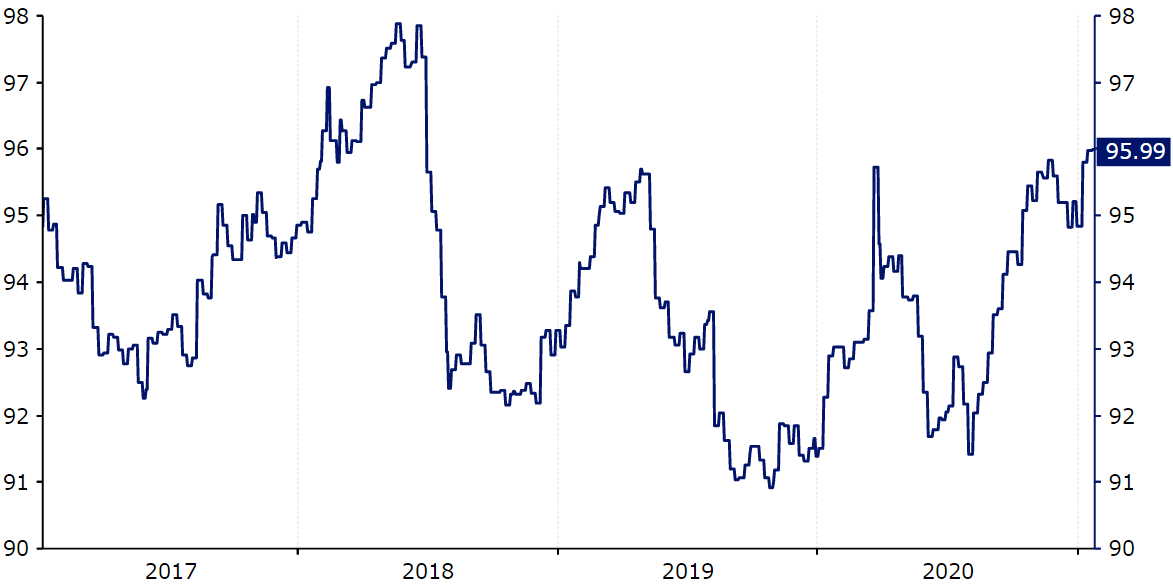

One of the main factors driving yuan strength in 2020 was the divergence in economic performance between China and almost every other country in the world. China’s economy suffered from its worst performance since 1976 last year, although growth still remained positive at 2.3%. The ability of Chinese authorities to suppress caseloads and enforce more localised restrictions have proved to be less harmful to the country’s economy. The economy expanded by 6.5% in the third quarter of 2020, beating expectations. Fourth-quarter GDP data for the main economies is not yet available, although it’s safe to assume that they struggled, while China powered through.

Figure 3: GDP Growth Rate [China vs. G3] (2020)

Source: Refinitiv Datastream Date: ##/01/2021

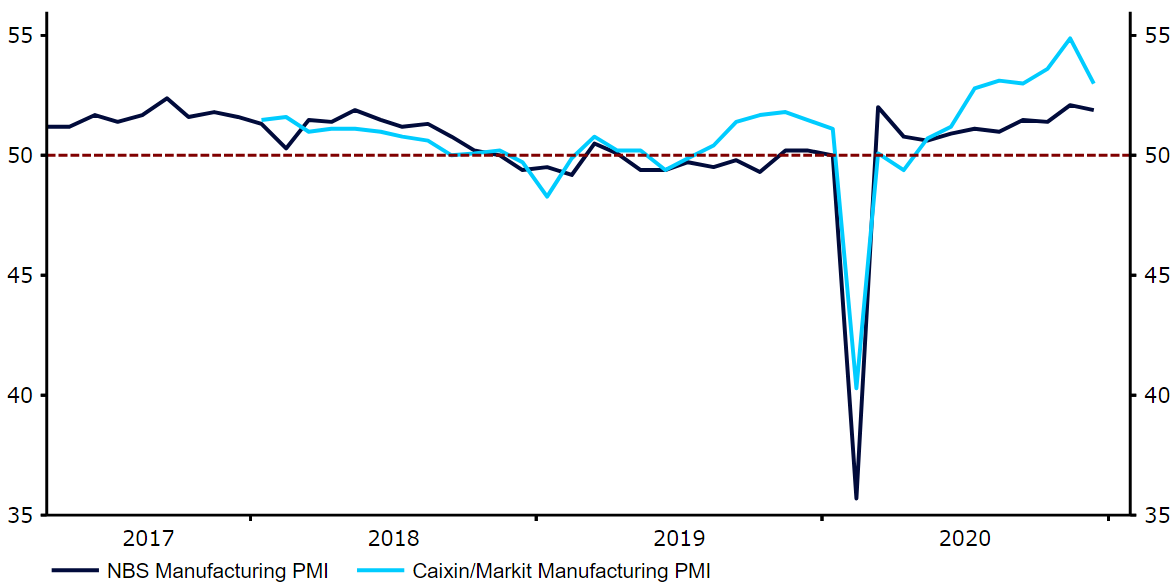

While an increase in virus cases has led to the recent reimposition of slightly stricter measures, China’s economy has continued to perform well. Retail sales have rebounded strongly since the peak of the crisis, when they contracted by more than 20%, and have remained in positive territory since August. Industrial production has bounced back well, reaching growth of around 7% year-on-year in the past few months. Both the private and official PMIs also still remain comfortably in expansion territory, despite easing somewhat in December.

Figure 4: China PMIs (2017 – 2020)

Source: Refinitiv Datastream Date: ##/01/2021

Another recent positive development for the yuan was the result of the 2020 US presidential election. Biden’s win has paved the way for greater fiscal support in the US, which investors are perceiving as a positive for the global economy. This is particularly important for the US’s major trading partners, of which China is the largest one. The likelihood of delivering ambitious fiscal measures in a timely manner increased further after the Democrats secured two additional seats during the run-off elections in Georgia in early-January, in the process regaining control of the Senate.

When it comes to its foreign and trade policy, the Biden administration is expected to be more predictable than Trump’s. While a quick resolution to the US-China trade war seems unlikely, we’re optimistic that the relationship between the two countries has a fair chance of improving and will most likely be better than under the Trump administration. It’s also worth noting that China’s relationship with the EU seems to be improving, with the two sides recently reaching an agreement in principle on an investment deal after years of negotiations.

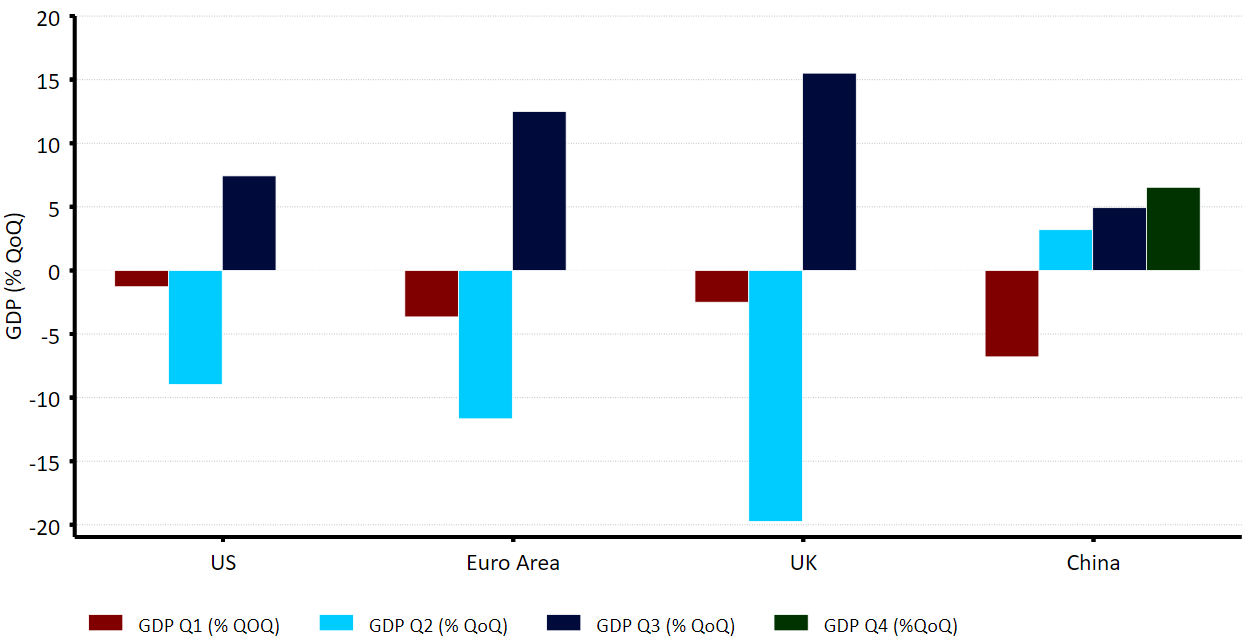

In our view, the yuan is unlikely to receive a boost from the rolling out of COVID-19 vaccinations in 2021, with an unwinding in restrictions set to narrow the gap in economic performance between China and most of the developed world. That being said, we remain bullish on the yuan over our forecast horizon and are continuing to pencil in gains for the currency versus the US dollar through to the end of 2022. We think that we are seeing a significant shift among investors whereby the yuan is, in many respects, now perceived as closer in resemblance to a major currency than an emerging market one. The yuan’s internationalisation and growing importance to global trade should, we believe, continue to support CNY this year, as should China’s solid macroeconomic fundamentals. China has a hefty hoard of reserves, equivalent to approximately 16 months’ worth of import cover, maintains a current account surplus, and has low external debt of less than 15% of GDP.

The lack of concern among the PBoC for a stronger currency also removes a potential stumbling block to yuan strength, particularly as China continues its efforts to diversify its economy away from being one that is highly export-oriented. We are, therefore, revising our USD/CNY forecasts downwards.